The SWS Group, Inc., Chancery Court Appraisal Decision

Fair Value Not Based on the Merger Price, Part I of II

This is a two-part article that focuses on the SWS Group Inc. case and the interplay between merger price and fair value. In earlier cases the Delaware Court of Chancery rejected a merger price indication in favor of its own discounted cash flow analysis. Yet, in the SWS Group, Inc., appraisal decision, instead of a decision supporting a higher fair value, the court ultimately found that the merger price was too high. This ruling highlights the risk of an arbitrage appraisal strategy and may give dissenting shareholders something to consider before invoking their appraisal rights. Also, this decision highlights how valuation analysts can sometimes arrive at significantly divergent opinions of value. The concern is that the court may view analysts as advocates for their clients—and not as advocates for their valuation opinion.

Introduction

In the matter of In re Appraisal of SWS Group, Inc. (SWS),1 an appraisal arbitrage strategy resulted in the Delaware Court of Chancery (Chancery Court) rejecting the merger price as a reliable fair value conclusion. The Chancery Court also rejected certain findings of the respondent analyst and petitioner analyst.

The Chancery Court noted that the “public sales process that develops market value is often the best evidence of statutory fair value.”2

However, in the instant case, the respondent analyst, the petitioner analyst, and the Chancery Court agreed that the merger price was not a fair value indication. In SWS, the Chancery Court prepared its own discounted cash flow analysis to arrive at fair value.3  As a result, the Court found the fair value of SWS Group, Inc., the company that is the subject of this litigation, to be lower than the merger price.

The Chancery Court, in the recent In re Appraisal of Dell (Dell I) matter, determined a greater fair value than the merger price in the appraisal rights proceeding.4

In the Dell I matter, the Chancery Court found that the merger price was also not a fair value indication.

In Dell I, the Chancery Court rejected—in certain parts, just like in SWS—the findings of the respondent analyst and petitioner analyst. The Chancery Court decided to prepare its own discounted cash flow method analysis. The Dell I conclusion suggested a fair value price per share of the common stock of Dell at the time of its sale of a price 27 percent greater than the total merger consideration price per share.

In the even more recent matter, the Supreme Court of the State of Delaware (Supreme Court) remanded the Dell I decision back to the Chancery Court on appeal (Dell II).5

According to the Supreme Court, the Chancery Court erred in Dell I because “its reasons for giving [the merger price] no weight—and for relying instead exclusively on its own discounted cash flow…do[es] not follow from the court’s key factual findings and from relevant, accepted financial principles.”6

In Dell II, the Supreme Court found that the deal price should have been given weight. However, the Supreme Court did not mandate that the deal price should be the ultimate fair value conclusion. The Supreme Court stated, “despite the sound economic and policy reasons supporting the use of the deal price as the fair value on remand, we will not give in to the temptation to dictate that result.”7

What is most interesting in Dell I is the Chancery Court finding that the merger price was less than the fair value of Dell, Inc., stock. Now that a ruling has been made in Dell II, but for sound reasoning, specifically involving the process by which deal negotiations proceed, that the Delaware courts are partial to merger pricing as a measure of fair value. This more recent decision follows the decision in In Re Appraisal of Petsmart, Inc.

As discussed further herein, the facts and circumstances involving the SWS Group, Inc., merger suggested that the fair value is most likely not the same as the merger price. If SWS is appealed, it would be somewhat surprising if the Supreme Court overturned and remanded the Chancery Court ruling that the discounted cash flow method provided a better indication of fair value than the merger price.

This discussion of the SWS decision highlights key dissenting shareholder decision making and possible ramifications.

First, an investor should consider the decision to invoke appraisal rights. Dissenting from a proposed merger may result in a decrease in respective merger proceeds.

Second, an investor should consider that a merger price may be considered fair value, as it appears that the Delaware courts are partial to merger price as an indication of fair value—depending on the facts and circumstances.

And, finally, an analyst should consider how a subject analysis may be viewed by the court. Does the analysis advocate a position that overwhelmingly favors its client?  Does the end-result produce a value that is unreasonable?

Background of SWS Group, Inc.8

The target company, SWS Group, Inc. (SWS Group), was a small bank holding company that was publicly traded on the New York Stock Exchange. SWS Group had two general business segments:

- traditional banking (Bank) and

- brokerage services (Broker-Dealer).

The Broker-Dealer operations had significantly more locations and resources than the Bank. In fact, the Bank had a deficient amount of retail deposits. Nearly 90 percent of SWS Group deposits came from overnight sweep accounts that were held by SWS Group Broker-Dealer clients.

