Leading with Your Heart

How to Avoid Romance of the Deal through Cold-Hearted Diligence

This paper attempts to address these issues while presenting summary critical considerations that can and do mitigate the likelihood of unintended consequences and deals that fail to deliver. Specifically, it will speak to how advisors and buyers can verify and substantiate the most critical and yet intangible value drivers in a deal.

Recently, private equity has been in the news again.

Roughly one month ago, Elizabeth Warren announced new proposed legislation—the Wall Street Looting Act—intended to curb “useless speculation,” encourage “economic patriotism,” while targeting “vampires” intent on “bleeding companies dry”. 2012, then Vice President candidate up for reelection took aim at Bain Capital, suggesting Mitt Romney represented “predatory capitalism” and that Bain was “parasitic”:

“You hear all these stories about his partners buying companies where they load up with a tremendous amount of debt,” Biden said. “The companies go under, everybody loses their job, the community is devastated, but they make money.”

Without question, private equity buy-outs tend to be leveraged transactions and at times that debt load, unbridled optimism and deal hubris, culture fit, integration challenges, and inadequate due diligence, can lead to deals that disappoint. Even up to and including the need to restructure, reorganize, or even liquidate.

This paper attempts to address these issues while presenting summary critical considerations that can and do mitigate the likelihood of unintended consequences and deals that fail to deliver. Specifically, we will speak to how can we verify and substantiate the most critical and yet intangible value drivers in a deal:

- Executive function

- Senior management team capability

- The degree of operational orientation and control

- “Human element” and cultural environment/fit

- Deep dive subject company risk assessment

- Classic due diligence accounting and finance emphasis

- Identification and assessment of executive function and organizational effectiveness attributes

- Essential deal risk assessment tool kit elements

- An orientation to win-win and why that matters in most successful transitions

For the past few years, absolutely extraordinary prices are being paid in merger and acquisition (M&A) transactions with historically unprecedented amounts going to goodwill; in particular from the drive to harvest strategic synergistic intangible value via capabilities premiums. Coupled with this dynamic are highly leveraged capital structures that increase the risks of impairment—especially with “unicorn” start-ups, social media plays, and development-stage ventures that are pre-, or nearly pre-revenue.

