Best Practices for Estimating the Company-Specific Risk

(Part IV of IV)

This is the final article of the four-part series that sets forth best practices for estimating the company-specific risk premium. This discussion of the series summarizes best practices about the analyst’s conduct of the functional analysis as one component in developing the CSRP estimate.

[su_pullquote align=”right”]Resources:

Best Practices for Estimating the Company-Specific Risk Premium (Part I of IV)

Best Practices for Estimating the Company-Specific Risk Premium (Part II of IV)

Best Practices for Estimating the Company-Specific Risk Premium (Part III of IV)

[/su_pullquote]

Introduction

Valuation analysts (analysts) often apply income approach business valuation methods to value the private company, business ownership interest, security, or intangible asset. The application of income approach valuation methods typically involves the selection of a present value discount rate or a direct capitalization rate. And one component of the associated cost of capital measurement is the analyst’s estimate of the company-specific risk premium (CSRP).

Previous discussions in this series summarized best practices with regard to (1) the application of the CSRP in the generally accepted cost of capital measurement models, (2) the analyst’s assessment and documentation of CSRP factors, and (3) empirical data sources that may provide a benchmark or proxy for developing the CSRP estimate.

This fourth discussion of the series summarizes best practices about the analyst’s conduct of the functional analysis as one component in developing the CSRP estimate.

The Company-Specific Risk Premium and a Functional Analysis

Typically, in developing the CSRP estimate, analysts perform a functional analysis of the private company. The implications of this functional analysis are discussed here.

Description of a Functional Analysis

A functional analysis is one typical component of developing the CSRP estimate.

A functional analysis is often applied for purposes of assessing the comparability of the private company to selected guideline or benchmark entities. These selected guideline or benchmark entities are typically considered to be comparable companies. The development of a functional analysis is certainly relevant in that context.

As will be described, the regulations related to Internal Revenue Code Section 482 explain the application of a functional analysis for purposes of determining reliability. Further, the Organization for Economic Cooperation and Development (OECD) regulations describe the application of a functional analysis within the context of an intercompany transfer of tangible property, intangible property, or services between two OECD countries.

A functional analysis is certainly relevant to such an intercompany transfer price determination made for purposes of Section 482 compliance (or of OECD regulations compliance). However, in addition to applicability to a transfer price analysis, a functional analysis is also relevant within the context of a discount rate or capitalization rate development as part of any private company valuation.

Many analysts initially think of a functional analysis within the context of an intercompany transfer price determination between the controlled entities of a taxpayer (often a multinational taxpayer) for Section 482 (or for OECD) compliance purposes. While there are broader applications of a functional analysis, the Section 482 (and the corresponding OECD) regulations do provide a definition of a functional analysis that is generally applicable for this discount rate and capitalization rate development discussion.

Regulation 1.482-1(d)(3)(i) relates to comparability issues with regard to the allocation of income and deductions among taxpayers. Specifically, this regulation section deals with the factors for determining comparability of transactions and companies. This regulation section describes a functional analysis as follows:

(i) Functional analysis. Determining the degree of comparability between controlled and uncontrolled transactions requires a comparison of the functions performed, and associated resources employed, by the taxpayers in each transaction. This comparison is based on a functional analysis that identifies and compares the economically significant activities undertaken, or to be undertaken, by the taxpayers in both controlled and uncontrolled transactions. A functional analysis should also include consideration of the resources that are employed, or to be employed, in conjunction with the activities undertaken, including consideration of the type of assets used, such as plant and equipment, or the use of valuable intangibles. A functional analysis is not a pricing method and does not itself determine the arm’s length result for the controlled transaction under review. Functions that may need to be accounted for in determining the comparability of two transactions include:

(a) Research and development;

(b) Product design and engineering;

(c) Manufacturing, production, and process engineering;

(d) Product fabrication, extraction, and assembly;

(e) Purchasing and materials management;

(f) Marketing and distribution functions, including inventory management, warranty administration, and advertising activities;

(g) Transportation and warehousing; and

(h) Managerial, legal, accounting and finance, credit and collection, training and personal management services.

While this regulation section lists eight functions, it does not imply that the eight-item list is exhaustive. Rather, the regulation section indicates that the factors to consider “include” the eight listed functions. In addition, the regulation does not imply that the eight listed factors cannot be disaggregated or rearranged.

Within the context of developing the CSRP estimate for a private company cost of capital, a functional analysis may consider the following risk and expected return topics:

- What products and services are offered to customers or clients (and how are those products and services designed or developed).

- What is the source of supply of the materials, labor, and overhead that is needed to produce those products and services (including sourcing dependence and sourcing logistics issues).

- How the products and services are manufactured or otherwise produced.

- How the products and services are differentiated, promoted, priced, and sold (including advertising and branding issues).

- How the inventory of products and services (including raw materials, work in process, and finished goods/services) are created, packaged, and stored.

