Home Health and Hospice Enterprises

Fair Market Value Considerations (Part II of II)

The first of this two-part series reviewed the unique value drivers that impact the typical valuation approaches, methods, and techniques that are often utilized in determining the value of these enterprises in the current healthcare delivery system. This second part will discuss the value drivers related to home healthcare and hospice enterprises.

Introduction

As discussed in Part I of this two-part series on the fair market value (FMV) considerations of home health and hospice enterprises, home healthcare enterprises are those enterprises that coordinate the delivery of healthcare services to patients in their homes. There are three types of entities that typically fall under the umbrella of home healthcare: (1) home healthcare enterprises, which provide medical and supportive care; (2) home care aide enterprises, which provide non-medical care or custodial/non-meal care; and (3) hospice enterprises, which provide end-of-life care.[1]

The valuation of home healthcare and hospice enterprises and services are influenced by certain market forces related to the Four Pillars of Healthcare Valuation, i.e.: (1) regulatory; (2) reimbursement; (3) competition; and (4) technology—each of which relates to almost all aspects of the U.S. healthcare delivery system. The first of this two-part series reviewed the unique value drivers that impact the typical valuation approaches, methods, and techniques that are often utilized in determining the value of these enterprises in the current healthcare delivery system. This second part will discuss the value drivers related to home healthcare and hospice enterprises.

Value Drivers: Home Healthcare Enterprises

Value drivers refer to specific factors that impact the valuation of a business. Similar to those of other outpatient enterprises, the value drivers identified for home healthcare and hospice enterprises are: (1) capacity, (2) revenue stream, (3) payor mix, (4) operating expenses, (5) capital structure, (6) suppliers, (7) market rivalries and competitors, and (8) subject entity specific/nonsystematic risk. Each of these are discussed below.

Capacity

The capacity of a home healthcare enterprise differs from other types of outpatient enterprises, in that home healthcare services are not provided at a specific facility, but rather in a patient’s home. Consequently, the requisite due diligence to ensure that the subject enterprise has sufficient resources to handle the projected patient volumes may require different considerations. Accordingly, capacity, as a unit of measurement for home healthcare enterprises, is typically based on labor metrics, e.g., the number of full-time equivalent (FTE) provider staff, and staffing mix (e.g., registered nurses, licensed practical nurses, home care aids, physical therapists, occupational therapists, social workers) to provide quality services efficiently and effectively to meet the available demand.

Revenue Stream

Reimbursement for home healthcare services is significantly limited by: (1) the type of condition being treated, (2) the type of service being performed, and (3) the source of payment. Accordingly, only certain patient populations are likely to generate a steady revenue stream, such as those patients who exhibit chronic health conditions. In addition, several services are reimbursed under episode-based payments, which use a different unit of productivity, i.e., the episodes of care (measured in 60-day episodes for Medicare reimbursements), than the metrics used for other professional practices, such as work relative value units (wRVUs) or procedure volumes.[2] Hospice services are available to terminally ill patients with less than six months to live, which may create challenges for the development of patient volume projections. Also, Medicare, which represents over 85% of the payor mix for hospice services, has payment caps in place that may impact the payments of the subject provider.

Although home healthcare is declining in certain geographic areas, total industry revenue is expected to rise to $122.6 billion in 2023, with an annual growth rate of 5.7% from 2018 to 2023.[3] The projected growth increase in the HHA industry, along with the current fragmentation in the industry, is expected to continue fueling consolidation within the home healthcare industry.[4] It should be noted that for hospice enterprises, for-profit entities typically experience significantly higher profitability than their not-for-profit counterparts (which may be taken into consideration as these entities seek alignment opportunities).[5]

Additionally, hospitals are referring fee-for-service (FFS) beneficiaries more frequently to home healthcare rather than to skilled nursing facilities.[6] Secondly, the rise of value-based care and alternative payment models have reinforced the idea of treating patients in less costly settings.[7] For example, in those areas participating in the Comprehensive Care for Joint Replacement (CJR) program, hospitals would be incentivized to work with less costly home agencies in order to maximize the benefits of receiving a bundled payment.[8]