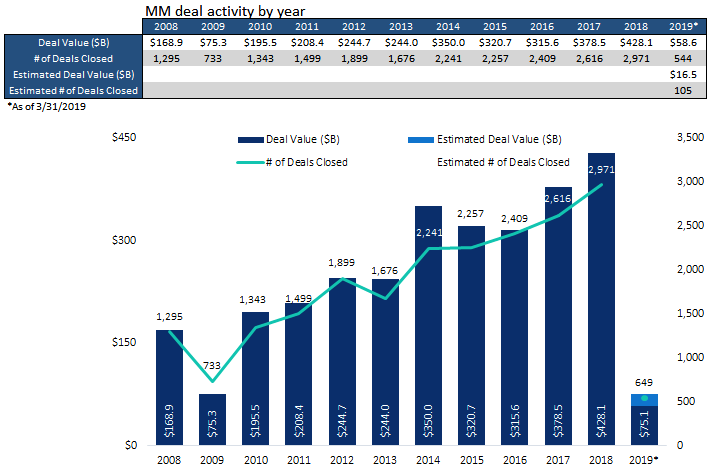

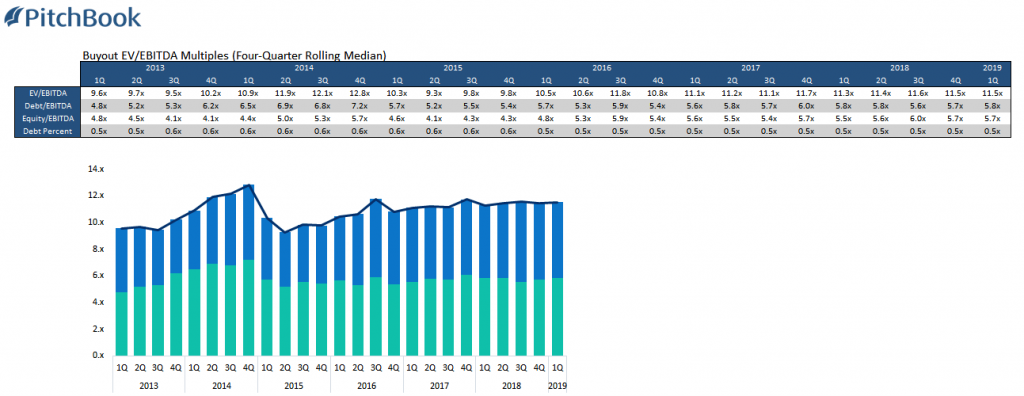

Although conditions are starting to show some early signs of “cooling” somewhat in some sectors, recent-year private transactions and multiples paid have shown a decided upward trend:

* PitchBook’s 1Q 2019 PE Middle Market Report

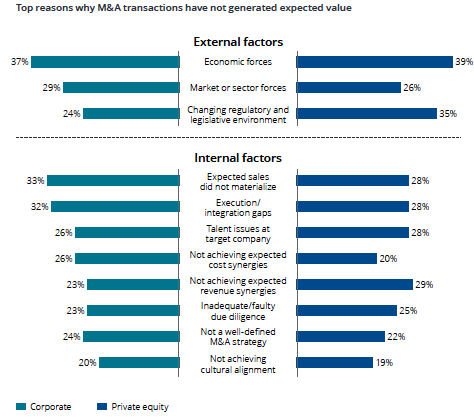

From the 2019 Deloitte M&A Study, the primary causes for deals that disappoint include:

Our experience at IronHorse is that deals can get a life, a momentum all their own. This can be due to inexperience with transactions, a corporate growth process that is ill-defined and poorly structured/resourced, perceived competitive pressures, a reluctance to “kill projects” while not defining critical go/no-go criteria, and other factors that contribute to a foregone inevitability that a deal will be closed, regardless.

The phenomena of Jerry Harvey’s, “The Abilene Paradox” is alive, well, and at times, a very powerful force driven by a combination of executive hubris and a fear of standing out and alone in expressing critical reservations as the process drives swiftly from an offer, through due diligence, to a closing. From our experience, we have compiled a short-list of primary drivers for deals that fail to deliver the goods:

- Getting the deal structure or price wrong; over-payment for acquisitions and/or over-leveraging the deal

- Misreading the new company’s culture; a bad marriage

- Integration plan not developed in advance; or blindly focusing on integration for its own sake

- Flawed, undisciplined corporate development

- Getting emotional; losing perspective, ignoring red flags, and romance of the deal

Transaction Process Overview

Potential acquirers can be strategic with portfolio assets in the acquired firm’s market space, financial buyers looking to invest and hold, or quasi-strategic hybrid financial buyers looking for add-on deals to their existing holdings. This is the marketplace for most private transactions and the capital market dynamics, the availability and pricing/terms for M&A funding play a crucial role. Especially when deal and capital markets cool and tighten down the road.

Most financial buyers (private equity funds, hedge funds, debt buyers) are looking to minimize, to the extent possible, the amount of capital they have provided and put at risk. As previously noted, a competitive M&A marketplace can accelerate upward pressure on multiples paid, and if conditions are conducive, the capital/funding can and does reflect highly aggressive and leveraged structures built on a foundation of very rosy optimism about the future.

Non-bank, commercial finance company asset-based lenders are not nearly as constrained in terms of regulatory restrictions, advance rates, LTV ratios, and they are extremely active players in M&A transactional financing.

