How is the Section 199A Deduction determined?

Underlying Policy Identified

The pass-through entity, that legal entity structure that has given valuators consternation over the years, is back in the news thanks to the Tax Cut and Jobs Acts (TCJA) signed into law at the end of 2017. According to the Joint Commission on Taxation, business owners filed 35.3 million pass-through returns in 2015. Another 1.6 million returns were file by C corporations. The TCJA has essentially created a flat tax of 21% for corporations. There is a lot of buzz about “199A”, a new Internal Revenue Code section and deduction and the introduction of a new term, “Qualified Business Income” (QBI).

Tax practitioners may be familiar with the Section 199 deduction (also referred to as the domestic manufacturing deduction, U.S. production activities deduction, and domestic production deduction), a tax break introduced as part of the Bush-era American Jobs Creation Act of 2004. The TCJA repeals the 199 deduction, which was an effort to ease the tax burden of domestic manufacturers and as a result make the investment in domestic manufacturing facilities more advantageous.

Section 199A creates a tax benefit of up to 20% of a pass-through entity’s income, but of course, subject to a number of rules and conditions. It appears that Congress’s intention of the 20% tax benefit is to match the tax break that was given to larger C corporations. Less obvious, there may be an intent to promote employment, or at least W-2 income rather than shareholder distributions. I say this since the calculations for the 199A deduction give a greater weight to W-2 income.

This article discusses the history and genesis of 199A, and provides an illustration of the QBI deduction.

The pass-through entity, that legal entity structure that has given valuators consternation over the years, is back in the news thanks to the Tax Cut and Jobs Acts (TCJA) signed into law at the end of 2017. According to the Joint Commission on Taxation, business owners filed 35.3 million pass-through returns in 2015. Another 1.6 million returns were filed by C corporations. The TCJA has essentially created a flat tax of 21% for corporations. There is a lot of buzz about “199A”, a new Internal Revenue Code section and deduction and the introduction of a new term, “Qualified Business Income” (QBI).

Tax practitioners may be familiar with the Section 199 deduction (also referred to as the domestic manufacturing deduction, U.S production activities deduction, and domestic production deduction), a tax break introduced as part of the Bush-era American Jobs Creation Act of 2004. The TCJA repeals the 199 deduction, which was an effort to ease the tax burden of domestic manufacturers and as a result, make the investment in domestic manufacturing facilities more advantageous.

Section 199A creates a tax benefit of up to 20% of a pass-through entity’s income, but of course, subject to a number of rules and conditions. It appears that Congress’s intention of the 20% tax benefit is to match the tax break that was given to larger C corporations. Less obvious, there may be an intent to promote employment, or at least W-2 income rather than shareholder distributions.  I say this since the calculations for the 199A deduction give a greater weight to W-2 income.

The Subchapter S was created in 1958 during the Eisenhower administration to relieve small businesses from the double taxation of a C corporation. However, in 1958 the top income tax rate was 52% for corporations and 91% for individuals, and S corporations did not become popular until the 1980s when the top rate decreased to 50% (1982), and then 38.5% in 1987.

Since the TCJA has reduced the top individual tax rate to 37% from 39.6%, an owner of a pass-through business that can deduct the full 20% of pass-through income effectively reduces their top effective rate to 29.6%.

For those trying to figure all this out, (1) the deadline for many business owners to make an election for 2018 has already passed (March 15, 2018) and (2) there is little guidance on the subject. The IRS indicated that guidance is a top priority and many suspect guidance will be issued this summer when the IRS “Blue Book” is released. The AICPA Tax Executive Committee sent a 22-page document to the IRS requesting immediate guidance regarding section 199A as well as the AICPA’s recommendations.

So, down to brass tacks. How is the Section 199A deduction determined?  First, we need to define a few key terms:

A pass-through entity is any trade or business other than a corporation.; i.e., sole proprietorship, S corporation, partnership.

QBI is generally net income from the business; it is net of owners’ salaries or guaranteed payments. Although QBI is calculated at the entity level, it is reported at the taxpayer level for taxpayers who may have an interest in more than one pass-through entity.