SWS Group provided loans to borrowers in North Texas that became past due as a result of the financial crisis in 2008 and 2009. From 2007 to 2011, the Bank’s nonperforming assets increased from two percent of total assets to 6.6 percent.

As a result, in July 2010, the Bank entered into a Memorandum of Understanding with Federal regulators that restricted certain business and required higher capital ratios.

The next year, in February 2011, federal regulators issued a cease and desist order to the Bank, which further restricted Banking activities.

SWS Group management searched for solutions to increase capital ratios of the banking business. First, the SWS Group management tried to increase bank-related capital by transferring capital from the Broker-Dealer to the Bank. This action resulted in a liquidation of Broker-Dealer assets.

Ultimately, this strategy only served to exacerbate the Bank’s problem. The transfer of assets caused the capital of the Broker-Dealer segment to decline below the threshold capital levels acceptable to counterparties, creating the potential for an impairment of the Broker-Dealer business segment.

SWS Group tried to raise capital in December 2010 through a public offering of convertible unsecured debt. The debt offering failed due to a lack of investor demand. Consequently, SWS Group management investigated opportunities in the private marketplace.

Discussions between SWS Group and Hilltop Holdings, Inc. (Hilltop),9 began in the early fall of 2010. At that time, both parties entered into a nondisclosure agreement allowing Hilltop to perform a due diligence review of SWS Group.

In March 2011, the terms of a Credit Agreement were finalized between SWS Group, Hilltop, and Oak Hill Capital Partners (Oak Hill).10

According to the Credit Agreement, Hilltop and Oak Hill provided a $100 million senior unsecured loan to SWS Group at an interest rate of eight percent. Also pursuant to the Credit Agreement, SWS Group issued an equity warrant to purchase 8,695,652 shares of SWS Group common stock to Hilltop and Oak Hill. The warrant had an exercise price of $5.75 per share.

Upon exercise of the warrants, the subject debt provided by Oak Hill and Hilltop is eliminated. If the warrants were not exercised, the subject loan would mature in five years.

At the same time that SWS Group entered into the Credit Agreement, it also entered into an Investor Rights Agreement (IRA) with Hilltop and Oak Hill. The IRA provided Hilltop and Oak Hill the right to appoint a board member and a board observer to the SWS Group board of directors.

The Credit Agreement contained anti-takeover clauses, which would place the loan in default if the board no longer consisted of a majority of continuing directors, or if any other stockholder acquired more than 24.9 percent of SWS Group stock.

In addition, a clause in the Credit Agreement included a covenant prohibiting the SWS Group from undergoing a fundamental change, which was defined to include a sale of SWS Group (Merger Covenant).

After the Credit Agreement was finalized, SWS Group implemented a plan to improve the business. From 2011 through 2014, SWS Group management prepared annual budgets. In order to prepare the annual budget, management asked its business leaders for aspirational goals/projections.

The annual budget was then presented to the SWS Group board of directors for approval. Single year projections are extrapolated to produce three-year strategic plans.

However, SWS Group never met its budget during the period from 2011 to 2014. Rather, SWS Group suffered declining revenue throughout the period and failed to earn a profit in every year except for 2012. In 2012, SWS Group recorded a small profit.

SWS Group hired a new CEO in 2012, who implemented changes and improved capital levels at the Bank. The CEO’s efforts resulted in the termination of the cease and desist order in 2013.

However, the Bank still struggled to maintain profitability. Disappointing financial performance of SWS Group led management to write down approximately $30 million of the deferred tax asset.

The deferred tax asset was comprised of accumulated net operating losses. SWS Group management did not believe that it would be able to generate sufficient income to realize the full benefit of the net operating losses within the requisite time frame.

In August 2013, the SWS Group board of directors directed the CEO to significantly reduce costs due to continued poor financial performance. The board of directors remained concerned about the ability to meet financial obligations under the Credit Agreement.

Before a sales process began, equity analysts speculated that SWS Group might be an acquisition target. SWS Group stock traded higher in public markets as a result of merger speculation. At the time, Hilltop was considering an acquisition of SWS Group. Hilltop management expected the acquisition to provide synergistic benefits to its business operations.

On January 9, 2014, Hilltop made an offer to acquire SWS Group for $7.00 per share, payable in 50 percent cash and 50 percent Hilltop stock. This offer price reflected a premium relative to:

- the closing price of $6.06 per share of SWS Group on January 9, 2014, and

- the one-year average price per share of $5.92.

Two other interested parties approached SWS Group regarding an acquisition. The first interested party, Esposito, a small Dallas, Texas, broker-dealer business, never provided a formal offer. The second interested party, Stifel Financial Corp. (Stifel),11 expressed interest at $8.15 per share.

