Incorporating Country Risk Premium Differentials

Into the Market-Based Valuation (Part II of II)

This is the second of the two-part article regarding country risk. In this second part, the author discusses how to incorporate the risk into multiples. Read Part I here.

Incorporating Country Risk into Multiples

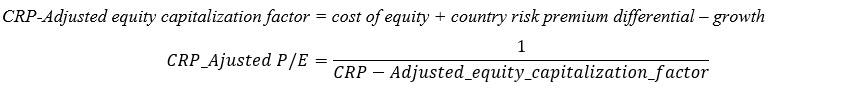

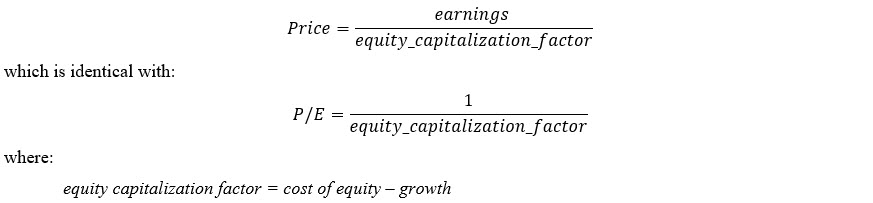

Having found the value of the country risk premium required, we can proceed with incorporating it into the market-based valuation. It is worth mentioning that the decisive feature for determining the difference in country risk is the area of activity, not the location of the corporate headquarters. Our goal is to determine what should be the multiple if the comparable company has been traded in the country of a valued entity. The solution is straightforward in the case of price to earnings multiple (P/E) as this ratio relates to the cost of equity capital only. We can state that according to this method of valuation, the price is depending on earnings and the capitalization factor. In turn, the value of the capitalization factor depends on risk (represented by the cost of equity capital) and the expected growth in profits of the company. We can present this as follows:

If we want to adjust the P/E ratio for the impact of country risk premium only, we must adjust the capitalization factor by adding the required value of additional risk. This leads to a change in the capitalization factor, impacting the P/E ratio in consequence.

To enable this adjustment, we must make an assumption that the fundamentals (growth rate) and cost of capital are defined in real terms. This prevents inflation differentials as the companies may be valued in different currencies.

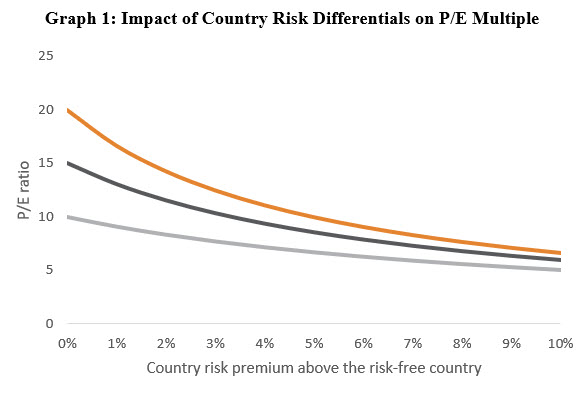

Graph 1 presents the impact of incorporating the country risk into the multiple. The rather obvious conclusion is that higher country risk leads to a lower P/E ratio. Investors taking higher risk require higher returns and are willing to pay a lower multiple of earnings. The impact is greater for higher multiples and its significance diminishes when the initial ratio decreases.

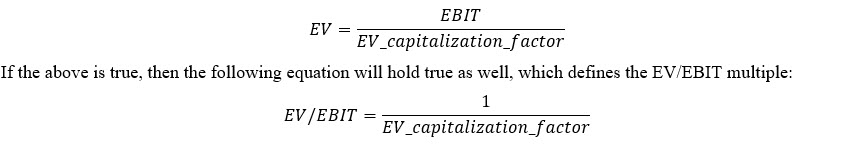

The issue of adjustment seems to be more complicated in the case of multiples based on the Enterprise Value (EV) as they are referring to both, equity and debt, and the weighted average cost of capital (WACC). Our starting assumption is that the enterprise value is based on the EBIT value, which is used as a proxy for the profit and cash-generating ability of the company. EBIT includes depreciation and amortization costs, which in most mature companies cover the majority or whole capital expenditures incurred for new assets. This is why the EBIT is a superior proxy for the free cash flow than the EBITDA is. EV may be obtained by capitalizing the EBIT value by the capitalization factor (expressed in percentage terms).

The capitalization factor reflects the cost of capital and expected growth in the profits and cash flows in the future into infinity (growth rate). For the sake of simplicity, we assume that the capitalization factor equals pre-tax WACC less the growth rate. Pre-tax WACC is used as EBIT does not include the tax burden.

EV capitalization factor = pre_tax_WACC – growth

For our analysis, two additional assumptions have to be made. The first is that the pre-tax WACC and growth rates are used in real terms to avoid inflation impact from different currencies. The other assumption is that the real risk-free rate (in opposite to the nominal risk-free rate) is similar in all currencies. The second assumption eliminates the potential impact of varying real risk-free rates which would require a separate adjustment mechanism.

