Seeking the Seller’s Market: Family-Owned Businesses

Perils of Selling to Family Members and Delaying a Sale Now to Third Parties

Are the increases in market multiples and the access to capital a sign of the impending surge of business exits? In this article, the author shares his views on selling to family members vis-à-vis to a non-heir third party, the perils of waiting to sell a business, discussing the valuation gap and seller’s expectations, and delaying a sell.

[su_pullquote align=”right”]Resources:

Exit Planning—What Advisors Need to Know

What are the Transitioning Options Available to the Exiting Business Owner?

Educating Your Client: The 5 Things They Need to Know about Exit Planning

Case Study–The Steps to a Successful Business Exit Plan

Value Enhancement in Relation to an Exit Plan

[/su_pullquote]

Are the increases in market multiples and the access to capital a sign of the impending surge of business exits? Let’s look at the market.

FairValueAdvisors reports for public companies that the median earnings before interest, tax, depreciation, and amortization (EBITDA) multiple was 11.51x, which is an increase of 11 percent from a year prior. The 2017 Private Capital Markets Report found that the average EBITDA multiple ranged from 3.6x for companies less than one million dollars to 8.8x for companies with revenue more than $50 million—and that over half of the respondents expect to close six or more deals in the next 12 months. Pratt’s Stats Private Deal Update, Q2 2017, saw increases in EBITDA multiple by 23 percent for deals with revenue less than one million dollars; for companies from one to five million dollars, the EBITDA multiple increased by 22 percent; but for deals more than five million dollars in revenue, the multiple decreased by 32 percent. Finally, BizBuySell, the nation’s largest marketplace for buying and selling a small business, indicated that the seller’s discretionary earnings multiple increased 5.1 percent.

We see that in nearly every revenue level of the deal making industry, that there are deals being made and market multiples going up. What happens if you miss the peak?

My firm was recently asked to prepare a retrospective valuation for the daughter of a business owner who I consulted with regarding exiting his business. When the father and I parted ways, he was going to continue running the business and work on improving the profitability to get the value he expected. The business was a service business and made the owner, between profit and rent he was paying himself, nearly $350,000. The daughter had been integral to the operation throughout her teens, twenties, and now thirties. Several years ago, the father sold the business to the daughter. One would think it would be a success, passing the family business from one generation to another. It was an initial success for the father, but one that would cost him and his daughter. Her father was financing the sale and after a few years into a ten-year promissory note, the daughter began to wonder if she paid too much. She recalled I had done some planning and analysis for her father years before and called to let me know she bought the business and wanted to know if she paid too much.

She paid him at least 2.5 times what it was worth.

Most of her growth and profit went to service the debt and the over fair market rent she was paying her father who still owned the real estate. Between the promissory note and the inflated rent, the father was making nearly 85 percent of his presale income. So, the daughter stopped paying and confronted him. He was appalled at the lack of integrity that she would default on his note. He filed suit. She walked in, gave him back the keys, and started a nearly identical business 1/4 mile away. She is thriving and his building sits empty. It is my understanding that the lawsuit was dropped after another expert affirmed my value. It is likely that no holiday will be the same for that family.

