Determining the Fair Market Value for a NFT

A Practice Guide for Practitioners

What are the proper questions and approaches that enable valuation professionals to value non-fungible tokens (NFTs)? The author describes the questions and methods used to value NFTs.

With the recent IRS proposal, the focus on fair market value is repeated as the preferred method for cryptocurrency transactions that do not involve cash.[1] The IRS redefines fair market value to simply market value for cryptocurrencies traded on an exchange; this limits the applicability to less than 10% of cryptocurrencies and highlights the need for practitioners to understand how to apply fair market value calculations to cryptocurrency. The proposal also does not require any exchange to publicly release the prices at which trades occur on their exchange in a standardized and accessible manner; gathering this data and determining the appropriate sources is also important for the practitioner to understand. A collection is a special term within the NFT ecosystem that refers to a group of NFTs (generally under the ERC-721, ERC-1155, or equivalent standards), but is not used consistently. For instance, the BoredApeYachtClub NFTs are referred to as a “collection” and OpenSea presents a floor price for that collection, but each one is issued under its own ERC-721 contract. This collection has a limited supply of 10,000 and each one is a similar, but unique, ape portrait. Other NFTs, such as Beeple’s Politics is Bull*, are arbitrarily limited to 100 print-equivalents, and are part of the Beeple Special Edition collection, which contains other images that are dissimilar.[2] Still other NFTs are issued under an ERC-1155 or equivalent smart contract and those are referred to as a collection where many NFTs can be issued under only one smart contract. Multiples of an NFT can be issued, similar to the edition-based multiples of an ERC-721 NFT, but the ERC-1155 standard offers a programmatic way to issue many NFTs.[3] A “portfolio” of NFTs is distinct from a collection in that the term refers to all of a user’s NFT holdings, regardless of which collection those NFTs are part of. This article will only use the term collection to refer to the NFT’s market grouping and will use the term portfolio to refer to a user’s holdings of NFT assets.

There are no less than three approaches to determine a fair market value, each with their own subset of methods:

- Cost Approach

a. Cost to Create from Scratch—This method is used to determine how much a person would expect to pay to rebuild the asset from scratch. With NFTs, if this approach is applicable, it would include the cost of creating the smart contract, the cost of a source code review if many changes to the standard contract are needed, the cost of marketing, and the costs of minting.

The cost approach is rarely applicable to NFTs because this method presumes that a willing buyer would not pay more than the cost to create the asset from scratch. NFTs are often sold or offered for sale at many times the cost to create them; without some other specific case facts, the cost approach is generally not appropriate. Creating an NFT is relatively inexpensive and applying the cost approach to artwork NFTs is equivalent to valuing a Jackson Pollock painting or the Mona Lisa at the cost of the canvas and paint.[4]

However, for NFTs that are not artwork NFTs, that do not relate to historical contributions, and do not have significant creators, the cost approach might be applicable. Also, when valuing a collection of NFTs, the cost approach might also be appropriate to determine replacement value for a claim of loss, although the user is likely to disagree because the amount paid by the user is likely to be higher than the cost to create it from scratch. For instance, when the large crypto exchange FTX collapsed, any NFT collection that relied on its platform could be valued at the cost to create it on a different platform. This is different from valuing a lost portfolio of NFTs.

If the NFT collection is created with an ERC-721 standard smart contract, it is likely to have a higher cost for multiple NFTs than a collection issued with the ERC-1155 standard smart contract, because multiple NFTs can be issued under one smart contract. If the subject asset’s smart contract contains deviations from the standard, it will also be a higher cost to recreate.

- Market Approach

a. Comparable Sales Method—This method relies on the availability of earnings data for other companies or property. For private companies, this data is generally purchased from a data aggregator and for real property, public or purchased aggregate sales data is relied upon. The goal is to derive an EBITDA multiple or a price per unit to apply to the subject asset.