Payor Mix

Like that of most healthcare enterprises, the payor mix affects the revenue (and subsequent net economic benefit) generated by an HHA and is often a significant factor driving the value of a specific enterprise. Medicare remained the largest single payor of home healthcare services in 2017, paying for 40% of all home healthcare expenditures; Medicaid trailed closely behind, paying for just over 36% of expenditures.[9] Since commercial payors typically pay higher reimbursement rates than public payors, the ability of the subject enterprise to obtain reimbursement from these higher-paying sources may positively affect their revenue generating capabilities. However, because the demand for home healthcare services is typically driven by an older patient demographic, Medicare reimbursement will likely continue to be a major funding source for home healthcare enterprises.

Operating Expenses

Despite the growing demand for home healthcare services, the industry’s average profit margin is expected to continue to decline, accounting for 7.2% of revenue in 2018.[10] Typically, the largest operating cost for home healthcare enterprises is staff costs, which include both skilled labor (e.g., physicians, nurses, social workers, chaplains, therapists, and counselors) and unskilled labor, such as nurse aides and home care aides.[11] Of those staff costs, the skilled labor component is usually the largest single expenditure.[12] Labor costs account for 52% of home healthcare revenues, in contrast to labor cost to revenue of 39.8% for the entire healthcare industry.[13]

Capital Structure

The implications of the capital structure decision for HHAs are similar to those of physician professional practices. These implications include: (1) the mix of debt and equity financing affects the risk-adjusted required rate of return for investment in the subject enterprise; (2) debt financing is typically cheaper than equity financing; and (3) financing costs reflect the risks associated with each type of capital provided, e.g., debt financing typically considers the risk of the four Cs: credit risk (default risk) of the borrower, capacity of the borrower to make timely repayments of both principal and interest (short-term liquidity and interest coverage), collateral to cover the lender in case of borrower default, and an analysis of the covenants included in the indenture agreement.

HHAs are characterized by low capital needs (exceptions may include those HHAs offering home respiratory therapy services) and the personalized nature of the services provided. Due to the presence of publicly traded companies operating in the home healthcare industry, data and information pertaining to the most probable capital structure of a home healthcare enterprise can be derived from normative industry benchmark survey data, as well as comparable publicly traded company data (with adjustments for the consideration of the specific enterprise’s service offerings and operating characteristics). In addition, the capital structure can be determined through techniques such as the iterative method. Further, for the purpose of establishing the FMV of a business enterprise, it is important to use formulas based on market values of equity and debt, rather than book values.[14]

Suppliers

The healthcare industry supply chain may also have a significant impact on the economic operating cost burden incurred by an HHA, due to the number of drugs, supplies, and durable medical equipment (DME) required by the organization to generate the services provided by the subject home healthcare enterprise. Enterprises, in general, generate a significant amount of their bargaining power from their size, with larger enterprises being more likely to have greater negotiating power with vendors and suppliers, which may translate into lower operating costs and a greater value attributable to the enterprise.

Market Rivalries and Competitors

As discussed above, the home healthcare market is highly fragmented, with 90% of the industry consisting of sole proprietorships.[15] While concentration in the industry is currently low, consolidation has begun increasing, and is anticipated to continue.[16] Home healthcare providers differentiate themselves in the competitive landscape mainly on the basis of price (particularly for Medicare’s Durable Medical Equipment, Prosthetics, Orthotics, and Supplies [DMEPOS] Competitive Bidding Program), quality of services offered, and brand/reputation.

Of note, the home infusion therapy market is expected to be worth $25 billion by 2024, with a compound annual growth rate (CAGR) of 10% during the forecast period.[17] The industry employment of this industry is steadily declining as well as the number of businesses. Similarly, the respiratory therapy market is steadily declining, decreasing to an estimated 4,000 providers from 18,000 in 2008, due to the implementation of Medicare’s competitive bidding that year.[18]

Subject Entity Specific/Nonsystematic Risk

In the determination of the adjustment for the specific risk premium for the interest in an HHA, a valuation analyst may, somewhat subjectively, consider the various risk factors that are inherent and specific to the enterprise being valued, as well as the enterprise’s operational performance as compared to the industry benchmarks. Specific risk factors may include: (1) diversity of referral sources; (2) depth of management; (3) stability of business; (4) level of competition; (5) operational performance; (6) risk related to future changes in reimbursement, due to the contracting ability of the subject enterprise; (7) diversity of payor mix and service offerings; and (8) variance in availability of workforce in the market service area.