Qualified property is tangible property subject to depreciation and available for use in the business at the end of the tax year. We will not be delving into any examples that include qualified property.

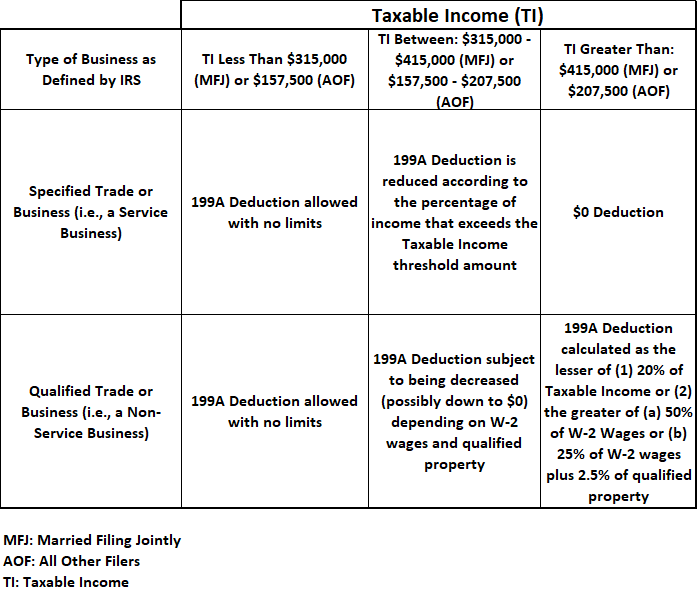

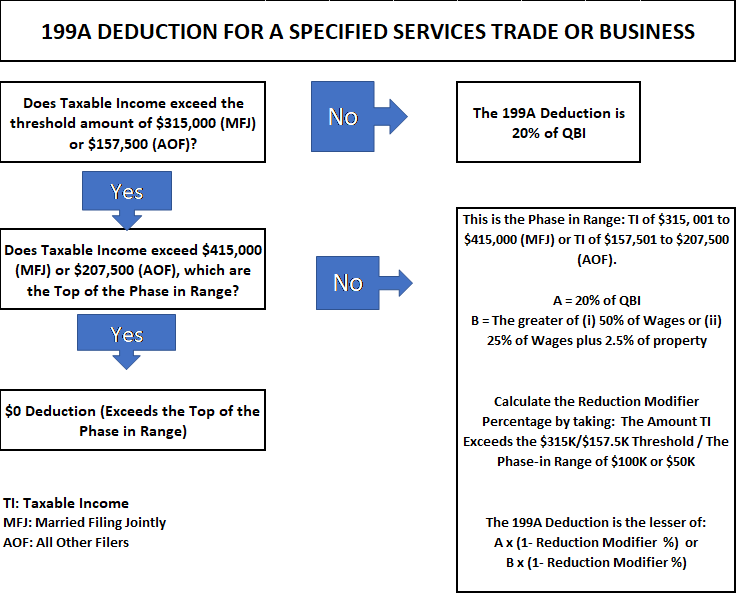

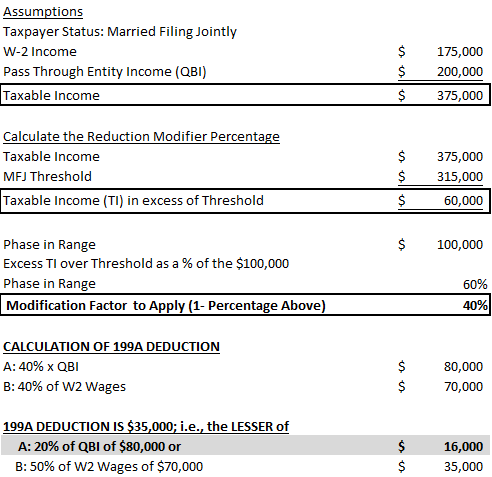

Phase-in threshold refers to when limitations on the 199A deduction begin. For married filing jointly (MFJ) taxpayers, the phase-in threshold is $315,000, meaning there will be a reduction in the deduction for amounts above $315,000; for all other filers (AOF), the phase-in threshold begins when taxable income is more than $157,500.