The cost of capital consists of the cost of equity and the cost of debt. Both should include the country risk relevant for a particular company in the same amount. As a consequence, the change in the country risk should translate into the change in the cost of equity and cost of debt in the same value. It means that the total weighted average cost of capital and capitalization factor will change by the same value (in percentage points) as well. The relative country risk premium is added to the capitalization factor on the premise that any difference in the level of country risk premiums between two countries directly translates to a similar difference in the cost of capital between the companies that operate mainly in each of these countries.

These would impact the capitalization factor similarly as in the case of the P/E ratio:

CRP-Adjusted EV capitalization factor = pre_tax_WACC + country risk premium differential – growth

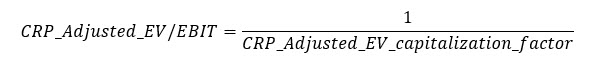

As a result, the final formula used for adjusting EV/EBIT for the country risk premium is as follows:

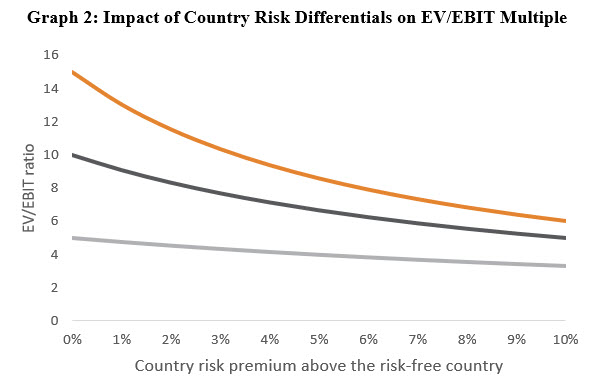

Graph 2 presents the impact of incorporating the country risk into the EV/EBIT multiple. The conclusion is, similarly to the previously shown relation for the P/E ratio, that higher country risk leads to a lower EV/EBIT ratio. Again, the impact is greater for higher multiples and its significance diminishes when the initial ratio decreases.

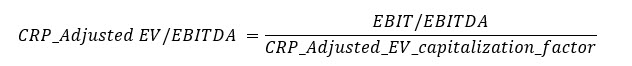

Even though the EBIT value is more reliable as a proxy for cash generation ability in the company, the EBITDA value is more often followed by the investors and, in consequence, the EV/EBITDA multiple is more often used in the valuation process. This is why we should be able to adjust this value for the country risk differentials as well. We may refer to the previous formula:

As explained above, the CRP-Adjusted EV/EBITDA multiple will incorporate the ratio of EBIT to EBITDA. However, this data is not always available. Very often the information made public after the transaction gives details only about the EBITDA of the target company. In such a case we may use an industry average for an approximation. The percentage change in the EV/EBITDA multiple due to the adjustment will be the same as for the EV/EBIT. This is because the EV/EBITDA is just a product of EV/EBIT and a constant ratio of EBIT to EBITDA. The point worth mentioning is that the EBIT to EBITDA ratio varies significantly among industries, ranging from about 0.2–0.3 for asset-heavy businesses (like energy or mining) to more than 0.9 in the case of asset-light operations (like services, trade, or some production undertakings).

There is one more approach that can be applied for finding the appropriate difference in multiples due to country risk premium. One can try to find the required discount (or premium) by looking at general market multiples in both countries and comparing their values. It can refer to the whole market or the average level for the given sector. The resulting proportion may be later adopted in the valuation of a given entity. The approach is based on a rational assumption that the difference in valuation levels is due to the country risk premium. However, several other factors can disturb the results. The differences may result, for example, from lower liquidity or lower growth expectations, while we aim to isolate the country risk premium. Because of this shortcoming, the adjustment in the capitalization factor will be a preferred method in the application as it allows for the separate analysis of country risk premium only.