Other Pertinent Valuation Considerations

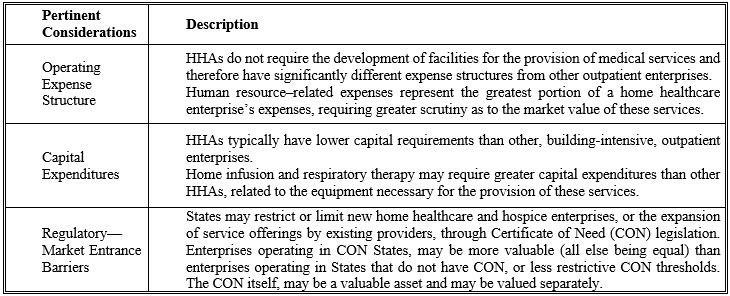

Table 1, below, illustrates some of the other pertinent considerations related to the valuation of HHAs:

Table 1: Other Pertinent Valuation Considerations for HHAs

Applicability of Valuation Approaches

Each of the three recognized valuation approaches (i.e., Income, Market, and Asset) may be applicable to the valuation of home healthcare and hospice enterprises. Careful considerations of the scope of the engagement, the level of value desired, and the availability of data and information should determine which approaches and methodologies to employ for the valuation of the enterprise.

Income approach-based methods are commonly used and widely accepted for the valuation of home healthcare and hospice providers when the enterprise has achieved sufficient cash flow to provide a reasonable return on its assets. The Discounted Cash Flow Method, if revenues, expenses, and working capital needs can be projected with some degree of certainty, may be the most useful valuation method to employ for it allows the value drivers, specific to the subject provider, to be explicitly identified and modeled. Market approach-based methods, while appropriate for the valuation of home healthcare and hospice enterprises, are more challenging to employ due to the difficulty in obtaining sufficient information regarding the comparable companies and transactions to make the necessary considerations and adjustments to apply to the subject provider being valued. Additionally, there are several large publicly traded home healthcare and hospice companies, which may, at a minimum, provide an understanding of the marketplace and value drivers from the perspective of the most likely buyers of HHAs, as well as provide a reasonableness test of other valuation approaches by calculating valuation multiplies of the guideline public companies. Asset approach-based methods employed for the valuation of a going-concern home healthcare or hospice enterprise, may be useful, but may also fail to capture the entirety of the intangible asset value of the company, especially if the company is capable of producing significant economic benefits (i.e., profits).

Conclusion

There are unique value drivers that impact the typical valuation approaches, methods, and techniques that are often utilized in determining the value of home healthcare and hospice enterprises and providers in the current healthcare delivery system. The value of home healthcare and hospice enterprises is significantly tied to the rapidly evolving U.S. healthcare industry, eminent in the modern era of U.S. healthcare reform and government regulation. The ability of these providers to operate in a continuum of care in the new value-based reimbursement paradigm may determine their viability as an ongoing enterprise in the future. It is critical when valuing these enterprises that not only consideration be given to, but an understanding be had, of the Four Pillars of Healthcare Valuation, i.e.: (1) regulatory; (2) reimbursement; (3) competition; and (4) technology—and their applicability to home healthcare and hospice enterprises within the U.S. healthcare delivery system.

Todd A. Zigrang, MBA, MHA, ASA, FACHE, is president of Health Capital Consultants, where he focuses on the areas of valuation and financial analysis for hospitals and other healthcare enterprises. Mr. Zigrang has significant physician-integration and financial analysis experience and has participated in the development of a physician-owned, multispecialty management service organization and networks involving a wide range of specialties, physician owned hospitals as well as several limited liability companies for acquiring acute care and specialty hospitals, ASCs, and other ancillary facilities.