However, SWS Group management was doubtful about the authenticity of Stifel’s interest. According to SWS Group management, Stifel had a reputation of pursuing acquisitions, backing out, and then poaching key employees from the acquisition target.

On or around March 20, 2014, SWS Group reached a handshake deal to consummate a merger with Hilltop. At this time, Stifel was still expressing interest in purchasing SWS Group at a purchase price above Hilltop’s offer price.

However, Hilltop made clear that it would not waive the merger covenant provided by the Credit Agreement. Stifel improved its offer to purchase the SWS Group, but Stifel was unable to complete its due diligence to its satisfaction and no agreement ever materialized.

An SWS Group financial advisor provided a fairness opinion that concluded that Hilltop’s proposal was fair to SWS Group shareholders. On March 31, 2014, the SWS Group board of directors approved the merger with a Hilltop subsidiary.

A few months prior to the merger closing, Oak Hill exercised the majority of its warrants on September 26, 2014, consisting of 6.5 million SWS Group shares. On October 2, 2014, Hilltop exercised the remaining equity warrants. After the subsequent warrant exercise, Hilltop owned 8.7 million SWS Group shares.

Subsequent to the warrant exercise, $87.5 million of SWS Group debt was eliminated. On January 1, 2015, the merger closed with Hilltop paying SWS Group shareholders total merger consideration of $6.92 per share.

The petitioners, former stockholders of SWS Group, dissented from the transaction and exercised their statutory right to a fair value appraisal. The petitioners were comprised of seven entities, which held, in aggregate, 7,438,453 shares of SWS common stock.

Certain stockholders of the petitioners started to accumulate shares shortly after the deal was announced. The apparent purpose of the share acquisition, after the transaction was announced, was to engage in an appraisal arbitrage strategy.

In SWS, several appraisal petitions were filed with the Chancery Court in January 2015. A four-day trial was held in September 2016 followed by a post-trial briefing. As noted by the Chancery Court, “as is typical in these proceedings, the experts present vastly divergent valuations.”

The petitioner expert arrived at $9.61 per share and the respondent expert arrived at $5.17 per share.

The Chancery Court Analysis

At trial, neither expert relied on the merger price. The petitioner expert justified the decision to ignore the merger price by highlighting the flaws in the sales process. Also, according to the petitioner expert, the merger price should be ignored due to the fact that Hilltop had a partial veto of any potential acquisition of SWS Group by another entity.

It appears that from the petitioner perspective, it is a reasonable assumption that the fair value was not equal to the merger price. The instant case involved different facts and circumstances than in the In Re Appraisal of Petsmart, Inc., matter where a rigorous sales process provided a reasonable indication of fair value.12

In the instant case, in addition to the partial veto issue, the Chancery Court found that SWS Group board of directors did not enter into a rigorous sales process.

The respondent expert argued that the merger price reflected the premium Hilltop paid for the shared synergies that it expected to realize from the transaction. The position of the respondent expert was that such a premium should not be considered in a fair value appraisal action.

The Chancery Court agreed with the petitioner expert that the merger price was an unreliable indicator of fair value. The Chancery Court found that price was unreliable because of the partial veto power Hilltop could exercise as part of its rights agreed to under the Credit Agreement.

As a result, the Chancery Court applied traditional valuation methodologies to arrive at a fair value conclusion.

Comparable Companies Analysis

Only the petitioner expert conducted a guideline comparable companies analysis for SWS Group, to which he gave a 20 percent weighting in his fair value conclusion.

The Chancery Court rejected the guideline comparable companies analysis. According to the Chancery Court, the selected companies do not have to be a perfect match, but the analysis must employ a good sample of actual comparable/guideline companies.

The Chancery Court found that the guideline companies selected were not sufficiently comparable given SWS Group’s unique structure, small size, and poor performance.

Guideline publicly traded companies should be similar to the subject company—it is not necessary that the guideline companies be exact copies.

Assuming there is a sufficient amount of similarity between a subject company and potential guideline companies, the application of the guideline publicly traded company method is generally beneficial to the valuation analysis.

The advantages of using the Market Approach include the following:13

- It is fairly simple to understand.

- It uses actual data and is not as dependent on long-term estimates.

- It generally includes the value of all business operating assets.

- It does not rely on explicit forecasts, and future growth is embedded in the pricing multiples.

The disadvantages of using the Market Approach include the following:

- No good guideline companies exist—the analyst may not be able to find sufficiently similar guideline companies.

- An insufficient number of data points or guideline companies exist, thus creating a problem with not enough information available to form an opinion.

