Valuation of Ambulatory Surgery Centers

Regulatory (Part IV of V)

As noted in the first installment of this five-part series, an ambulatory surgery center (ASC) is a distinct entity that primarily provides outpatient surgical procedures to patients who do not require an overnight stay after the procedure. ASCs typically provide relatively uncomplicated surgical procedures in a non-hospital, outpatient setting, and most ASC cases are non-emergency, noninfected, and elective. This fourth installment will discuss the regulatory environment in which ASCs operate.

[su_pullquote align=”right”]Resources:

- Valuation of Ambulatory Surgery Centers—Introduction (Part I of V)

- Valuation of Ambulatory Surgery Centers—Competition (Part II of V)

- Valuation of Ambulatory Surgery Centers—Reimbursement (Part III of V)

[/su_pullquote]

As noted in the first installment of this five-part series, an ambulatory surgery center (ASC) is a distinct entity that primarily provides outpatient surgical procedures to patients who do not require an overnight stay after the procedure.[1] ASCs typically provide relatively uncomplicated surgical procedures in a non-hospital, outpatient setting, and most ASC cases are non-emergency, noninfected, and elective.[2] This fourth installment will discuss the regulatory environment in which ASCs operate.

Federal Fraud and Abuse Laws

The Anti-Kickback Statute (AKS) and the Stark Law are generally concerned with the same issue: the financial motivation behind patient referrals. However, while the AKS is broadly applied to payments between any healthcare industry actor and relates to any item or service that may be paid for under any federal healthcare program, the Stark Law specifically addresses the referrals from physicians to entities with which the physician has a financial relationship for the provision of defined services that are paid for by Medicare or Medicaid.[3] Additionally, while violation of the Stark Law carries only civil penalties, violation of the AKS carries both criminal penalties (up to a five-year prison term per violation) and civil penalties.[4] It is also important to note that many states also have “baby” Stark and AKS laws, which are more restrictive than their federal counterparts.[5]

AKS

The AKS makes it a felony for any person to “knowingly and willfully” solicit or receive, or to offer or pay, any “remuneration,” directly or indirectly, in exchange for the referral of a patient for a healthcare service paid for by a federal healthcare program.[6] Of note, interpretation and application of the AKS under case law has created a precedent for a regulatory hurdle known as the “one purpose” test, under which test healthcare providers violate the AKS if even one purpose of the arrangement in question is to offer remuneration deemed illegal under the AKS.[7]

The Patient Protection and Affordable Care Act (ACA) made two additional changes to the intent standards related to the AKS. First, the legislation amended the AKS by stating that a person need not have actual knowledge of the AKS or specific intent to commit a violation of the AKS for the government to prove a kickback violation.[8] However, the ACA did not remove the requirement that a person must “knowingly and willfully” offer or pay remuneration for referrals in order to violate the AKS.[9] Therefore, in order to prove a violation of the AKS, the government must show that the defendant was aware that the conduct in question was “generally unlawful,” but not that the conduct specifically violated the AKS.[10] Second, the ACA provided that a violation of the AKS is sufficient to state a claim under the False Claims Act (FCA).[11] The amended AKS points out that liability under the FCA is “[i]n addition to the penalties provided for in [the AKS]…”[12] This suggests that in addition to civil monetary penalties paid under the AKS, violation of the AKS would create additional liability under the FCA, which itself carries civil monetary penalties of over $21,500 plus treble damages.[13]

Due to the broad nature of the AKS, legitimate business arrangements may appear to be prohibited.[14] In response to these concerns, Congress created a number of statutory exceptions and delegated authority to the U.S. Department of Health and Human Services (HHS) to protect certain business arrangements by means of promulgating several safe harbors,[15] which set forth regulatory criteria that, if met, shield an arrangement from regulatory liability, and are meant to protect transactional arrangements unlikely to result in fraud or abuse.[16] Failure to meet all of the requirements of a safe harbor does not necessarily render an arrangement illegal.[17]