- How the products and services are delivered (including shipping, transportation, and other delivery logistics issues).

- What assets are utilized to perform the functions within the business entity (including working capital assets, tangible assets, and intangible assets).

- How profits are earned in the business entity (including the cost/volume/profit relationships regarding both (1) production/service creation cost of sales and (2) production/service delivery revenue recognition).

- How the accounting, finance, human resources, management information, marketing, sales, and other administrative activities operate within the private company.

- How the private company is organized, managed, and capitalized (legally and administratively), including both (1) the relationship between the company owners and the company operators/managers and (2) the relationship between the company and its sources of capital.

There are various financial, competitive, and operational analyses that are components of the functional analysis.

Components of the Functional Analysis

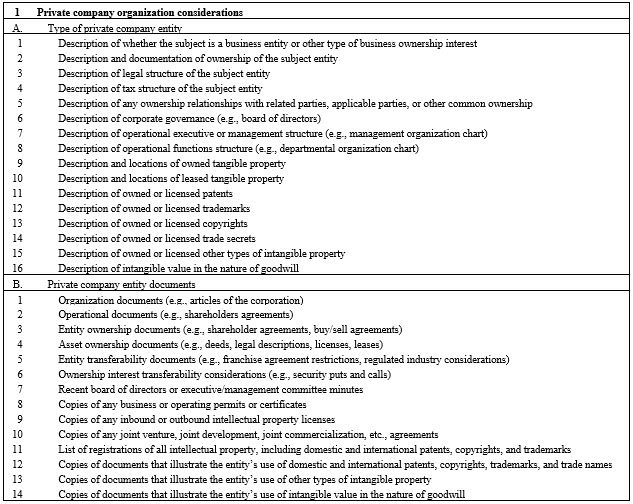

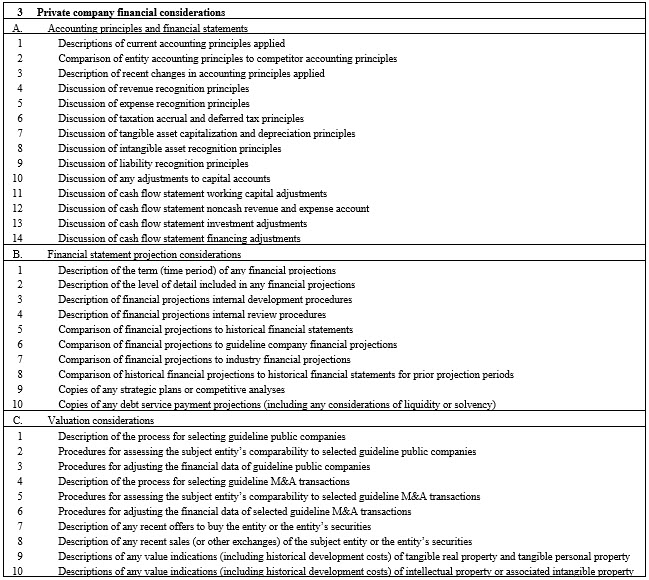

Tables 1a through 1d present a listing of the typical considerations in the analyst’s development of a functional analysis. Tables 1a through 1d serve as a checklist of considerations for any analyst who is considering the CSRP component of a discount rate or capitalization rate for purposes of a private company valuation.

Table 1a: Functional Analysis Considerations—Application to the CSRP Estimate in the Discount Rate or Capitalization Rate Development

Table 1b: Functional Analysis Considerations—Application to the CSRP Estimate in the Discount Rate or Capitalization Rate Development (cont.)

Table 1c: Functional Analysis Considerations—Application to the CSRP Estimate in the Discount Rate or Capitalization Rate Development (cont.)

Table 1d: Functional Analysis Considerations—Application to the CSRP Estimate in the Discount Rate or Capitalization Rate Development (cont.)

The functional analysis considerations listed in Tables 1a through 1d may be used to develop an understanding of the private company. Analysts may apply this understanding in developing the CSRP component of the discount rate or capitalization rate.

Risk Considerations in a Functional Analysis

One reason to conduct a functional analysis is to allow the analyst to identify the risks that are being assumed by the private company. A significant portion of the return earned by the company’s operations is due to the risks assumed by the private company.

The functional analysis allows analysts to compare these risks (1) within the private company; (2) between the private company and the selected comparable companies, transactions, and licenses; and (3) between related party (or associated) entities in a controlled transaction.

The analyst applies these risk considerations in developing the CSRP estimate for the discount rate and capitalization rate.

The 12 Steps of the Functional Analysis

In the CSRP estimate, analysts typically group all of the above-listed functional analysis considerations into 12 steps—or categories of analyst procedures and investigations. Analysts perform these 12 steps in developing the CSRP estimate for the discount rate or capitalization rate.