Mr. Zigrang can be contacted at (800) 394-8258 or by e-mail to: tzigrang@healthcapital.com.

Jessica Bailey-Wheaton is Vice President and General Counsel for Heath Capital Consultants.

Ms. Baily-Wheaton can be contacted at (800) 394-8258 or by e-mail to: jbailey@healthcapital.com.

[1] “IBISWorld Industry Report 62161: Home Care Providers in the US” By Dmitry Diment, IBISWorld, December 2018, p. 13.

[2] “Home Health Care Services Payment System” Medicare Payment Advisory Commission, Payment Basics, October 2011, p. 1.

[3] “Home Care Providers Industry in the US” IBIS World, 2018, https://www.ibisworld.com/industry-trends/market-research-reports/healthcare-social-assistance/ambulatory-health-care-services/home-care-providers.html (Accessed 3/15/19).

[4] “Home Health Executive Forecast for 2019: Obamacare, Consolidation and PDGM” By Robert Holly, Home Healthcare News, December 20, 2018, https://homehealthcarenews.com/2018/12/home-health-executive-forecast-for-2019-obamacare-consolidation-and-pdgm/ (Accessed 3/12/19).

[5] “Chapter 9: Home health care services” Medicare Payment Advisory Commission, March 2017, http://www.medpac.gov/docs/default-source/reports/mar17_medpac_ch9.pdf (Accessed 3/12/19), p. 247.

[6] “Hospitals Slow to Shift Medicare Referrals from SNFs to Home Health” By Tim Mullaney, Home Health Care News, March 15, 2018, https://homehealthcarenews.com/2018/03/hospitals-slow-to-shift-medicare-referrals-from-snfs-to-home-health/ (Accessed 1/18/19).

[7] Ibid.

[8] Ibid.

[9] Note that the data includes freestanding facilities only. Additional services of this type provided in hospital-based facilities are counted as hospital care. “Table 4: National Health Expenditures by Source of Funds and Type of Expenditure: Calendar Years 2011–2017” available at “Historical” Centers for Medicare & Medicaid Services, December 11, 2018, https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsHistorical.html (Accessed 3/12/19).

[10] “IBISWorld Industry Report 62161: Home Care Providers in the US”, By Dmitry Diment, IBIS World, December 2018.

[11] “Homes for the Elderly 5-Year Industry Financial Report” BizMiner, August 2012, p. 2; “Hospice Facts and Statistics” Hospice Association of America, November 2010, p. 6.

[12] “Private Pay in Home Health Care How Medicare Certified Home Health Agencies Can Succeed in Private Duty Home Care” By Stephen Tweed, Leading Home Care, http://www.nahc.org/assets/1/7/am13-510.pdf (Accessed 3/12/19).

[13] “IBISWorld Industry Report 62161: Home Care Providers in the US”, By Dmitry Diment, IBIS World, December 2018, p. 21.

[14] “Cost of Capital: Applications and Examples” By Shannon P. Pratt and Roger J. Garbowski, 3rd ed., Hoboken, NJ: John Wiley & Sons (2008), p. 276–277.

[15] “IBISWorld Industry Report 62161: Home Care Providers in the US”, By Dmitry Diment, IBIS World, December 2018, p. 25.

[16] “Home Health Executive Forecast for 2019: Obamacare, Consolidation and PDGM” By Robert Holly, Home Healthcare News, December 20, 2018, https://homehealthcarenews.com/2018/12/home-health-executive-forecast-for-2019-obamacare-consolidation-and-pdgm/ (Accessed 3/12/19).

[17] “Home Infusion Therapy Market Expected To Be Worth US $25 Billion by 2024” Market Watch, August 31, 2018, https://www.marketwatch.com/press-release/home-infusion-therapy-market-expected-to-be-worth-us-25-billion-by-2024-2018-08-31 (Accessed 1/18/10).

[18] “Policymakers must fix problems with Medicare’s competitive bidding program for home oxygen therapy” Council for Quality Respiratory Care, December 3, 2017, http://www.cqrc.org/news121117.html (Accessed 1/18/19).