The New Tax Bill

A Run-Down on What is Changing

President Donald Trump signed the Tax Cuts and Jobs Act (TCJA) presented to him by Congress on December 22, 2017. Debate on the provisions of the bill dominated the last quarter of 2017. It was first presented on November 2, 2017 by Texas Congressman Kevin Brady, chair of The House Ways and Means Committee. Two weeks later, November 16, the House passed the Bill and forwarded it on to the Senate. The Senate Finance Committee passed its own version of a tax reform Bill and the full Senate voted 51 to 49 to pass their version. The “reconciled” and compromised version was passed by both houses of Congress. His article, highlights some of the more well-known provisions.

[su_pullquote align=”right”]Resources:

[/su_pullquote]

President Donald Trump signed the Tax Cuts and Jobs Act (TCJA) presented to him by Congress on December 22, 2017.  Debate on the provisions of the bill dominated the last quarter of 2017. It was first presented on November 2, 2017 by Texas Congressman Kevin Brady, chair of The House Ways and Means Committee. Two weeks later, November 16, the House passed the Bill and forwarded it on to the Senate.  The Senate Finance Committee passed its own version of a tax reform Bill and the full Senate voted 51 to 49 to pass their version.  The “reconciled” and compromised version was passed by both houses of Congress.

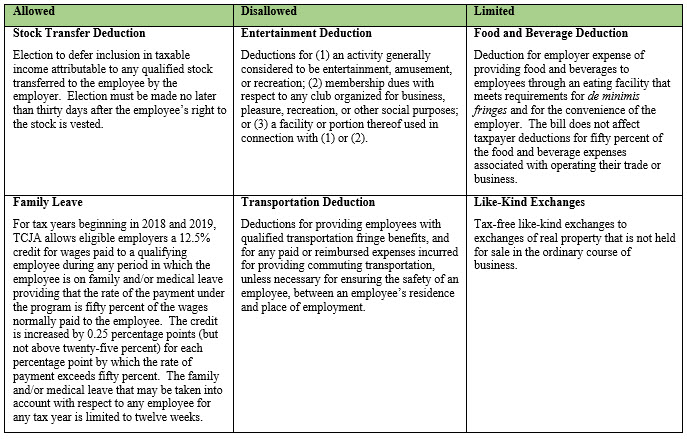

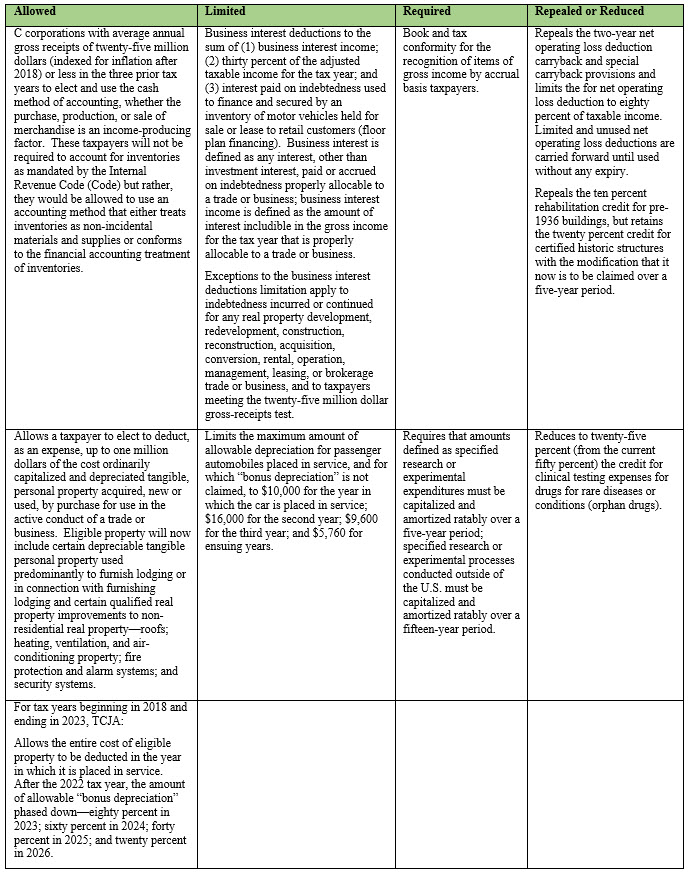

It is imperative to note here at the outset that virtually no substantive tax change/reform under TCJA will be effective for the 2017 tax year.  For tax years beginning in 2018, the bill repeals the current exceptions for commissions and performance-based compensation and redefines “covered employee” to include both the principal executive officer and the principal financial officer. The number of other officers included is reduced to the three most highly compensated officers for the tax year and requires that once an individual is a covered employee for any tax year, they will forever remain a covered employee. Chart 1 gives a quick overview of the deductions that have been allowed, disallowed, or limited for qualified employees. Chart 2 outlines deductions allowed, limited, repealed, or required for business owners.

Chart 1: Beginning in 2018, TCJA Rules for Qualified Employees

Chart 2: What is Allowed, Limited, Required, and Repealed Starting in 2018

This article is published here with permissions and can be viewed in its entirety in The Value Examiner, January/February 2018 issue.

James P. Crumlish, CPA, CGMA, provides professional accounting and forensics services to business entities, high net worth individuals, trusts and estates, and charitable foundations. Mr. Crumlish has more than twenty years of experience in trusts and estates.

Mr. Crumlish can be contacted at (212) 996-3788 or by e-mail to jamespcrumlish@gmail.com.