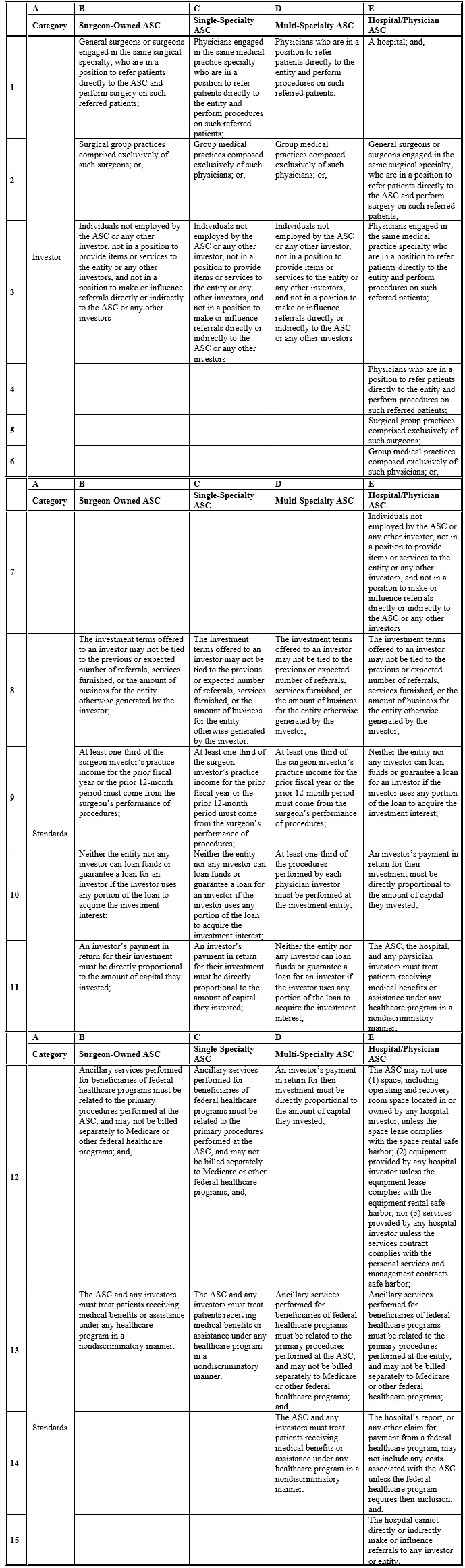

Under the AKS, ASCs are treated differently. ASCs must meet specific AKS safe harbor provisions: the entity must be certified in accordance with applicable regulations; the entity’s operating and recovery room space must be exclusively dedicated to the ASC; all patients referred to the entity by an investor must be fully informed of the investor’s ownership interest; and, all the following applicable standards must be met within one of the following categories set forth in the table below.

Table: ASC Exceptions to the AKS[18]

Stark Law

The Stark Law governs those physicians (or their immediate family members) who have a financial relationship (i.e., an ownership investment interest or a compensation arrangement) with an entity, and prohibits those individuals from making Medicare referrals to those entities for the furnishing of designated health services (DHS).[19] DHS encompasses the following items and services:

- Clinical laboratory services;

- Physical therapy services;

- Occupational therapy services;

- Radiology services, including magnetic resonance imaging, computerized axial tomography scans, and ultrasound services;

- Radiation therapy services and supplies;

- Durable medical equipment and supplies;

- Parenteral and enteral nutrients, equipment, and supplies;

- Prosthetics, orthotics, and prosthetic devices and supplies;

- Home health services;

- Outpatient prescription drugs;

- Inpatient and outpatient hospital services; and,

- Outpatient speech-language pathology services.[20]

ASCs are generally not subject to Stark Law restrictions, because they typically do not furnish DHS. However, in the event that the ASC is performing DHS (e.g., radiology services), and that DHS is not reimbursed by Medicare as part of a composite rate,[21] then any financial relationship between the physicians and the hospital, and their connection to the ASC, may be subject to Stark; the application of which regulations (and any appropriate exceptions) would be determined by the structure of the financial relationship between the parties (e.g., direct/indirect, compensation/ownership investment).