These 12 steps—or categories or groupings of analyst procedures—are listed in Table 2.

The first 10 steps in Table 2 primarily relate to the functions performed at the private company. Step 11 in Table 2 primarily relates to the assets employed by the private company. And step 12 in Table 2 primarily relates to the risks assumed by the private company.

Application of the Functional Analysis to Measure the Company-Specific Risk Premium

Based on the discussion above, analysts consider the functional analysis procedures presented in Table 2. Considering these functional analysis procedures, analysts consider this functional analysis when estimating the CSRP component of the discount rate and capitalization rate.

Table 2: 12 Steps of the Functional Analysis—Considered in the Private Company CSRP Estimate

Summary and Conclusion

Valuation analysts, forensic accountants, financial advisors, industry consultants, economists, or other analysts are often retained to value the private company, business ownership interest, security, or intangible asset. These business valuations may be performed for transaction, financing, taxation, business planning, litigation, financial accounting, and other purposes. These analysts apply generally accepted business valuation approaches and methods to value the private company ownership interests. Often, these analysts apply income approach business valuation methods.

Most of these business valuation analyses involve the analyst’s measurement of the private company cost of capital. This cost of capital becomes the basis for the analyst’s development of the present value discount rate or direct capitalization rate. For most private company valuation analyses, the discount rate and capitalization rate include the analyst’s estimate of a company-specific risk premium. This four-part series summarized the best practices that analysts apply to develop the CSRP estimate.

This discussion explained the reasons why the CSRP should be included in the various cost of capital measurement models. This series also described the qualitative factors that analysts consider in developing the judgment-based CSRP estimate. This CSRP estimate is one component of what is often called “alpha” in the measurement of a company-specific cost of capital.

This discussion summarized the market-derived, empirical data sources that analysts may consider as a proxy—or benchmark—in developing the CSRP estimate. These empirical data sources do not directly measure the CSRP. That is because, by definition, the CSRP is unique to each individual private company. However, these empirical data sources provide general guidance to help the analyst develop the CSRP estimate. Finally, this series summarized one procedure that impacts both the qualitative and quantitative assessment of the CSRP estimate: the functional analysis of the private company.

Robert Reilly, CPA, ASA, ABV, CVA, CFF, CMA, is Managing Director of Willamette Management Associate’ Chicago offices. His practice includes business valuation, forensic analysis, and financial opinion services.

Mr. Reilly has performed the following types of valuation and economic analyses: economic event analyses, merger and acquisition valuations, divestiture and spin-off valuations, solvency and insolvency analyses, fairness and adequacy opinions, reasonably equivalent value analyses, ESOP formation and adequate consideration analyses, private inurement/excess benefit/intermediate sanctions opinions, acquisition purchase accounting allocations, reasonableness of compensation analyses, restructuring and reorganization analyses, tangible property/intangible property intercompany transfer price analyses, and lost profits/reasonable royalty/cost to cure economic damages analyses.

He has prepared these valuation and economic analyses for the following purposes: transaction pricing and structuring (merger, acquisition, liquidation, and divestiture); taxation planning and compliance (federal income, gift, estate, and generation-skipping tax; state and local property tax; transfer tax); financing securitization and collateralization; employee corporate ownership (ESOP employer stock transaction and compliance valuations); forensic analysis and dispute resolution; strategic planning and management information; bankruptcy and reorganization (recapitalization, reorganization, restructuring); financial accounting and public reporting; and regulatory compliance and corporate governance.

Mr. Reilly can be contacted at (773) 399-4318 or by e-mail to rfreilly@willamette.com.

Connor Thurman is a senior associate with Willamette Management Associates. He performs the following types of valuation and economic analysis assignments: valuation of fractional ownership interests in businesses, forensic analysis, valuation of intangible assets and intellectual property, lost profits/economic damages analysis, and appraisal reviews.

Mr. Thurman prepares these valuation and forensic analyses for the following purposes: taxation planning and compliance (federal income, state and local property tax, transfer tax), forensic analysis and dispute resolution, marital dissolution, strategic information and corporate planning, ESOP transactions and financing, and ESOP-related litigation.

He performs these valuations for the following types of business entities and securities: closely held corporation business enterprises, closely held corporation noncontrolling ownership interests, various classes of common/preferred stock, general and limited partnership interests, professional service corporations, professional practices, and limited liability companies.

Mr. Thurman has performed these valuations for clients in the following industries: assisted living facilities, banking, coal power, electrical equipment manufacturers, electric utilities, food distribution, forestry products, grocery stores, logging, marijuana dispensaries, medical practices, natural gas distribution, natural gas power, natural gas transmission, oncology centers, railroads, real estate development, real estate holding, sawmills, telecommunications, transportation, travel agencies, and wineries.

Mr. Thurman can be contacted at (503) 243-7514 or by e-mail to cjthurman@willamette.com.