The Repurchase Obligation of an ESOP-Owned Company

Funding and Planning for Repurchase Obligation and the Use of COLI

Understanding the potential detriments of unfunded (or under-funded) repurchase agreements, the ability to put the proper insurance in place to adequately address the financing of retirement benefits for ESOP shareholders has been proven to be a prudent financial decision for many companies. There are many significant benefits to being an employee-owned company. Management must take care to ensure that funding is planned for and available to.

One of the purposes of an employee stock ownership plan (ESOP) is to provide retirement benefits to ESOP participants. Because an ESOP holds assets consisting primarily of stock of the sponsoring company, there must be a mechanism for participants to realize the value of the stock held on their behalf, or the benefits would be meaningless. For most ESOP companies, the sponsor (or employer) company stock is privately held and, as such, there is no active “market” on which the stock is traded. Generally, the Internal Revenue Code requires that the company sponsoring the ESOP buy back the stock from participants. Mechanically, this occurs through a “put” option, which entitles participants to require that the sponsor company buy back the stock at fair market value as determined by an independent business appraiser.

The obligation of the sponsor company to honor the “put” option is usually referred to as the ESOP “repurchase obligation.” The timing and magnitude of a company’s repurchase obligation depends upon the provisions included in its ESOP plan document, the demographics of its employee population, and the current value1 of its stock.

Planning for Repurchase Obligations

The plan provisions having the greatest impact on repurchase obligations are those relating to the timing and form of distributions from the plan, and the vesting schedule. Ideally, the impact that plan provisions will have on repurchase obligations should be considered at the time the plan document is being drafted. Distribution provisions of the ESOP can be structured to mitigate the negative impact on the sponsor company’s cash flow. This requires careful planning when designing the plan, as well as continuous planning and monitoring each year as the ESOP matures.

Repurchase obligations are becoming a more important issue for ESOPs, especially as they mature. An analysis of the sponsor company’s economics related to its ESOP needs to consider the plan’s repurchase obligations. Like traditional pension liabilities, a repurchase obligation represents a company’s liability related to the expected share redemption requests by eligible ESOP participants. The obligation is generally an off-balance sheet liability and will not be found on a CPA’s financial statements (unless it is covered in the notes to the financials). In addition to actuarial assumptions, some of the primary factors that impact a sponsor company’s repurchase obligation include, but are not limited to: (i) the maturity of the ESOP; (ii) the accumulated cash balance in the employee stock ownership trust2; (iii) the company’s projected cash flows; (iv) participant vesting and demographics; and (v) the current and future expected share prices.

A sponsor company’s repurchase obligations for a mature ESOP can be substantial, and over time can mushroom and become significant and sometimes crippling to the viability of the company. There are several ways a sponsor company can fund a repurchase obligation: cash, savings (sinking fund), or debt. However, these options can be difficult to execute or expensive and inefficient. In addition, accruing cash on the balance sheet to pay the repurchase obligation can have the opposite effect, exacerbating the financial obligation, as the increasing cash balance on the balance sheet functions to increase the value (and, thus, the repurchase obligation) of the sponsor company.

Funding Repurchase Obligations

Two case studies of ESOP companies that were less than diligent in planning for and funding their repurchase obligations—which surfaced at a time when both companies had competing cash needs—resulted in two different decisions.

Company A, established in 1957, was a profitable wholesale distributor of industrial, mechanical, and oilfield supplies. Company A was a proud ESOP company, which established its ESOP in 2005. Despite the ESOP providing tangible benefits in retirement dollars as well as intangible benefits in terms of employee morale, pride and productivity, the company had a looming situation that came to a head in 2018. At that point, anticipating a sizeable repurchase obligation over the ensuing three years, the company keenly understood that it would not have sufficient funding available, either with cash or with bank financing. The executive decision was made to sell the company. While the ESOP participants were eventually well paid for their ESOP shares (due to the buyout), the draconian measure of selling the company was devastating to many long-time employees and ESOP participants.

Company B, established in 1974, is a professional services company. Similar to Company A, Company B is an employee-owned ESOP company and considers the ESOP a tremendously positive benefit for its employees that is a strong factor both in retaining and recruiting personnel, in a professional field that suffers from high turnover. Company B also had a looming repurchase obligation that weighed on the minds of the executive team, but they fell short of properly planning for it. Their solution was to “re-leverage” the ESOP. The company bought back a significant number of shares at fair market value, leveraging itself to finance the redemption of these shares. While the company successfully accomplished its goal of redeeming shares, it also was forced to deplete cash reserves and/or obtain external financing, both of which impacted the post-redemption share prices for ESOP participants.

Both above scenarios were detrimental to the sponsor companies and had long-lasting implications for corporate and ESOP shareholders. To avoid either of these situations, it would be prudent for any ESOP company to consider an alternative and readily accessible option for funding pending repurchase obligations—insurance.