- Certain assumptions may be hidden, as growth rate assumptions, subject equity risk assumptions, and margin assumptions are incorporated in pricing multiples but are embedded and not explicit.

The following sources can assist the valuation analyst in creating a potential list of guideline companies:14

- Company management—ask company management about publicly traded competitors.

- Standard Industrial Classification (SIC) or North American Industry Classification System (NAICS)—base a search off an SIC code or NAICS code using an online database.

- Online databases—use databases to find and screen potential guideline companies.

- Industry research—reading trade journals and industry reports can be helpful to identify guideline companies.

In general, a valuation analyst may choose to focus a guideline search based on business description matching. After a group of companies has been identified, a typical next procedure is to identify the group of guideline companies that provides the most meaningful pricing evidence.

Often, though not in all valuation assignments, there is usually enough size variation among publicly traded companies that this method should be at least considered as a means to estimate value.15

As a means of eliminating guideline companies, the issue of size-related comparability is an important consideration in selecting guideline companies. One of the main reasons is that smaller companies typically have more business and financial risk than larger companies.16

Small company risk characteristics include the following:

- Potential competition issues (it is easier to enter the market and compete with small companies while larger companies have resources to mitigate competitive challenges).

- Economic issues and concern (larger companies can better cope with economic downturn than small companies).

- Limited access to capital (small companies can find it difficult to obtain funding while larger companies typically have more options for funding).

- Management depth concerns (large companies do not have key employee concerns in the same way that smaller companies do).

- Customer concentration and product concentration risk (small companies are typically not as diversified in product offerings and are often beholden to a small group of customers).

- Liquidity concerns and lack of market coverage (small companies do not enjoy the same level of analyst coverage and small company stock is typically less liquid than larger companies).17

Assuming a guideline publicly traded company is sufficiently similar to a subject business, in terms of business operations based on its business description, there are methods by which publicly traded guideline company multiples can be adjusted for differences in size and in growth. In general, adjusting guideline publicly traded company pricing multiples for size and growth is not commonly applied in valuation analysis.

It is generally more common for an analyst to use professional judgment and consider the size-related differences in the selection and application of pricing multiples. However, it is important to recognize that there are methods for adjusting pricing multiples.

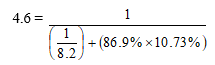

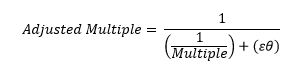

For example, to prepare a size-adjusted guideline publicly traded company pricing multiples analysis, the following equation may be used:18 where:

where:

Multiple =      Guideline publicly traded company pricing multiple

ε       =         Percent of equity capital in guideline company capital structure

θ        =      Percent difference between (1) mean return for guideline company based on its Center for Research in Security Prices (CRSP) size classification and (2) mean return for subject company based on its CRSP size classification

The guideline publicly traded company pricing multiple size-premium adjustment is similar in concept to the equity-related size-premium adjustment. Based on arithmetic mean returns published in the Duff & Phelps publication 2017 Valuation Handbook—U.S. Guide to Cost of Capital, companies categorized as the largest decile, size decile 1, provided an average return of 11.05 percent.19

Companies categorized in the subdecile 10z, the smallest subcategory decile, provided an average return of 25.54 percent.20

Based on relative size, if a subject company is classified as a subdecile 10z security, the previously provided equation can be used to adjust pricing multiples derived from larger guideline companies.

Assuming a guideline public company has a market capitalization of $1.98 billion, it is classified as a decile 6 security. The arithmetic average return for a decile 6 security is 14.81 percent.21

Therefore, the average return of a decile 6 security is 10.73 percent lower than the average return for a subdecile 10z security. The percent of equity capital in the guideline company capital structure is 86.9 percent.

Based on the previously provided formula, the adjustment to a market value of invested capital (MVIC) to earnings before interest, taxes, depreciation, and amortization (EBITDA) market pricing multiple of 8.2 times is as follows:

Adjusted MVIC to EBITDA Pricing Multiple:

Therefore, based on this singular example, a guideline public company pricing multiple of 8.2 is adjusted to 4.6 percent to reflect a more reasonably appropriate pricing multiple to apply to a subject company.

However, it is up to the analyst to decide if this type of adjustment is appropriate given the specific facts and circumstances of the valuation engagement.

Discounted Cash Flow Analysis

Both the petitioner expert and respondent expert prepared a discounted cash flow (DCF) analysis.

As discussed, the Chancery Court found that the experts presented significantly divergent valuation opinions. And, ruling out the guideline company method, the Chancery Court constructed its own DCF analysis.

