A Hybrid Approach to Determining Company-Specific Risk

Using Weights and Factors to Quantify Risk

This is a condensation of the author’s article, originally published in The Value Examiner, July/August 2022. The author proposes an alternative way of calculating the company specific risk premium.

This is a condensation of my article originally published in The Value Examiner, July/August 2022.

Most of us who value businesses are not valuing businesses in the middle market or the size of businesses that the major writers and instructors on business valuation are valuing. We generally value businesses with revenues under $3,000,000, if not $1,000,000. Not only is there a substantial difference between closely-held middle market companies and publicly traded companies, for the small companies we value the differences are much greater.

The basic principles of economic value, include the principles of alternatives and substitution: for any proposed transaction a buyer has alternatives, and a buyer will accept an equally desirable substitute. Empirical data supports that the smaller a company, the greater the required return. The data further shows that the shape of the curve is a concave curve—risk increases faster as the size of the business gets smaller. Thus, when using the build-up method based on publicly traded company data, a CSRP is required on theoretical and empirical grounds.

The build-up method begins with the return on a small cap publicly traded return and adds to this the company specific risk premium (CSRP). Currently, there is no generally accepted methodology for calculating the CSRP. Deriving a CSRP necessarily requires qualitative analyses and professional judgment.

Valuators have different ways of estimating the CSRP. Some propose using various empirical means to reduce the size of the CSRP. These include using Kroll (Duffs and Phelps) data and looking at other measurements based on empirical data. Others estimate the CSRP through the use of probability weighted cash flows. For me, these are better suited to larger companies and not the smaller companies we typically value.

More typically, I see valuators using something like the following:

However, under this or similar methods, the analyst, using their professional judgment, will assign a risk factor. It might look something like this:

While the above does show what the valuation analyst considered and what their thought process was, it still leaves open the possibility that their risk assessment is subjective. However, our conclusion as to the CSRP does not need to be a mystery or appear like something we pulled out of the air. There are tools to help us.

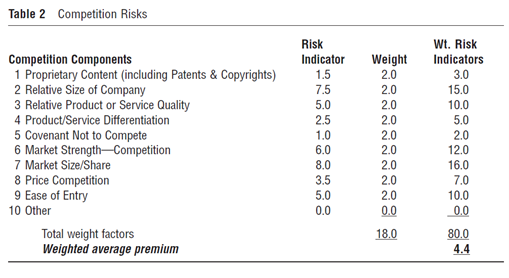

One such tool is the Risk Rate Component Model (RRCM)[1].

This is done for a variety of attribute categories and then each weighted average premium is added to arrive at the discount rate.

The hybrid model I propose here uses a modified version of the RRCM and the multi-attribute utility model (MAUT) to derive the CSRP. You may be familiar with MAUT from David Wood’s MUM for allocating goodwill between personal and enterprise goodwill. Such a model is still a largely qualitative analysis. However, it also shows how the allocation of personal and enterprise goodwill was calculated. Thus, it is not just a number pulled out of the air, or that which the valuation analyst uses to get the result they want.

The MAUT is a decision-making theory where there may be certainty or uncertainty in the outcomes. In making the decisions, there may be a number of attributes. Some attributes may be considered more important than other attributes. Also, certain attributes may be more likely to occur than other attributes. Basically, MAUT is a decision tree model.

In applying the MAUT to developing company specific risk (CSR), I consider the importance to various attributes comprising CSR (IU) and the extent to which the attribute increases risk (EU). For example, we may determine that one key attribute is customer concentration, and the more concentrated the customers the higher the risk.

To develop the model, the first step was to identify those attributes which contribute to CSR. The model I developed has 36 attributes grouped by category: financial, industry, management quality and reliability, staffing, market risks, regulatory risks, and other company risks. Others may use more or fewer attributes. It is important to note that the model is built around the number of attributes to be considered. This is because the attributes are additive. The more attributes, the higher the resulting calculation.

The weighting (importance of the attribute) is represented by IU. The existence or extent to which the attribute is considered to increase risk is represented by EU. IU times EU is the multiplicative utility (MU) (weighted contribution to risk). The total multiplicative utility (TMU) is the sum of the individual MUs. Here is an extract of a portion of the model:

In looking at the above, the IU is the importance factor. EU is the extent to which the factor increases risk. MU is the multiplicative utility (IU x EU). The total of the multiplicative utilities is the TMU.

For alternative ranges of TMUs, a CSRP is assigned. The following is a five-range model based on testing the model for different total multiplicative utilities:

In this five-range model, the possible outcomes are 1%, 3%, 5%, 7%, and 9%. You might ask what about the even numbered percentages? A sensitivity analysis showed that the variance between the abutting even percent and the odd percentages resulted in a difference in value of 4% to 7%. Given what we do, I think this is an acceptable variance.

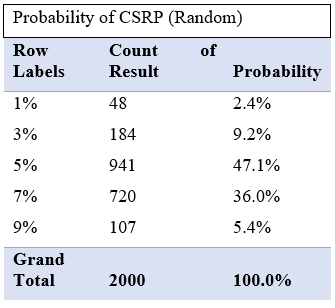

The following is what the probability of ending up with a particular CSRP was using Monte Carlo simulation, based on 2000 iterations.

I created a FREE Excel worksheet to be used in determining the CSRP. If this piques your interest and you would like my Excel worksheet, e-mail me and I will send it to you. For a more complete explanation, read my article in The Value Examiner, July/August 2022.

In a future article, I will expand the range to include even percents and incorporate Monte Carlo simulation into the model. The Monte Carlo simulation provides a range of CSRP with 95% certainty based on the valuation analyst’s assessment of most likely CSRP, worse case CSRP, and best case CSRP.

David H. Goodman, MBA, CPA, CVA, of Jesson, Oslin & Associates, LLP, in Boston, has 25 years of experience in performing business valuations and forensic accounting services for family law and business disputes; as well as tax and buy-sell purposes. Mr. Goodman has an MBA from the Tuck School of Business at Dartmouth College. He is a past president of NACVA’s Massachusetts State Chapter, past chair of the Massachusetts Society of Certified Public Accountants Litigation and BV committee, and a past board member and Treasurer of the Massachusetts Collaborative Law Council.

Mr. Godman can be contacted at (617) 698-3950 or by e-mail to dgoodman@joacpa.com.