Corporate-Owned Life Insurance—One Potential Solution

Traditional life insurance may be used to provide death benefits as a complement to other investments in a sinking fund or for “pay-as-you-go” funding.

Obtaining life insurance for an ESOP-owned company can be considered when the company needs to ensure funding for larger account balances and when the ESOP ownership structure is expected to be long-term.

Potential Advantages

- Pre-retirement death benefits reimburse the company for the loss of key employees.

- Life insurance cash value is an asset on the corporate balance sheet.

- Potential to smooth cash flow requirements.

- Provides liquidity in the event of unanticipated deaths.

- Death proceeds and cash value growth can be income tax-free.

- Potential recovery of repurchase and premium costs if held until death.

- Flexibility to repurchase or redeem shares.

Potential Disadvantages

- Expense and mortality costs associated with insurance.

- Life insurance premiums are not tax deductible.

- Investment return may be lower if policy is surrendered before death.

- For “C” corporations, cash values and death benefits may be subject to corporate Alternative Minimum Tax (AMT).

One unique life insurance product designed for ESOPs has the following attributes which mitigate the potential disadvantages of traditional life insurance:

- Permanent guaranteed life insurance for executive and non-executive employees. This particular program provides more coverage for more employees, increasing the available policy value and death benefits for the ESOP sponsor.

- Low cost, long-term premium funding for life insurance. Provides: (1) the lowest financing cost generally available; (2) up to 50-year financing structures; and (3) minimal up-front out-of-pocket costs, reducing the cash normally required to fund life insurance premiums.

- Efficient asset utilization. Allows the sponsor company to secure life insurance obligations using company stock, thus providing a fully contained structure. This unique type of life insurance program can also be used to secure additional debt without direct, unlimited recourse to the ESOP plan assets.

- Eliminates the need for the company to pay annual premiums. By using premium funding, the company eliminates annual premium payments. A bank will pay the necessary premiums in all years.

- No out-of-pocket expense whatsoever for the company. Funded life insurance policies are designed to have zero out-of-pocket outlay for the purchase of insurance. Although bank funding is used, the corporation makes no interest payment or no premium payments, and all money borrowed from the bank is repaid from the policies.

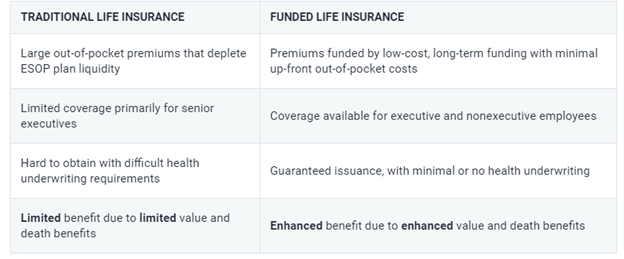

The chart below highlights the differences between traditional life insurance used by ESOP sponsor companies and funded life insurance.

Understanding the potential detriments of unfunded (or under-funded) repurchase agreements, such as those illustrated in the above case studies, the ability to put the proper insurance in place to adequately address the financing of retirement benefits for ESOP shareholders has been proven to be a prudent financial decision for many companies. There are many significant benefits to being an employee-owned company. Management must take care to ensure that funding is planned for and available to deliver on the promise of the payout related to such ownership.

This article was previously published on marcumllp.com Insights, September 28, 2020, and is republished here with permission.

Endnotes:

- Current value is typically determined by the ESOP Plan as the most recent valuation of the sponsor company stock (typically stated as the most recent calendar year end).

- The legal trust that actually owns the shares of the ESOP.

Kenneth J. Pia, Jr., CPA, ABV, ASA, MCBA, is a partner and the leader of the Business Valuation Industry group at Marcum LLP. With more than 30 years of professional business valuation and litigation support experience, Mr. Pia has developed a national reputation working on a wide range of complex valuation engagements. He has performed valuations of businesses and partial business interests for a variety of purposes including, but not limited to, family law matters, employee stock ownership plans, business damages, buy-sell agreements, shareholder litigation, estate and gift tax matters, and buying and selling businesses. Additional valuation services include reasonable compensation analysis for tax and non-tax assignments.

Mr. Pia can be contacted at (203) 781-9780 or by e-mail to ken.pia@marcumllp.com.

Patrice Radogna, ASA, CPA, ABAR, is a director within the Advisory Services Practice at Marcum LLP. Ms. Radogna has more than 20 years of professional services experience specializing in the valuation of operating businesses and pass-through entities for a myriad of purposes. Her experience also includes providing fiduciary services for ESOP companies, including assisting in buy transactions from existing shareholders.

Ms. Radogna can be contacted at (617) 807-5219 or by e-mail to patrice.radogna@marcumllp.com.

Mark S. Goodman is CEO and Partner of Opus Funding Partners.

Mr. Goodman can be contacted by e-mail to Mark.Goodman@Marcumllp.com.