To develop its own DCF, the Chancery Court made decisions regarding DCF valuation variables and inputs. The Chancery Court specifically decided DCF inputs including cash flow projections, terminal value growth rate, equity risk premium, beta, and equity size premium.

This article was previously published in Willamette Insights, Spring 2018.

Notes:

- In re Appraisal of SWS Group, Inc., C.A. No. 10554—VCG, 2017 WL 2334852 (Del. Ch. May 30, 2017).

- The Court cited In Re Appraisal of Petsmart, Inc., No. 10782, 2017 WL 2303599 (Del. Ch. May 26, 2017) as evidence of Court precedent.

- In a more recent matter, not specifically discussed herein, the Chancery Court arrived at similar conclusions. See In re Appraisal of AOL, Inc. (AOL), C.A. No. 11204-VCG, 2018 WL 1037450 (Del. Ch. Feb. 23, 2018) and Verition Partners Master Fund Ltd. and Verition Multi-Strategy Master Fund Ltd., v. Aruba Networks, Inc. (Verition), C.A. No. 11448–VCL, 2018 WL 922139 (Del. Ch. Feb. 15, 2018). In AOL, the Chancery Court rejected the deal price and relied on the discounted cash flow to establish its fair value conclusion. In Verition, the Chancery Court rejected the deal price and arrived at a fair value based on the thirty-day average unaffected publicly traded market price. In Verition, similar to SWS Group and the recent AOL decision in result, the concluded fair value was lower than the subject deal price.

- In re Appraisal of Dell Inc., C.A. No. 9322-VCL, 2016 WL 3186538 (Del. Ch. May 31, 2016).

- Dell, Inc. v. Magnetar Global Event Driven Master Fund Ltd., et al., 177 A.3d 1 (Del. 2017).

- Id. at 1.

- Id. at 44.

- In Re SWS Group, Inc., 2017 WL 2334852.

- Hilltop Holdings, Inc., provides business and consumer banking services. It became a bank holding company after its acquisition of PlainsCapital Corporation in 2012. Hilltop is headquartered in Dallas, Texas.

- Oak Hill Capital Partners is a private equity and distressed company firm specializing in buyouts, recapitalizations, and complex turnaround investments in middle-market companies. Oak Hill is headquartered in Stamford, Connecticut.

- Stifel Financial Corp. is a financial services and bank holding company. Stifel is headquartered in St. Louis, Missouri.

- In Re SWS Group, Inc., 2017 WL 2334852 at *1.

- James R. Hitchner, Financial Valuation: Applications and Models, 4th ed. (New York: John Wiley & Sons, 2017), 296-297.

- Gary R. Trugman, Understanding Business Valuation a Practical Guide to Valuing Small to Medium Sized Businesses, 5th edition (New York: American Institute of Certified Public Accountants, 2017), 324.

- Hitchner, Financial Valuation, 309.

- Ibid.

- Roger J. Grabowski, “The Size Effect—It Is Still Relevant,” Business Valuation Review 35, No. 2 (Summer 2016): 63.

- Hitchner, Financial Valuation, 339.

- See Duff & Phelps, 2017 Valuation Handbook: U.S. Guide to Cost of Capital (New York: John Wiley & Sons, 2017), 7–11.

- Ibid.

- Ibid.

Jeffrey A. Jensen is an associate at Willamette and is located in the firm’s Chicago office. He is a licensed Certified Public Accountant (CPA) in the state of Illinois. Mr. Jensen has passed Level II of the Chartered Financial Analyst (CFA) program sponsored by the CFA Institute. He is a member of the American Institute of Certified Public Accountants (AICPA) and a member of the Forensic and Valuation Services (FVS) section of the AICPA. He is also a member of the Business Valuation Association in Chicago.

Mr. Jensen can be contacted at (773) 399-4317 or by e-mail to jajensen@willamette.com.

Kevin M. Zanni is a valuation director at Willamette and is located in the firm’s Chicago office. He is an accredited senior appraiser (ASA) of the American Society of Appraisers, accredited in business valuation; a certified business appraiser (CBA) of the Institute of Business Appraisers; a certified valuation analyst (CVA) of the National Association of Certified Valuators and Analysts; and a certified fraud examiner (CFE) of the Association of Certified Fraud Examiners. Mr. Zanni is a past president of the Chicago chapter of the American Society of Appraisers and is a current board member of the Business Valuation Association of Chicago. He has written numerous articles on the subject of security valuation and economic analysis. He has spoken on economic and business valuation issues to numerous professional groups and associations.

Mr. Zanni can be contacted at (773) 399-4333 or by e-mail to kmzanni@willamette.com.