Application of the Tax Amortization

Benefit Valuation Adjustment

The so-called tax amortization benefit (TAB) adjustment represents the present value of the federal income tax savings resulting from the tax amortization of an acquired intangible asset over a statutory period. Internal Revenue Code Section 197 allows the cost of certain acquired intangible assets to be amortized for federal income tax purposes. However, not all acquired intangible assets are subject to such amortization tax deductions. Analysts should apply the so-called TAB adjustment to an intangible asset valuation analysis only when it is appropriate. This discussion summarizes what analysts should know before applying the TAB adjustment to an intangible asset valuation analysis.

Introduction

For U.S. federal income tax purposes, an acquirer company may retain a valuation analyst (analyst) to perform a purchase price allocation of a business transaction that was structured as an Internal Revenue Code Section 1060 asset acquisition.[1] Such an acquisition purchase price allocation may also be appropriate in certain stock acquisitions if the acquirer entity makes appropriate elections under Section 336(e)[2] or 338(h)(10).[3]

The Financial Accounting Standards Board Accounting Standards Codification (ASC) Topic 805, Business Combinations, provides U.S. generally accepted accounting principles (GAAP) guidance related to the accounting for business combinations. Under ASC Topic 805, the acquirer recognizes the identifiable intangible assets acquired in a business combination separately from goodwill.

ASC Topic 805-20 provides two criteria related to the recognition of identifiable intangible assets in an acquisitive transaction accounted for as a business combination: (1) the accounting for a business combination separability criterion (i.e., can the acquired intangible asset be separated or divided) or (2) the contractual-legal criterion (i.e., does the acquired intangible asset arise from contractual or other legal rights).

The appropriate standard of value for the GAAP financial accounting for a business combination is fair value. Fair value is defined in ASC Topic 820, Fair Value Measurement, as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

ASC Topic 805-20 lists the following categories of so-called identifiable intangible assets:

- Marketing-related intangible assets (e.g., trademarks, service marks, noncompetition agreements, etc.)

- Customer-related intangible assets (e.g., customer lists, customer contracts, customer relationships, backlogs, etc.)

- Artistic intangible assets (e.g., books, plays, musical works, photographs, etc.)

- Contract-related intangible assets (e.g., leases, licenses, royalty agreements, etc.)

- Technology-related intangible assets (e.g., patented and unpatented technology, trade secrets, etc.)

For federal income tax purposes, acquirers may amortize the cost of many purchased intangible assets (i.e., Section 197 intangible assets) over a statutory 15-year amortization period. The amortization tax deduction related to the purchased intangible asset results in a tax expense saving for the acquirer.

An analyst may incorporate a so-called tax amortization benefit (TAB) adjustment into an intangible asset valuation developed by the application of the income approach.

The TAB adjustment is a procedure that is considered in the GAAP fair value measurement of intangible assets acquired in a business combination transaction. When applying the TAB adjustment in the income approach valuation or fair value measurement of these identifiable intangible assets, the analyst may consider the following:

- Which acquired assets qualify as Section 197 amortizable intangible assets

- What valuation methods are appropriate for the application of the TAB

- Whether the subject acquisition transaction is a taxable transaction

- Would Section 197 or a similar law apply in an international business combination

There is a diversity of practice in the application of the TAB adjustment in intangible asset analyses performed for fair value measurement purposes. When applying the TAB adjustment in an income approach valuation analysis, the analyst should consider all the issues listed above to ensure that the TAB is properly applied.

History of the TAB

Congress passed Section 197 as a solution to resolve the historical issue of acquired intangible assets acquired in a taxable business combination transaction. This legislation eliminated disputes between acquirers and the Service related to the allocation of the purchase price in certain transactions between acquired goodwill and other acquired intangible assets.

Pursuant to Section 197, most acquired intangible assets are allowed the same income tax treatment, and the useful life of purchased intangible assets is set at a uniform 15-year cost recovery period.