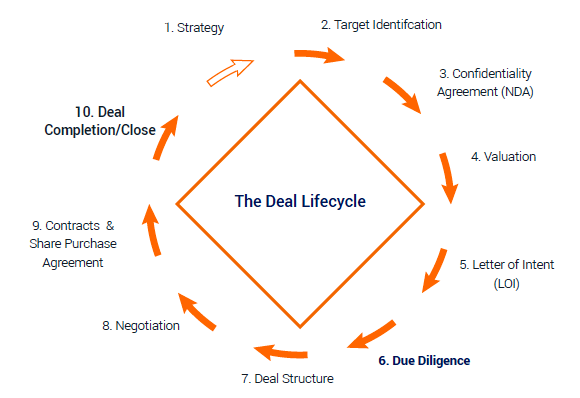

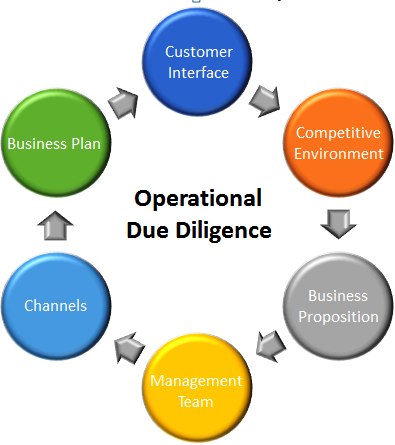

Visually, firms with active, well-structured and adequately resourced corporate growth capabilities have a cyclical but iterative looking process:

Acquirers need to be rigidly disciplined with this process, they need to know who they are and who they are not, and must be prepared at any point of #2 through #10 to walk away from the deal. They need to know when to hold ‘em, when to fold ‘em, and the culture needs to respect and support this philosophy. Much, much better to endure the pain of “under-deployed” capital than risk a deal that blows up. Active acquirers accept the reality that no matter their diligence, the risk associated with uncertainty is always prevalent, and the possibility of paying too much, leveraging too much, or taking on a lot of unintended water is always at play.

Critical questions to answer include what is the worst-case scenario, what is the cost of the worst-case scenario, and can we absorb that cost should we face that scenario. Some cultures discourage this kind of objective, brutally honest consideration—especially if political conditions within the organization run counter.

Searching For, Finding, and Harvesting Strategic Capabilities Premiums

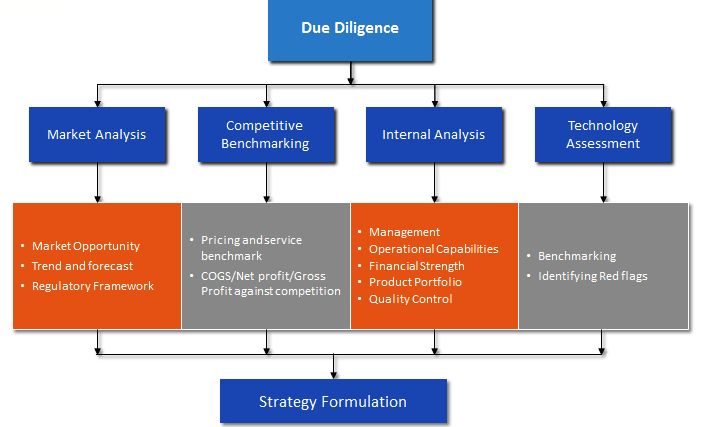

In some ways, traditional financial and operational due diligence can be pictured as well-organized, very rational audit work program with specific action steps to explore, assess, and hopefully validate marketplace considerations, operational capabilities, and internal controls to prevent and mitigate “the adverse”.

This process visually resembles:

The work programs reflect rather exhaustive action steps and checklists ensuring the due diligence considers:

- Human resources

- IT

- Logistics

- Sales strategy

- Suppliers

- Customers

- Internal operations

Risk analysis takes on the form of specific company risk premium workups, but at a much, much deeper and broader perspective. It includes evaluation of macroeconomic external risks, industry and market risk factors, operational risks, and a very thorough quality of earnings analysis. The QE assessments must take a very hard look at:

- Profitability and primary value drivers

- Cost structure

- Leverage and solvency

- Liquidity and efficiency

- Concentrations and dependencies

- Product and customer profitability reporting capability and quality

- Forward looking forecasting capabilities and accuracy

- Capital intensity/cap-ex demands on operating cash flow

- Ready-access to capital markets

- Volatility of reported results

- Repeat revenue probability

- Customer attrition rates and causes

One important up-front consideration is a thorough analysis of potential exit opportunities and alternatives. How ready is a speedy, viable exit when we deem the timing is right? Best time to consider an exit is before the deal is closed and funded.