Certificate of Need

Certificate of Need (CON) laws present market entry barriers for potential ASCs.[22] CON programs have the major goal of controlling costs by restricting provider capital expenditures.[23] The rationale behind CON laws mainly originates from the belief that healthcare does not operate like other markets to correct excess supply, and healthcare is plagued by market failures resulting in excess supply and needless duplication of some services, causing overall costs to rise.[24]

ASCs located in a state with a CON law must complete a regulatory review process in order to obtain a certificate.[25] Currently, 27 states have CON laws relating to the opening of an ASC.[26] Of note, states without CON laws restricting the formation of ASCs have slightly more ASCs per 100,000 individuals on average than states with CON laws restricting ASCs.[27]

Future Regulatory Trends

In October 2019, the Centers for Medicare and Medicaid Services (CMS) published proposed rules related to the Stark Law and AKS,[28] outlining significant modernization and clarification of these fraud and abuse laws. While the timeline for finalizing these rule changes remain unclear, their impact on ASCs may be minimal as the Stark Law generally does not apply to ASCs, and the AKS proposed rule did not modify the exceptions related to ASCs.

It is important to note that, despite the stance of the current presidential administration toward de-regulating healthcare,[29] the regulatory scrutiny of healthcare entities (especially regarding fraud and abuse violations) has generally increased in recent years. Due to the nature of AKS, and its criminal and civil penalties, disregarding federal and state regulation of the ASC industry may result in more than an unassuming fine. With the level of regulation of the ASC industry intensifying,[30] ASC operators increasingly need to pay heed to current regulations and understand how future regulatory developments may affect the industry going forward.

Todd A. Zigrang, MBA, MHA, ASA, CVA, FACHE, is president of Health Capital Consultants, where he focuses on the areas of valuation and financial analysis for hospitals and other healthcare enterprises. Mr. Zigrang has significant physician-integration and financial analysis experience and has participated in the development of a physician-owned, multispecialty management service organization and networks involving a wide range of specialties, physician owned hospitals as well as several limited liability companies for acquiring acute care and specialty hospitals, ASCs, and other ancillary facilities.

Mr. Zigrang can be contacted at (800) 394-8258 or by e-mail to tzigrang@healthcapital.com.

Jessica Bailey-Wheaton, Esq., is Vice President and General Counsel for Heath Capital Consultants, where she conducts project management and consulting services related to the impact of both federal and state regulations on healthcare exempt organization transactions, and provides research services necessary to support certified opinions of value related to the Fair Market Value and Commercial Reasonableness of transactions related to healthcare enterprises, assets, and services. She is a member of the Missouri and Illinois Bars and holds a J.D., with a concentration in Health Law, from Saint Louis University School of Law.

Ms. Bailey-Wheaton can be contacted at (800) 394-8258 or by e-mail to jbailey@healthcapital.com.

[1] “Chapter 5: Ambulatory Surgical Center Services” in “Report to Congress: Medicare Payment Policy” Medicare Payment Advisory Commission, March 2019, p. 127–129.

[2] “Ambulatory surgical centers: Development and management” By Thomas R. O’Donovan, Aspen Systems Corp, 1976, p. xiv.

[3] “COMPARISON OF THE ANTI-KICKBACK STATUTE AND STARK LAW” Office of Inspector General, 2019, https://oig.hhs.gov/compliance/provider-compliance-training/files/StarkandAKSChartHandout508.pdf (Accessed 10/16/19).

[4] Ibid.

[5] See “State Health Care Fraud Law: An AHLA 50-State Survey with Summaries and Links” American Health Lawyers Association Fraud and Abuse Practice Group: Washington, D.C., September 9, 2018, available at: https://www.healthlawyers.org/store/Pages/Product-Details.aspx?productid=%7B3B609F69-E8B1-E811-80DF-0050569E287F%7D (Accessed 12/3/19).

[6] “Criminal Penalties for Acts Involving Federal Health Care Programs” 42 U.S.C. § 1320a-7b(b)(1).

[7] “Re: OIG Advisory Opinion No. 15-10” By Gregory E. Demske, Chief Counsel to the Inspector General, Letter to [Name Redacted], July 28, 2015, https://oig.hhs.gov/fraud/docs/advisoryopinions/2015/AdvOpn15-10.pdf (Accessed 10/15/19), p. 4-5; “U.S. v. Greber” 760 F.2d 68, 69 (3d Cir. 1985).

[8] “Health Care Reform: Substantial Fraud and Abuse and Program Integrity Measures Enacted” McDermott Will & Emery, April 12, 2010, p. 3; “Patient Protection and Affordable Care Act,” Pub. L. No. 111-148, § 6402, 124 Stat. 119, 759 (March 23, 2010).

