How to Determine Fair Value

In a SPAC Merger Transaction

The fair value of equity consideration issued in a merger involving a public company is generally calculated as the product of the quoted price for the individual equity instrument times the quantity issued (commonly referred to a “P times Q”). However, if the merger involves a special purpose acquisition company (SPAC), determining “P” can be subjective and may result in different interpretations of U.S. GAAP fair value between the valuation specialist and the parties involved in the deal.

Introduction

The fair value of equity consideration issued in a merger involving a public company is generally calculated as the product of the quoted price for the individual equity instrument times the quantity issued (commonly referred to a “P times Q”). However, if the merger involves a special purpose acquisition company (SPAC), determining “P” can be subjective and may result in different interpretations of fair value between the valuation specialist and the parties involved in the deal.

What is a SPAC?

A SPAC is a special purpose entity with no operations whose sole purpose is to raise capital in an IPO, typically at $10.00 per share, and then acquire a target operating company within a specified time period, normally 18 to 24 months from the date of the SPAC’s IPO. In a SPAC merger, the SPAC acquires and merges with the target company, upon which the SPAC is dissolved and the merged entity becomes the new public entity whose shares trade in the market on a go-forward basis, similar to the completion of an IPO. Sellers of the target company receive cash, rollover equity in the merged entity, or a combination of both as consideration, and the SPAC public stockholders receive rollover equity. SPAC mergers have become more common in the past few years (e.g. Diamond Eagle Acquisition Corp’s merger with DraftKings, a popular sports betting online platform, on April 24, 2020) as private companies seek to go public without the lengthy and costly regulatory process of a traditional IPO.

Illustrative Example of Equity Consideration Issued in a SPAC Merger

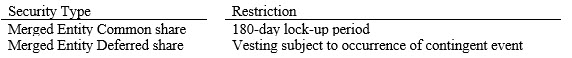

In a recent SPAC merger transaction in which I assisted the merged entity in determining the appropriate U.S. GAAP acquisition accounting treatment, the following equity consideration was issued by the merged entity as components of the purchase price to the sellers:

Valuation Question

What is the fair value of the equity consideration issued in the SPAC merger transaction above?

Valuation Specialist’s Determination of Fair Value

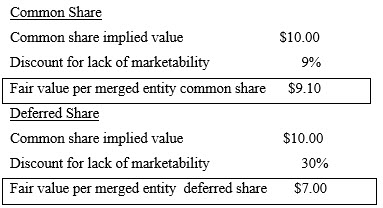

A national valuation firm, with previous experience in SPAC merger transactions, was engaged by the merged entity to calculate the fair value of the common and deferred shares issued by the merged entity on the merger date. Summarized below are the valuation specialist’s calculations of fair value per share.

In the valuation specialist’s calculations above, the common share implied value represents the price per common share, as a component of the negotiated transaction price between the SPAC and sellers of the target company in accordance with the terms of the executed merger agreement. Based on the valuation specialist’s interpretation of ASC 805, Business Combinations, the implied value was indicative of the price of the merged entity’s common shares prior to and upon the consummation of the merger. The discount for lack of marketability applied reflects the restrictions on transferability associated with the lock-up period and contingent event vesting conditions, respectively. In their opinion, the valuation specialist believed a market participant would take these restrictions into consideration in pricing the merged entity’s common and deferred shares subsequent to the merger date, applying ASC 820 interpretive guidance that states, “A restriction that would transfer with the asset in an assumed sale would generally be deemed a characteristic of the asset and therefore would likely be considered by market participants in pricing the asset, and “a fair value measurement is for a particular asset or liability. Therefore, in measuring fair value, a reporting entity shall take into account the characteristics of the asset or liability if market participants would take those characteristics into account when pricing the asset or liability at the measurement date. Such characteristics include, for example, restrictions, if any, on the sale or use of the asset.”