Phase-in range/top of phase-in range. For MFJ, the phase-in range is $100,000 ($415,000 top of the phase-in range less $315,000 phase-in threshold). For AOF, the phase-in range is $50,000 ($207,500 top of the phase-in range less $157,500 phase-in threshold).

What this means is for taxable income between $315,001 and $415,000 (MFJ) and between $157,501 and $207,500 (AOF), the 199A deduction will be reduced.

A specified services trade or business as the IRS has defined it, are the fields of testing health, law, consulting, athletics, financial services, brokerage services, or any trade or business where the principal asset of such trade or business is the reputation or skill of one or more of its employees or owners. Excluded from this definition are engineering and architecture firms. Or, a business that involves the performance of services that consists of investing and investment in management trading, or dealing in securities, partnership interests, or commodities.

A qualified trade or business means any trade or business other than a specified services trade or business.

Below is a general outline of the 199A deduction; this is a very simple schematic, to give a 30,000-foot overview; the TCJA is complex, and many nuances are subject to IRS review later in 2018. As with all tax matters, you should see a qualified professional for your specific situation.

Given the depth of the new code, using the flow chart below, we will focus on one example for a service business that is in the phase-in range.

Using the assumptions below for a taxpayer with a service trade or business with $175,000 W-2 income and $200,000 pass through income (i.e., QBI), we calculate a 199A deduction of $16,000 as shown below.

Let’s conclude with some takeaways and additional points of interest:

- The 199A deduction has two overall limitations: (a) 20% of QBI in the aggregate for all businesses of the taxpayer and (b) 20% of taxable income less capital gains. 199A will expire at the end of 2025.

- For taxpayers below $315,000 (MFJ) /$157,500 (AOF) taxable income, the 199A deduction is very simple: it is the lesser of 20% of taxable income less capital gains or 20% of QBI, regardless of the type of business.

- Wages will become more important, specifically:

a. Proper classification of employees versus independent contractors.

b. Remember, the IRS requires S corporations to pay reasonable compensation to shareholders who provide substantial services. Expect more IRS scrutiny on reasonable compensation; for example, if officers’ compensation decreased from say, $300,000 historically, to $200,000, it may draw IRS scrutiny. Currently, sole proprietorships and single member LLCs are not subject to reasonable compensation. This may change upon further issuance of IRS guidance.

c. W-2 wages are wages paid by the business or a separate company set up by the shareholders to pay wages (company paymaster); and, it most likely will include W-2 wages via professional employer organization (PEO) arrangements (in other words, outsourced staffing). It is recommended that the business have a written agreement with the issuer of the W-2 (PEO) that the business will be using the W-2 wages for the section 199A deduction since both firms cannot use them! - Similar to the personal exemption, which was repealed with the 2017 tax overhaul, the 199A deduction is not a decrease in adjusted gross income, but rather, a decrease in taxable income.

- It appears that self-employment taxes will still be calculated on the net business income before the Section 199A deduction. For example, if a taxpayer earns $100,000 and deducts $20,000 under Section 199A, they could still pay self-employment taxes on $100,000. This remains unclear until further IRS guidance.

- What if a taxpayer has an interest in multiple pass-through entities? The QBI and 20% deduction is calculated separately for each entity. The taxpayer will need to aggregate all of the deductions to arrive at one 199A number on their tax return. Perhaps there will be changes to K-1 form.

- We have not examined the W-2 wages and depreciable property limitations (which apply to taxable income above $315,000/$157,500) in detail in this article; these limitations are also applied at the entity level.

Lastly, proceed with caution. The IRS has indicated that guidance is a top priority. And, there is already talk of a potential Phase 2 of the TCJA!

Michael Bankus, MBA, CVA, AFSB, is principal of Goriano Experts & Advisors, a consulting firm serving the legal and business communities with business valuation, business consulting, and litigation support services, mainly to the construction industry. Previously, Mr. Bankus held senior finance roles at The Bank of New York Mellon, PNC Financial, CentiMark Roofing, USF&G Insurance, and Rite Aid Corporation.

Mr. Bankus can be contacted at (484) 557-6644 or by e-mail to Mike@GorianoLLC.net.