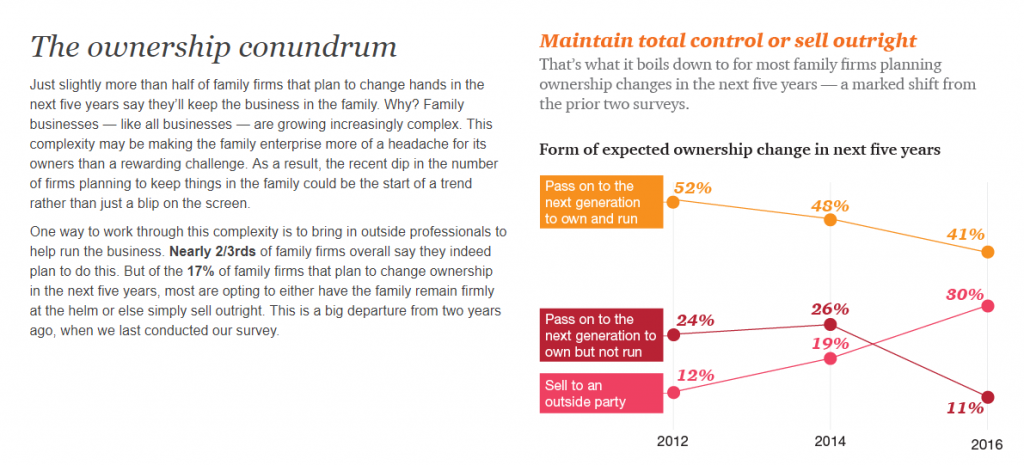

PriceWaterhouseCooper released their PwC 2017 Family Business Survey (http://www.pwc.com/us/en/private-company-services/publications/family-business-survey/succession.html) regarding the “Form of expected ownership change in the next five years.” The survey below found that when transferring ownership to the non-operating heir, it decreased from 26 percent to 11 percent. Selling to an outside party increased from 19 percent to 30 percent. It appears that family businesses are currently positioning for an outright sale or seeking operators for day-to-day management due to the complexity of the family business.

In his article, Family Business Survival: Understanding the Statistics (The Family Business Consulting Group), Craig Aronoff, PhD, made a couple of observations regarding the success of transition from one generation to another—“30 percent of family businesses make it to the second generation, 10 to 15 percent make it to the third, and three to five percent make it to the fourth.” First, the statistic that 30 percent make it to the second generation is actually “make it through the second generation, and so on.”

How does he know that?

His company conducted the survey. Second, he studied the family businesses that were on the Dow Jones Industrial Average (DJIA) for four generations. He concluded that the lifespan of the public companies researched and those family businesses are somewhat consistent in their lifespans. It also means that businesses make it to the next generation, but perhaps through no fault of the heir owner, the business was unsuccessful.

It is common that the selling parents continue to use seller-financing vehicles as retirement income. If designed correctly, it is beneficial for everyone. What I suspect is that what was negotiated was the parent’s desire rather than what another buyer would pay. Perhaps an unintentional form of usury?

You should empathize with the father. I knew him. He was a loving father and proud business owner. He would have never intentionally put his relationship with his daughter in harm’s way for the sake of the business—yet somehow, he did. When I presented my findings, and he shared his disappointment in the value gap between what he wanted and what it was worth, he knew that there was only one buyer. That buyer would certainly recognize the sacrifices that were made to build the business. That buyer soon realized the sacrifices that would be required to keep it operating.

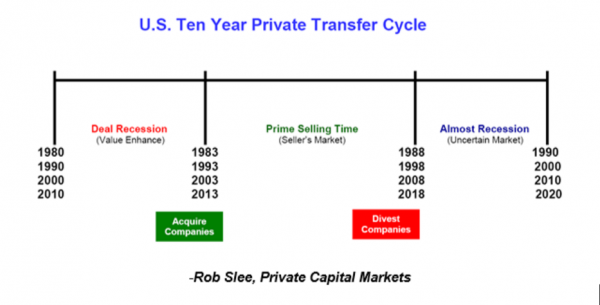

I recalled in Robert Slee’s seminal book, Private Capital Markets, there is a “Private Transfer Cycle” (p. 565) that comes every 10 years or so, and it suggests that we are in the prime selling time with an uncertain market coming soon. See below:

Is the increase in family owned businesses looking to third parties as their exit preference evidence of the peak of the market, or is it the precursor to a recession? My client was trying to sell in a suppressed market (2013) based on considerably higher multiples just a few years earlier. I wonder how many of the boomer generation are going to miss the seller’s market and then look to the children as their means to get their cake (value) and eat it too (structure the sale that maintains a lifestyle).

Ed Mysogland is President and Managing Member of Legacy Transition Advisors, LLC. The firm is an Indiana-based company that provides exit planning and business valuation services for small and mid-sized privately held business owners who seek to grow and improve their business. Recognizing the tremendous economic impact that owners have, the company is committed to helping its clients through critical decisions and implementing value enhancing solutions. Mr. Mysogland is President of the Central Indiana Chapter of the Exit Planning Institute and leads the State of Owner Readiness research efforts in his local business community.

Mr. Mysogland can be contacted at (800) 430-1442 or by e-mail to ed@legacytransitionadvisors.com.