[9] “Health Care Fraud and Abuse Laws Affecting Medicare and Medicaid: An Overview” By Jennifer A. Staman, Congressional Research Service, September 8, 2014, https://www.fas.org/sgp/crs/misc/RS22743.pdf (Accessed 10/16/19), p. 5.

[10] Ibid.

[11] “Health Care Reform: Substantial Fraud and Abuse and Program Integrity Measures Enacted” McDermott Will & Emery, April 12, 2010, p. 3; “Patient Protection and Affordable Care Act,” Pub. L. No. 111-148, § 6402, 124 Stat. 119, 759 (March 23, 2010).

[12] “Liability under subchapter III of chapter 37 of title 31” 42 U.S.C. § 1320a-7b(g) (2013).

[13] “False claims” 31 U.S.C. § 3729(a)(1) (2013).

[14] “Re: OIG Advisory Opinion No. 15-10” By Gregory E. Demske, Chief counsel to the Inspector General, Letter to [Name Redacted], July 28, 2015, https://oig.hhs.gov/fraud/docs/advisoryopinions/2015/AdvOpn15-10.pdf (Accessed 10/15/19), p. 5.

[15] Ibid.

[16] “Medicare and State Health Care Programs: Fraud and Abuse; Clarification of the Initial OIG Safe Harbor Provisions and Establishment of Additional Safe Harbor Provisions Under the Anti-Kickback Statute; Final Rule” Federal Register, Vol. 64, No. 223 (November 19, 1999), p. 63518-63520.

[17] “Re: Malpractice Insurance Assistance” By Lewis Morris, Chief Counsel to the Inspector General, United States Department of Health and Human Services, Letter to [Name redacted], January 15, 2003, http://oig.hhs.gov/fraud/docs/alertsandbulletins/MalpracticeProgram.pdf (Accessed 10/15/19), p. 1.

[18] “Exceptions: Ambulatory Surgery Centers” 42 C.F.R. § 1001.952(r) (2015).

[19] “Limitation on Certain Physician Referrals” 42 U.S.C. § 1395nn(a).

[20] “Limitation on Certain Physician Referrals” 42 U.S.C. § 1395nn(h)(6)(A).

[21] The regulations specifically note that “DHS do not include services that are reimbursed by Medicare as part of a composite rate (for example, SNF Part A payments or ASC services identified at §416.164(a)), except to the extent that services listed in paragraphs (1)(i) through (1)(x) of this definition are themselves payable through a composite rate (for example, all services provided as home health services or inpatient and outpatient hospital services are DHS).” “Definitions” 42 C.F.R. § 411.351.

[22] “IBISWorld Industry Report 0D5971 Ambulatory Surgery Centers in the US” By Dmitry Diment, IBISWorld, August 2019, p. 22.

[23] “Chapter 8: Miscellaneous Subjects” Department of Justice, June 25, 2015, https://www.justice.gov/atr/chapter-8-miscellaneous-subjects#1a (Accessed 10/15/19).

[24] Ibid.

[25] “IBISWorld Industry Report 0D5971 Ambulatory Surgery Centers in the US” By Dmitry Diment, IBISWorld, August 2019, p. 22.

[26] “CON-Certificate of Need State Laws” National Conference of State Legislatures, February 28, 2019, http://www.ncsl.org/research/health/con-certificate-of-need-state-laws.aspx (Accessed 10/11/19).

[27] “CON versus non-CON states: Which regions boast more Medicare-certified ASCs?” By Mary Rechtoris, Becker’s ASC Review, June 15, 2017, https://www.beckersasc.com/asc-coding-billing-and-collections/con-versus-non-con-states-which-regions-boast-more-medicare-certified-ascs.html (Accessed 10/15/19).

[28] For more information, see: “Proposed Stark Law Changes: Healthcare Valuation Implications” Health Capital Topics, Vol. 12, Issue 10 (October 2019), available at: https://www.healthcapital.com/hcc/newsletter/10_19/PDF/STARK.pdf (Accessed 12/16/19).

[29] “Executive Order Minimizing the Economic Burden of the Patient Protection and Affordable Care Act Pending Repeal” The White House, January 20, 2017, Federal Register Vol. 82, No. 14, p. 8351–8352.

[30] “IBISWorld Industry Report 0D5971 Ambulatory Surgery Centers in the US” By Dmitry Diment, IBISWorld, August 2019, p. 29.