Section 197 allows acquirers to amortize and deduct the cost of most intangible assets purchased on or after August 11, 1993, beginning with the month in which the intangible asset is acquired. In addition, Section 197 allows the amortization of acquired goodwill in certain circumstances.

Not all identifiable intangible assets qualify as Section 197 amortizable intangible assets. Further, not all Section 197 intangible assets are amortizable.

According to Section 197(d)(1), “Section 197 intangible assets” include the following:[4]

- Goodwill

- Going-concern value

- Any of the following: (1) workforce; (2) business books and records, operating systems (including customer lists); (3) patents, copyright, formulas, processes, designs, patterns, know-how, and formats; (4) customer-based intangibles; and (5) supplier-based intangibles

- Any license, permit, or other rights granted by a government agency

- Any covenant not to compete entered into in connection with the acquisition of a business

- Any franchise, trademark, or trade name

In general, Section 197 intangible assets means any Section 197 intangible asset (1) that is acquired after August 10, 1993, and (2) that is used in a trade or business.

Amortizable Section 197 intangible assets exclude any Section 197 intangible assets created by the taxpayer (i.e., a self-created intangible). A self-created intangible asset is created by the taxpayer if the taxpayer makes payments or incurs costs for its creation or improvement.

It does not matter whether the taxpayer performed the development work himself/herself, or a third party under contract with the taxpayer performed the work. If the taxpayer signed a contract with the developer before development, or improvement of the intangible asset began, then it is considered a self-created asset.

The following list presents exceptions to self-created intangible assets. These intangible assets are amortizable under Section 197.[5]

- Licenses, permits, or other rights granted by a government unit

- Covenants not to compete

- Franchises, trademarks, and trade names

For example, capitalized costs incurred in the development, registration, or defense of a trademark are amortizable under Section 197.

The following self-created intangibles are not amortizable intangible assets:[6]

- Any Section 197 intangible created in connection with the purchase of a trade or business

- Any re-acquired intangible asset

- A property to which anti-churning rules apply

Anti-churning provisions do not allow amortization deductions for goodwill and similar intangible assets held by the seller that were not amortizable prior to the enactment of Section 197. Churning is a process in which a taxpayer would sell assets to himself/herself, or a related party (i.e., a paper transaction) to create a new tax amortizable asset that would not have been amortizable under previous regulations, to take advantage of the tax benefit.

The TAB Adjustment Example

When an intangible asset can be amortized as a deduction for federal income tax purposes, the income approach implied value of that intangible asset may be enhanced by the present value of the future income tax savings derived from the amortization of the asset (i.e., the so-called TAB adjustment factor).

Since the inception of Section 197, the so-called TAB adjustment factor has been a consideration in the valuation of certain intangible assets. The TAB factor is typically added as a value increment adjustment to the estimated, unadjusted income approach value of the intangible asset.

The inputs to the TAB adjustment factor calculation include: (1) a present value discount rate, (2) an income tax rate, and (3) the number of years for which the tax deduction is effective.

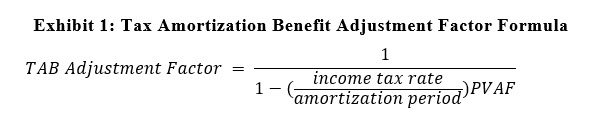

The TAB adjustment factor is often measured using the formula presented in Exhibit 1.[7]

PVAF = The present value of an annuity factor for 15 years at the present value discount rate used in the unadjusted intangible asset valuation analysis. The income tax rate is the effective income tax rate used in the unadjusted intangible asset valuation analysis.

In the selection of the present value discount rate, the analyst may determine if the risk of the TAB is (1) closely aligned with the risk of the underlying asset that generates the TAB or (2) more aligned with the risk of a market participant who would hypothetically realize the TAB.

Documentation of the selection process regarding the present value discount rate should be provided in the valuation work files.