Merged Entity Management’s Determination of Fair Value

The merged entity’s management, along with its independent auditors, did not agree with the valuation specialist’s use of the implied value or application of a discount for lack of marketability in the determination of fair value of the merged entity’s common and deferred shares. This was problematic for the merged entity as the independent auditors were required to review and sign-off on the U.S. GAAP accounting treatment for the SPAC merger transaction in conjunction with its disclosure in the financial statements of the merged entity’s initial SEC 10-Q filing.

The independent auditors regarded the implied value of $10.00 per common share as a transaction price, not an indication of fair value on the acquisition date. Rather, in their opinion, upon the consummation of the merger and the simultaneous exchange of SPAC common stock for merged entity common shares, the fair value of a merged entity common share was the NASDAQ quoted market price of the SPAC common stock of $12.00 on the date of the merger, in accordance with ASC 820, which states, “a quoted price in an active market provides the most reliable evidence of fair value and shall be used without adjustment to measure fair value whenever possible.” The independent auditors also relied on their interpretive guidance of ASC 805, which stated, “if the acquirer issues equity instruments to the acquiree in the business combination, then the acquirer measures the fair value of the equity instruments on the acquisition date and includes that amount as part of the consideration transferred.” As a result, the total fair value of equity consideration issued to the sellers would be calculated using “P times Q,” as discussed above.

In addition, the merged entity considered the restrictions on transferability to be post-vesting restrictions, analogizing to the guidance in ASC 718, Share-based Compensation, which states, “Certain post-vesting restrictions, such as a contractual prohibition on selling shares for a specified period of time after vesting, are essentially the same restrictions that may be present in equity instruments exchanged in the marketplace.” Finally, the merged entity referred to interpretive SEC accounting guidance provided by its independent auditors on the topic of discounts for lack of transferability applied to a security, which stated, “absent cash transactions in the same or similar instruments, an appraisal of the fair value of the shares by an independent expert generally provides the best evidence of fair value. However, the SEC staff typically carefully examines the determination of the fair value of equity securities. In particular, the SEC staff has aggressively challenged significant discounts from the market price of freely transferable equity securities when valuing equity securities with restrictions. In the absence of objective and verifiable evidence that supports the fair value of restricted securities, the SEC staff generally presumes that the best available evidence of fair value is the quoted market price of traded securities with similar, but not identical characteristics (generally, the similar traded unrestricted securities).”

Conclusion

The determination of fair value of equity consideration issued as components of the purchase price in a SPAC merger transaction can be subject to disagreements in the interpretation of U.S. GAAP business combination and fair value guidance between the valuation specialist and the parties to the deal, which must be resolved prior to the issuance of the merged entity’s financial statements. In the example discussed above, the valuation firm and the management of the merged entity agreed to disagree and, as a result, the merged entity’s management ultimately was required to provide assertions in the valuation specialist’s final report as to the use of $12.00 per share as the fair value of the merged entity’s common and deferred shares on the merger date.

This article was previously published in BVR, August 2020, and is republished here with permission.

Russell Frawley III, MBA, CPA, ABV, principal at Frawley & Co. PLLC (www.frawleyco.com), has over 25 years of diversified accounting experience including Big Four public accounting, financial accounting oversight roles at global, public companies, and specialized, project-related engagements for a diverse clientele. Mr. Frawley holds active licenses as a Certified Public Accountant (CPA) in the states of Florida and Virginia and is a member of the Accounting Principles and Auditing Standards Committee of the Florida Institute of Certified Public Accountants (FICPA). He is a member and holds the designation of Accreditation in Business Valuation (ABV) from the American Institute of Certified Public Accountants (AICPA) and is also a member of the American Society of Appraisers (ASA). He earned degrees in Accounting from the University of Central Florida, MBA in Finance and Economics from the University of Miami, and a Certificate in Business Valuation from Florida Atlantic University. He is also an adjunct professor in the School of Accounting at Florida International University in Miami, Florida.

Mr. Frawley can be contacted at (305) 546-0776 or by e-mail to russell@frawleyco.com.