Do Not Double Tax Your Business

How the PTE Tax Can Impact the Valuation of Pass-Through Entities

This paper explains how the PTE tax in Massachusetts and several other states affects the valuation of a business and how business owners can account for this tax to avoid double taxation.

Introduction

Taxes can have a significant impact on the value of a business. Pass-through entities such as S-Corporations and partnerships generally do not pay any taxes since the income is passed through to the individual shareholder or partner. Taxes are then paid on their individual income tax returns. But what if I said that Massachusetts pass-through entities DO pay taxes at the entity level? Let me explain.

Some of you may be aware of the potential “double-tax” on C-Corporations. While that still holds true, the focus here is strictly on pass-through entities (S-Corporations and partnerships). In business valuations for pass-through entities, “tax affecting” the earnings of a pass-through entity, should be considered. The landmark case for tax affecting in Massachusetts is Bernier v. Bernier,[1] a divorce proceeding in which a judge ruled that taxes should be considered for pass-through entities even though they do not directly pay taxes. The ruling states the valuator needs to consider the benefits of the tax-free distributions from the entity as opposed to the taxes paid on the dividends from a C-Corporation. While there are different models and theories regarding tax affecting, taxes need to be considered, especially in light of the Bernier case.

Beginning with the 2018 tax year, the Tax Cuts and Jobs Act (TCJA) limited the state and local income tax (SALT) deduction on individual tax returns to $10,000 (previously there was no limit). This had a huge impact on taxpayers in states with high income taxes. Consequently, states took note of this limitation and began implementing their own “pass-through entity tax (PTE tax)” in which pass-through entities would be taxed at the entity level and a deduction would be allowed for this tax against the federal income tax from the business. Then the individual would get a credit for the state tax paid on their individual return. So, in theory, they would have $0 tax on a state level from business income. The most notable state to do this immediately was Connecticut, which implemented a PTE tax beginning with the 2018 tax year.

This paper explains how the PTE tax in Massachusetts and several other states affects the valuation of a business and how business owners can account for this tax to avoid double taxation.

Since Connecticut (and Wisconsin) implemented the PTE tax beginning with the 2018 tax year, nearly 30 states have adopted this tax, which will be in effect for the 2022 tax year. Some states have made this tax mandatory (Connecticut), while other states, such as Massachusetts, have made this tax optional. The fact that the election is optional does not matter to the valuation. However, if the company chooses to take the PTE election, it has to be careful not to underestimate the income of the business by the amount of this tax.

Massachusetts pass-through entities can elect and pay this tax beginning with the 2021 tax year. If or when the election is made, taxes paid are reported on Form 63D-ELT and this form is filed with the business tax return.

Properly Using PTE to Arrive at Pre-Tax Income

While not getting into the mechanics of how Massachusetts entities can elect, register, and pay the PTE tax, generally all pass-through entities operating in Massachusetts are eligible. Massachusetts entities can pay estimated taxes throughout the year or pay with the filing of their tax returns. The tax rate is 5% of net Massachusetts income—Massachusetts taxpayers are paying their tax at the entity level rather than at the individual level.

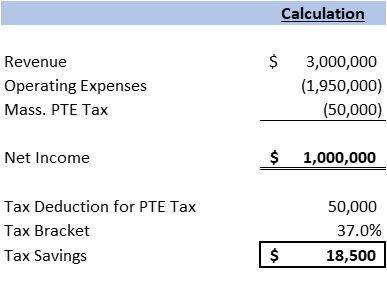

Elections to pay this tax are made on a yearly basis. Most companies, especially highly profitable ones, can benefit from this election. For example, if a company has $1,000,000 of net income and pays 5% tax ($50,000), the individual shareholder(s) in the highest tax bracket could save up to $18,500 ($50,000 X 37%). The calculation is shown below:

So how does this tax affect a business valuation? As discussed above, taxes should be considered when valuing a business. But what happens if a company elects to pay the PTE tax and takes an expense for it through the business? You have essentially underestimated the income of the business by the amount of this tax. You will have deducted this tax when arriving at pre-tax income and then be deducting taxes AGAIN when using your tax affecting model (see Bernier v. Bernier). Don’t Double Tax Your Business! You should be adding this PTE tax back as a normalizing adjustment when arriving at pre-tax income.

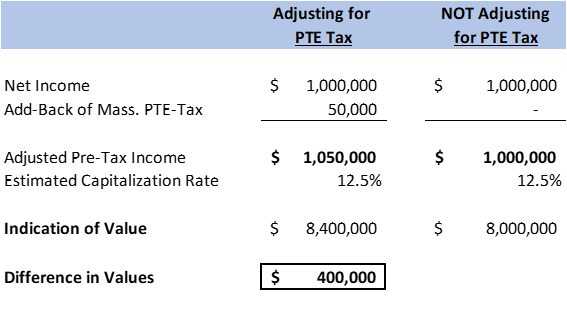

The effect of not adjusting for this tax can impact the value of a business. For instance, in the above example where the business has $1,000,000 of net income and pays $50,000 of Massachusetts PTE tax, failure to add this tax back to income can undervalue the business by as much as $400,000. Here is the calculation:

Conclusion

Factors such as the industry and other risk characteristics will still play a major role in the final value but ignoring this PTE tax can have major implications. Since it is such a new concept for pass-through entities (particularly in Massachusetts) to pay income taxes at the entity level, valuation experts should be on the lookout for state income taxes being deducted as a normal operating expense. There could be even more states that may implement this PTE tax in years to come, so this can have an impact on businesses in many states, not just Massachusetts. The higher the tax rate in a particular state, the larger the impact on value. Taxing your business one time is enough, why would you want to do it twice!

We would like to thank Erik Blaushield for providing insight and expertise that greatly assisted this research.

This article was originally published by J.S. Held, 11/02/2022, and is republished here by permission.

[1] Bernier v. Bernier, 449 Mass. 774 873 N.E. 2nd 216 SJC-09836

Erik Blaushield, CPA,CVA, is a Vice President in the Economic Damages & Valuation practice at J.S. Held. Based in Boston, he focuses on business valuation engagements and potential tax consequences of divorce, family law, and other related matters. With nearly two decades of experience, including several years as a former tax partner at a certified public accounting firm, he provides expertise in tax consulting, compliance, mergers and acquisitions, audit, and finance.

Mr. Blaushield can be contacted at (978) 259-9232 or by e-mail to Erik.Blaushield@jsheld.com.

DISCLAIMER: J.S. Held, its affiliates and subsidiaries, are not certified public accounting firms and do not provide audit, attest, or any other public accounting services. Further, J.S. Held is not a law firm and does not provide legal advice or legal opinions in connection with any of the services provided by the firm, reports issued by J.S. Held, or Client’s use of such reports. Client agrees that J.S. Held has not and does not render legal advice or offer legal assistance in any of the services provided under this Agreement. No statements or representations by J.S. Held should be construed to be legal advice, and J.S. Held advises Client to always consult with its own attorney. All rights reserved.