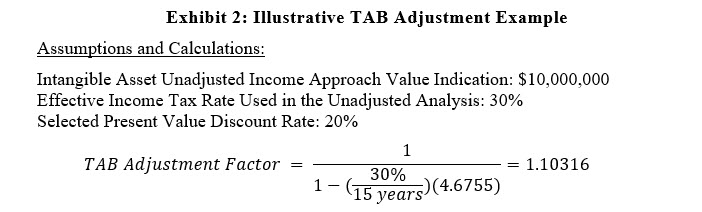

Exhibit 2 provides an example that illustrates the application of the TAB adjustment in a simple income approach intangible asset valuation analysis.

In this case, the TAB adjustment factor calculates to 1.10316, indicating an income approach value adjustment of approximately 10.3 percent.

The analyst would then multiply the unadjusted income approach value indication of $10 million with the TAB adjustment factor of 1.10316, as follows: $10,000,000 unadjusted value × 1.10316 TAB = $11,000,000 fair value (rounded).

In this example, the application of the TAB resulted in an additional $1,031,600 (or, $1 million rounded) in the indicated income approach value of the purchased intangible asset.

Guidance on the Application of the TAB

While the passage of Section 197 simplified the matter of what and how certain acquired intangible assets should be amortized for federal income tax purposes, not all acquired intangible assets are subject to a TAB adjustment. The analyst should apply the TAB adjustment only when appropriate.

For example, the Mandatory Performance Framework (MPF) discusses considerations related to the TAB adjustment in the fair value measurement of acquired intangible assets in a business combination transaction. When applying the TAB, the MPF requires the analyst to document in writing within a work file, the appropriateness of applying the TAB and assumptions used in the analysis (such as the selected income tax rate and discount rate).

The American Institute of Certified Public Accountants, the American Society of Appraisers, and the Royal Institute of Chartered Surveyors collaborated to develop the MPF. The MPF is designed to provide guidance on the type and amount of documentation that should be gathered to support a valuation analysis.

The MPF sets requirements for analysts who hold the Certified in Entity and Intangible Valuation designation and perform fair value measurements for financial accounting purposes.

In the valuation of an intangible asset, the analyst should consider the three generally accepted valuation approaches: the cost approach, the market approach, and the income approach. Within these three generally accepted intangible asset valuation approaches, there are several generally accepted valuation methods to estimate the value of intangible assets.

According to the MPF, a TAB adjustment is generally considered appropriate when measuring the fair value of an entity using an income approach for a presumed taxable transaction.[8]

According to the MPF, applying the TAB adjustment is not appropriate in a cost approach intangible asset valuation analysis. The cost approach typically does not include any income tax considerations. The MPF states that the TAB adjustment is not appropriate when applying the cost approach when: (1) the transaction is nontaxable, (2) when pretax costs are expended, and (3) when the price paid fully reflects the full fair value of the entity.

The MPF specifies that including the TAB in a market approach intangible asset valuation analysis also is not appropriate. Applying a market approach valuation method, the value of an intangible asset is estimated based on market prices paid for comparable assets and those prices typically include all the benefits of owning the intangible asset, including the TAB adjustment.

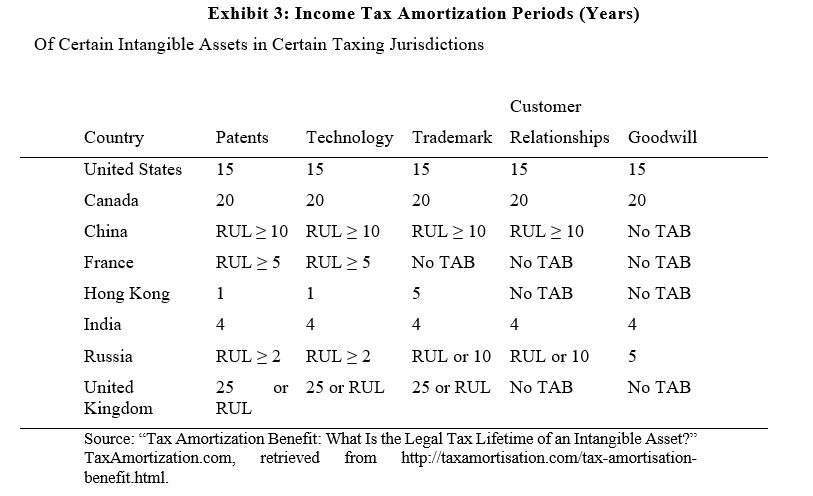

The MPF also requires the analyst to document the consideration of the TAB adjustment when accounting for foreign transactions. Income tax rules related to intangible asset amortization may vary considerably between different countries.