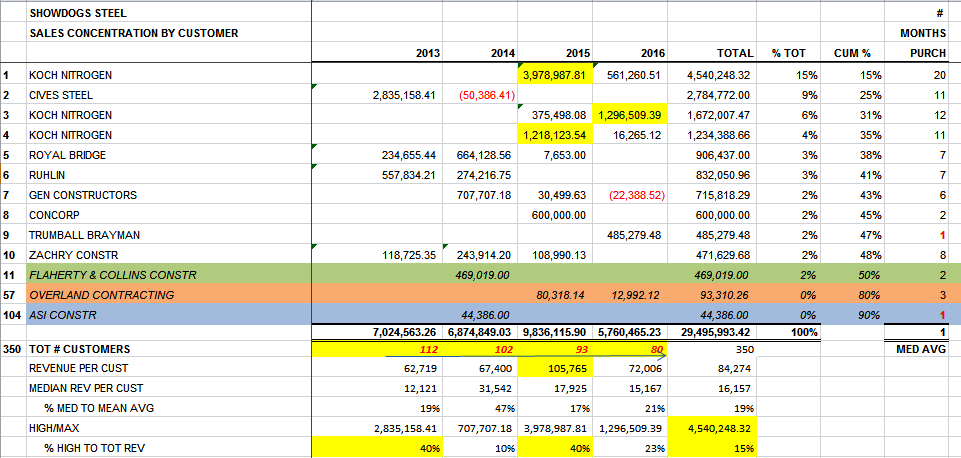

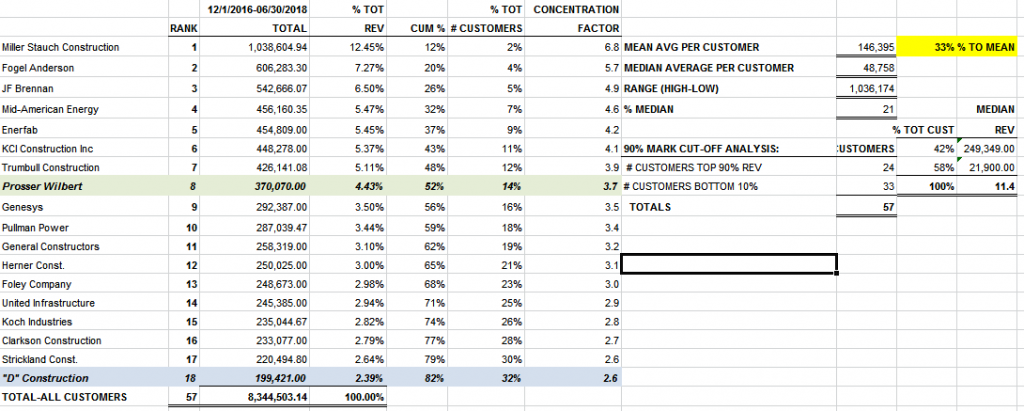

Some customer concentration and dependency sample reporting output:

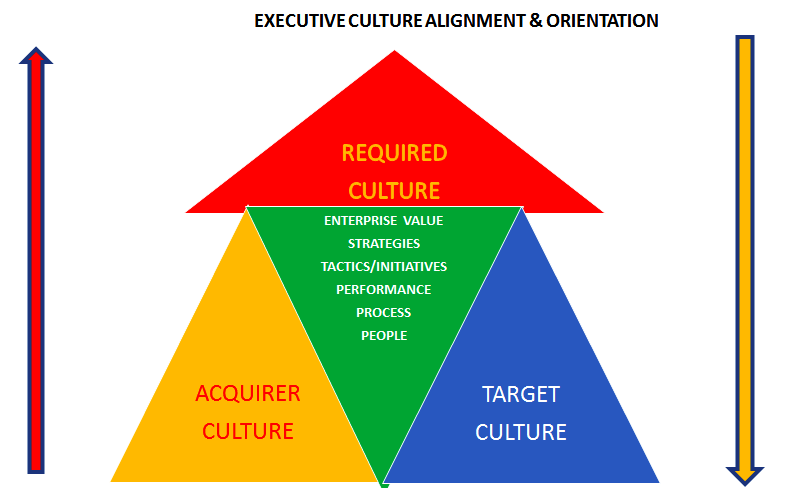

Executive Culture Alignment and Orientation

Unfortunately, far too often a “bad marriage” emerges from the merged entity, much of which can be traced back to challenges in assessing softer, highly intangible and challenging to precisely measure attributes; of both the acquired and also the acquiring firm. And yet, there are a number of effective due diligence tools that can be utilized to attempt to objectively assess and consider this very critical deal-killer risk which manifests itself in so many transactions. In particular, when a “strategic” acquirer acquires and attempts to assimilate a culture that may not be a good fit for the existing one in place. Our approach centers around focusing on indicators of executive and senior management alignment and orientation. We attempt to pay attention to and document what the two firms “pay attention to”. Orientation and alignment (or lack thereof) leaves very distinct trails and indicators. We see if the two firms are “measuring what matters,” while “managing what they measure”.

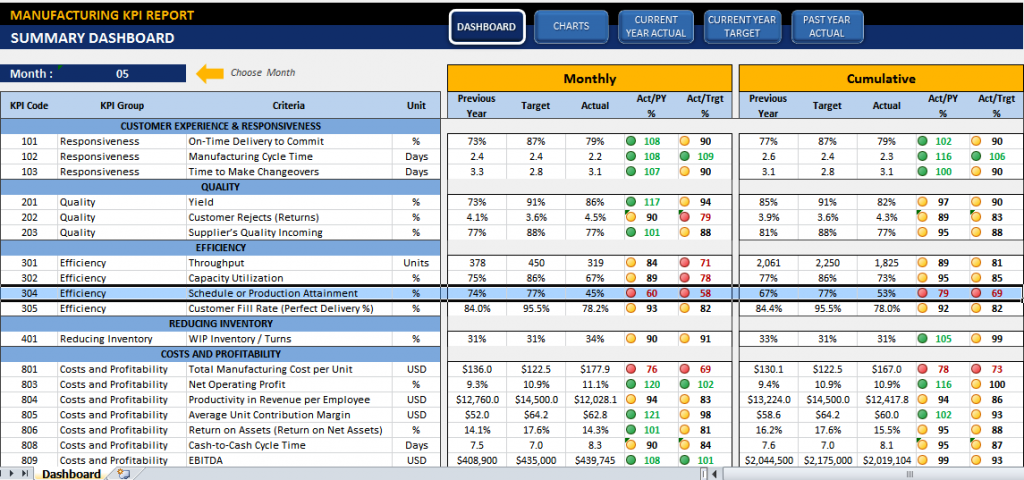

A well aligned and oriented culture uses powerful, visible, and readily accessible dashboards of critical numbers to monitor and manage their critical vital signs and value drivers:

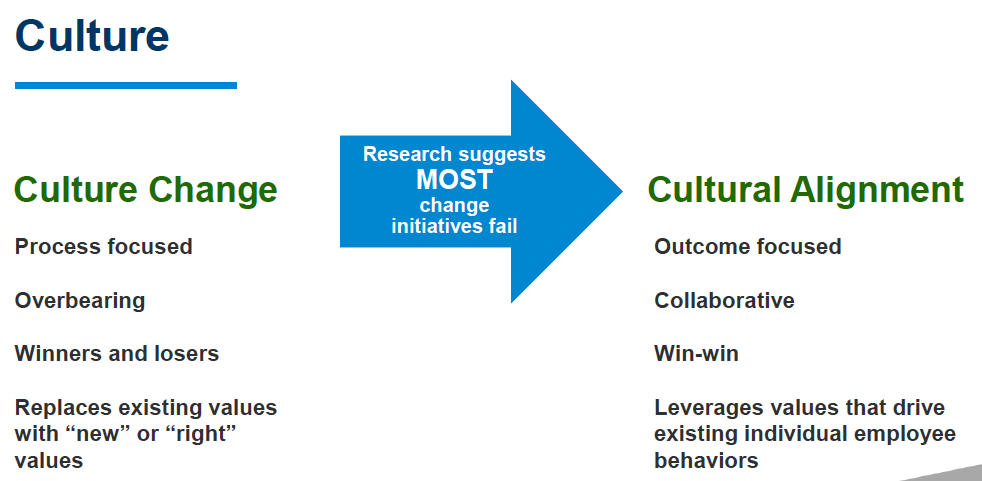

Softer side culture evaluation needs to focus and isolate upon:

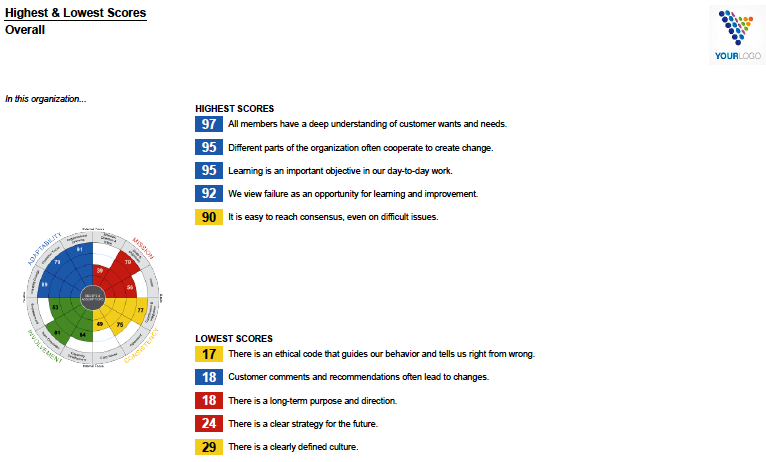

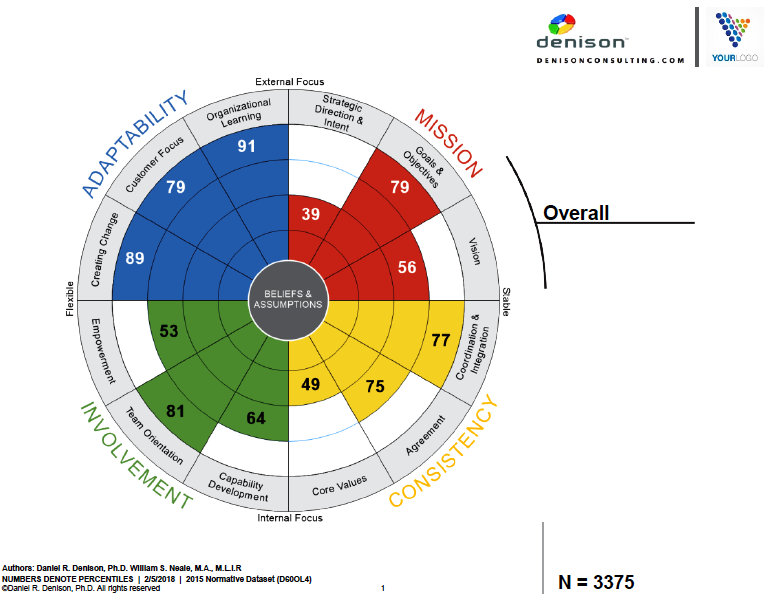

We have found that the Denison Organizational Culture Survey, when broadly circulated, provides a terrific foundation to picture the two cultures and for the acquirer to critically evaluate some of the intangible transaction barriers, and also some of the post-deal integration areas of focus that may become an issue down the road.

The following output is a sample of actual compiled output for a survey completed by members of our firm:

Conclusion

Again, there is nothing certain about the future, and that reality is especially applicable with M&A transactions. Reality is most deals fail to meet expectation, but using a disciplined corporate growth process, the allocation of adequate resources to this process, and the reliance upon very rigorous, objective, and even cold-hearted diligence, the odds of success can be greatly improved. It is a greatly expanded, much deeper dive exploration of industry and subject-company risks and as valuation professionals, understanding what goes into a successful and, more importantly, unsuccessful deal, positions us to make very potentially valuable contributions as buy or sell-side advisers, or in providing exit readiness assessments as part of comprehensive exit planning.

Tony Wayne, CVA, CPA, CIRA, CFF, FCPA, is President of IronHorse LLC, a Kansas City-based specialty consulting firm with practice concentrations in business valuation, due diligence, litigation support/expert witness services, and turnaround consulting. Mr. Wayne has led dozens of M&A engagements, both sell- as well as buy-side representation. IronHorse maintains close relationships with private equity firms, investment bankers, as well as the commercial lending industry. In particular, they specialize in difficult, special situation deals as well as M&A transaction/litigation engagements.