Five Key Findings in Our Survey

of Accounting and Financial Services Firms

In this article, Dr. Frederiksen discusses five key findings derived from a Hinge Marketing Survey of accounting and financial services firms. The findings provide actionable steps and an opportunity for firms serving in the industry to grow.

[su_pullquote align=”right”]Resources:

What Works Now—The Best Practice Development Techniques for 2017

Rethinking Referrals—Research-Based Approach to Attracting More Referrals

Gaining an Advantage in a Changing Marketplace

Implementing Your Referral Marketing Plan

[/su_pullquote]

How do the fastest-growing accounting and financial services firms stay ahead of the pack? Â My firm recently surveyed more than 256 firms to find out.

I encourage you to download and read this free study and judge for yourself—but in the meantime, I want to share five of the major takeaways from the survey that you can start benefitting from immediately.

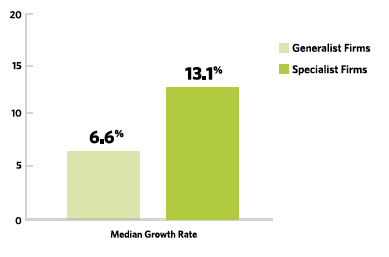

1. Â Specialist firms outgrow generalist firms.

We started by asking firms to rate themselves on their level of specialization in five areas: solving challenges; offering highly niche services; helping particular roles in client organizations; specializing in an industry; and specializing in a geographic region.

We found the firms that specialize outgrow those that do not—by a ratio of 2 to 1 (See Figure 1).  This may seem counterintuitive.  However, this more sharply focused approach to the market enables firms to better position themselves as experts in their field.  Firms that try to be all things to all people do not have the laser sharp focus needed for growth.  Almost any kind of specialization is better than being positioned as a generalist.

Figure 1. Â Median Growth by Accounting and Financial Services Firm Specialization

Figure 1. Â Median Growth by Accounting and Financial Services Firm Specialization

2. Â Specialist firms market differently.

Another way that specialist firms differ from generalists is that they tend to use different marketing techniques and channels.  Their marketing activities usually focus more on sharing content that audiences find valuable—and in the process, demonstrating the firms’ expertise.  Generalist firms, in comparison, tend to focus their marketing on their image and on reaching a broad, undifferentiated audience.  As Figure 2 shows, the two categories of firms have entirely different marketing mixes.

Figure 2. Â Favored Marketing Techniques by Level of Specialization

Figure 2. Â Favored Marketing Techniques by Level of Specialization

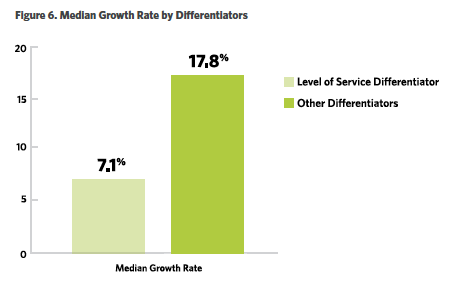

3.  “Service” is not a differentiator.

Better service will not win clients.  Our study uncovered that the leading differentiator used by most of our respondents (63%) is in the level of service they provide.  This includes claims along the lines of “what really makes us different is the personal care and attention we provide.”

There are two problems with using such a claim as a differentiator. Â First, if most firms make essentially the same claim, by definition, it is not a real differentiator. Â More interesting is the fact that, as shown in Figure 3, firms that focus on other differentiators grow 2.5X faster than those that claim their level of service sets them apart.

Figure 3. Â Median Growth Rate by Differentiators

Figure 3. Â Median Growth Rate by Differentiators

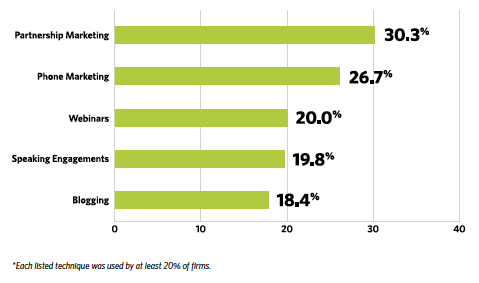

4. Â Visible expertise wins clients.

Our survey also examined the various types of marketing techniques firms use.  We asked respondents to identify which of 24 marketing techniques they had used and to rate the impact of each on a scale of 0–10 (10 representing the most impact).

Of all the marketing techniques we examined, five rose to the top. Â Figure 4 shows the percentages of firms that gave these techniques an impact rating of 9 or 10.

Partnership marketing, defined in our survey as a mutually beneficial marketing relationship between a firm and another organization (e.g., co-branded educational events) provides partners with speaking and writing opportunities that demonstrate expertise among new target audiences. Â Phone marketing is often used to supplement activities that showcase expertise. Â For instance, some firms will follow up with prospects on the phone after the prospects have participated in an online seminar or downloaded a piece of content. Â And, of course, webinars, speaking engagements, and blogging are all marketing techniques that allow firms to educate clients and highlight their expertise.

Figure 4. Â Top 5 Most Impactful Marketing Techniques for Accounting and Financial Services Firms

Figure 4. Â Top 5 Most Impactful Marketing Techniques for Accounting and Financial Services Firms

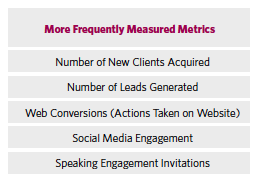

5. Â It pays to measure results.

More than ever, accounting and financial services firms are gathering and analyzing metrics to evaluate and manage their marketing.

It may come as no surprise that the most impactful marketing mix for firms includes both digital and traditional methods. Â But of the two, it is easier (and far more accurate) to measure the impact of digital marketing. Â Therefore, digital marketing provides a unique opportunity to determine what is really working in your marketing. Â In our study, we found that firms are measuring 60% more marketing metrics than they did last year. Â The more frequently measured metrics are shown in Figure 5.

Figure 5. Â More Frequently Measured Metrics

Figure 5. Â More Frequently Measured Metrics

Time to get growing?

Growth within the accounting and financial services industry may be slow—our study found it to be an average of 9.6%—relative to other professional services industries.  But that does not mean there are not opportunities.

The findings of our recent survey give some insights into the strategies and techniques that high-growth firms are using to achieve success.  In some cases, they may be a little counterintuitive; in other cases, they are just a new take on old strategies.  But in every case, the focus is on becoming more specialized—in whom you market to, how you position yourself and your expertise, and on how you measure success.

Lee W. Frederiksen, PhD, is Managing Partner at Hinge, the leading branding and marketing firm for the professional services. Hinge conducts groundbreaking research into high-growth firms and offers a complete suite of services for firms that want to become more visible and grow.

Dr. Frederiksen can be contacted at (703) 391-8870 or by e-mail to LFrederiksen@hingemarketing.com.