Application of the Method

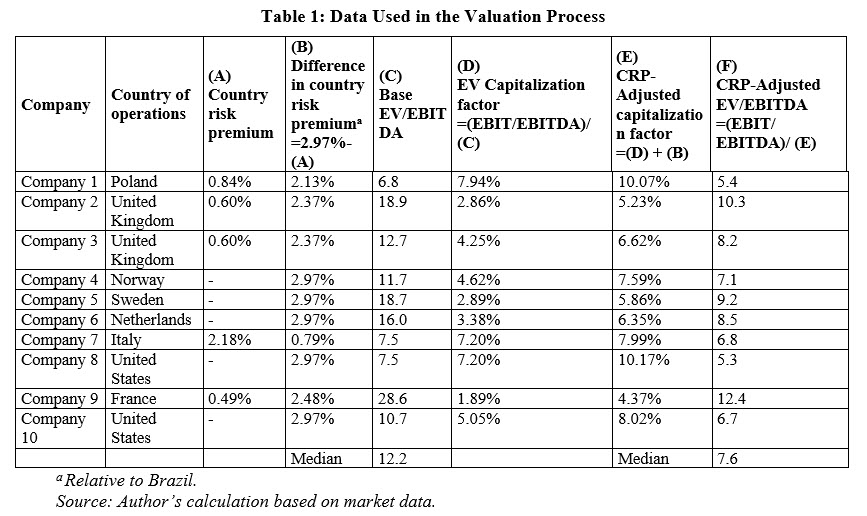

The application of the method will be presented in the hypothetical case study where the valued entity was a private company operating in the telecommunication services sector in Brazil. That country is included in the category of emerging markets by MSCI[1] and is perceived as riskier than most developed countries. The entity was valued with the use of the comparable transactions method based on multiples from relevant acquisitions (i.e., where the subject company operated in a similar business) completed in the recent past. The market data allowed for the calculation of the EV/EBITDA multiple only, and it will be used in the valuation. However, the gathered transaction data concerned companies operating in developed countries, providing an environment perceived as less risky (exposed to less country risk). As a result, even assuming the same general business characteristics and growth prospects, the valued entity should have been assigned a lower multiple than comparable companies because of the higher country risk.

The starting point is to determine the country risk premiums for all countries where the deals were originated and used in the valuation process and verify if the differences in risk are significant. We can refer to the data on country risk premium from the analysis published by prof. A. Damodaran.[2] Brazil has assigned a country risk premium at the level of 2.97%. This level is significant in comparison to other states, and it should be adjusted for in the valuation. Our second step is finding the difference in the country risk premium for every country in relation to Brazil. These values are presented in the table, next to the transaction multiples.

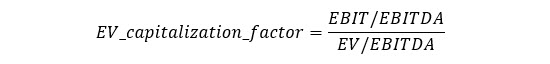

From the base transactional multiples, we find the EV capitalization factor, which is a reciprocal of the multiple, adjusted by the EBIT to EBITDA ratio, which, for the telecommunication services on average, equals 54%:

According to our previous assumptions, the capitalization factor should be adjusted for the country risk premium differential for every company. It might be compared to the situation when we would have moved those companies to Brazil, the country of a valued entity, and adjusted their multiples because of the changing environment in which they would be operating now. Having done this, we can find the EV/EBITDA multiple adjusted for the country risk premium with the formula:

This way, we have calculated the adjusted multiples, which can be now used for the valuation of a Brazilian entity. The median multiple may be applied as an input into the final calculation. As a result, our value obtained in the process will be significantly lower than without the adjustment for the country risk. However, this is a more realistic estimate of the potential value of the entity than one based on base multiples.

Conclusions

Country risk has a significant impact on the investors’ perception of total risk related to the given investment. Consequently, differences in this parameter should lead to variance in the price paid for a company in the form of the multiple assigned to the earnings generated by the valued entity. As shown in an example of a Brazilian company valued based on transactions from the developed markets, the impact of the adjustment can be significant and lead to a material reduction in a multiple eventually applied.

The country risk premium is only one factor that should be considered in the market-based valuation approach. The other distinctions (e.g., pace of expected growth, earnings quality) should be accounted for separately. Even though the total adjustment can cause a drastic reduction in the value of a multiple, this leads to a more reliable value estimate which is the goal of fair value measurement. This also shows that the market-based approach to valuation is not as straightforward as is commonly seen and requires in-depth analysis during the valuation procedure.

References

Damodaran, A. 2018, The Dark Side of Valuation. Valuing Young, Distressed and Complex Businesses, Pearson Education Inc.

Harrington J., Nunes C., International Cost of Capital: Understanding and Quantifying Country Risk, Journal of Business Valuation, 2019 edition, CBV Institute.

Kruschwitz, L., Loeffler, A. and Mandl, G., Damodaran’s Country Risk Premium: A Serious Critique (July 31, 2010). Available at SSRN: https://ssrn.com/abstract=1651466 or http://dx.doi.org/10.2139/ssrn.1651466.

Mercer, Z.C. 2013, Fundamental Adjustments to Market Capitalization Rates, reprinted from Mercer Capital’s Value Matters 2004-11. Available from Internet: https://mercercapital.com/article/fundamental-adjustments-to-market-capitalization-rates/.

Milenković, N. 2015, Market Multiples Adjustments for Differences in Risk Profile – an Airline Company Example, International Journal for Traffic and Transport Engineering, 2015, 5(1): p. 17-28. Available from Internet: http://ijtte.com/uploads/2015-02-25/935be804-f903-5243IJTTE_Vol%205(1)_3.pdf.

S&P Global Ratings, 2017, Sovereign Rating Methodology, https://www.spratings.com/documents/20184/4432051/Sovereign+Rating+Methodology/5f8c852c-108d-46d2-add1-4c20c3304725.

Country risk premiums obtained from the analysis of prof. A. Damodaran available at: http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ctryprem.html.

[1] https://www.msci.com/market-classification.

[2] http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ctryprem.html.

Tomasz Manowiec, CFA, FCCA, is a Director at Baker Tilly TPA, an audit, consulting, and advisory company, and is responsible for the Corporate Finance department. His practice includes valuation of enterprises and financial instruments, financial modeling and analysis, transaction advisory, and business planning. Before his consulting role, he was in the investment industry working as a sell-side analyst, buy-side analyst, and fund manager responsible for the equity markets.

Mr. Manowiec can be contacted at (0048) 606244697 or by e-mail to tomasz.manowiec@bakertilly-tpa.pl.