For instance, some taxing jurisdictions typically use the intangible asset’s remaining useful life (RUL) in the calculation of the TAB. Other taxing jurisdictions use a statutory amortization period.

The United States allows the application of a 15-year amortization period to calculate the TAB for patents, trademarks, customer relationships, and goodwill. In India, the amortization period for the same intangible assets is only four years. In Hong Kong, patents and technology may be amortized over a one-year period while trademarks are amortizable over five years. However, customer relationships and goodwill are not amortizable.

Exhibit 3 illustrates how the tax amortization periods (i.e., years) of certain intangible assets of select industrialized taxing jurisdictions can vary significantly.

Summary and Conclusion

Acquirers may retain an analyst to value intangible assets as part of a taxable business combination for federal taxation purposes. Pursuant to Section 197, certain acquired intangible assets may be amortized over a 15-year life. The amortization of an intangible asset over the 15-year statutory period results in an income tax expense saving for the acquirer (i.e., the TAB).

Analysts who perform fair value measurements of intangible assets acquired as part of a business combination transaction (1) should be aware of the TAB adjustment and (2) should consider if the TAB is appropriate in their analysis.

To apply the TAB adjustment, an analyst may consider (1) which assets qualify as Section 197 amortizable intangible assets, (2) what intangible asset valuation methods are appropriate for the consideration of the TAB, adjustment, (3) whether the acquisition transaction is a taxable business, and (4) whether Section 197 or a similar law applies in an international business combination transaction.

Failure to consider these factors may result in an unsupported application of the TAB adjustment.

Lisa Tran is a vice president and the financial accounting valuation services practice leader in the Portland, Oregon, practice office of Willamette Management Associates.

Ms. Tran can be contacted at (503) 243-7510 or by e-mail to lhtran@willamette.com.

Travis Royce is an associate in the firm’s Portland, Oregon, practice office.

Mr. Royce can be contacted at (503) 243-7513 or by e-mail to tcroyce@willamette.com.

[1] Pursuant to the Tax Reform Act of 1986, Internal Revenue Code 1060 (Special Allocation Rules for Certain Asset Acquisitions) prescribes the rules for the seller and the buyer each to allocate the consideration paid or received in a transaction, among the assets transferred in an applicable asset acquisition.

[2] Enacted in 1986, the provisions of Section 336(e) are like Section 338(h)(10). However, the purchaser is not required to be a single corporation but can be an individual or a partnership. In fact, multiple purchasers are allowed.

[3] Enacted in 1982, Section 338(h)(10) allows a purchaser making a stock acquisition to elect to treat the stock purchase as an asset purchase for federal income tax purposes. The sale of stock is ignored, and the transaction is treated as a deemed sale of assets by the corporation followed by a deemed liquidation of the corporation. A fictional “new corporation” is treated as purchasing the assets for their fair market value. This election requires the purchaser to purchase at least 80 percent of the vote and value of the target company stock. This election can only be made if the target corporation is an S corporation or a corporate subsidiary of a consolidated group, and the purchaser is a single corporation.

[4] Internal Revenue Code Section 197 (2018).

[5] Treasury Regulation Section 1.197-2.

[6] Ibid.

[7] Robert F. Reilly and Robert P. Schweihs, Best Practices: Thought Leadership in Valuation, Damages, and Transfer Price Analysis (Ventnor, NJ: Valuation Products and Services, 2019), 913–14.

[8] Application of the Mandatory Performance Framework for the Certified in Entity and Intangible Valuations Credential, Corporate and Intangibles Valuation Organization, LLC (January 2017): 24.