When valuing NFTs, the sales data of that specific NFT, of other NFTs in that collection, of other NFTs from the same issuer, and of other NFTs that were owned by a specific individual can be determined from public NFT marketplaces. This may be more difficult if the NFT issuers run their own centralized marketplace because the issuers may control or manipulate the internal data. When selecting comparable sales, the practitioner must determine whether a transaction was arms-length. In NFT transfers, this can be determined with transaction analysis, tracing the buyer’s and seller’s other transactions, and determining whether Address Convergence indicates a non-arms-length transaction.[5]

b. Gross Revenue Multiple Methods—When internal financials are not available for a company and an EBITDA multiple cannot be determined, but revenue data is available, a revenue multiple method may be applied. This method is rarely applicable to valuing an individual NFT, a collection, or a portfolio.

When a user holds the majority of an NFT collection as inventory intended for sale, other methods may be more appropriate. When the subject holder is the creator of an NFT collection, the revenue multiple method may be appropriate if that creator has issued other collections that generate revenue for the creator after the sale or transfer. This method may also be appropriate if the NFT itself generates revenue without being transferred or sold by the holder and if comparable revenue generating NFTs can be found. For instance, the ChickenFT4 collection generates a 5% revenue to the creator upon each sale in perpetuity.[6] If revenue has been generated in such a way for prior NFTs issued by the same creator, the value of the new NFTs may be determined using the revenue multiple method. If the NFT represents property in the metaverse (or physical universe for that matter) that has been leased, other methods may be more appropriate, such as the cap rate.

It is not likely that a similar portfolio can be found to compare for revenue multiples due to the uniqueness among NFT holdings, the importance placed on creators, and the lack of revenue reporting by other issuers. Such an application may double-count the expected earnings of the holding entity when the entity is also being valued. If the collection of NFTs is valued using a revenue multiple, this approach is most akin to an asset approach for valuing the holding entity and other methods may be more appropriate.

c. Guideline Public Company Method—This method uses the value of public companies that are similar to the subject company and that value is then discounted for the lack of marketability inherent in private holdings.

For NFTs, this method is not likely to be applicable until many public companies exist with their operations solely within the NFT ecosystem (issuing, collecting, reselling, etc.). And even then, the practitioner would need to identify those public companies with similar portfolio holdings and operations, and again, that is not likely among NFTs given the nature of the NFT ecosystem overall.

- Income Approach

a. Income Capitalization (Cap Rate) Method—This method is generally applied to stable income streams, like rent. If a stable income stream can be identified, this method may be appropriate. For instance, if an NFT represents property in a metaverse that has a long-term rental contract, this method may be applicable.[7] This is a likely hypothetical. For instance, Mastercard leased space in the Decentraland metaverse to host its Pride Plaza in 2022.[8] This method may be appropriate when an NFT has terms that pay the creator a percentage of each subsequent sale if a consistent pattern of sales exists.

If this approach is used, the practitioner must determine a reliable source for the capitalization rate or calculate it manually. To calculate this manually, the practitioner must determine the income from other leased property NFTs that have been sold, ideally within the same metaverse.

b. Discounted Cash Flow (DCF) Method—This method is the most versatile valuation method and allows the practitioner to consider a wide variety of factors. Future cash flows are projected and then discounted using a rate determined by the practitioner. The factors contributing to the discount rate include industry risk and company-specific risk.

When valuing NFTs, the DCF method may offer the potential for an accurate valuation assessment compared to other models that are limited to available data. Within the DCF model, factors like the number of users on the metaverse platform on which a property resides as compared to other platforms can be considered. Likewise, the rarity of attributes contained within an artwork NFT can be considered compared to other NFTs in the collection with less rare attributes. In the NFT ecosystem, where variance, uniqueness, and volatile growth rates abound, the DCF method may be most appropriate because it allows the practitioner to consider risk associated to cash flows; however, the method is prone to overly subjective and optimistic projections which must be carefully avoided by the practitioner.

In addition, when using a build-up method to determine a discount rate, the practitioner has more relevant options to consider than just the treasury rates of various terms that are the standard in the traditional DCF. Within the cryptocurrency ecosystem, the equivalent to the risk-free rate would be the rate of a native token and should be calculated by the practitioner, it should not be cited from an article.[9]

There are several other valuation methods and variations on the methods described above. The selection method for an NFT valuation depends on the facts of a subject asset, the availability of accurate and comparable data, and the purpose of the valuation itself. The traditional valuation analyst already possesses the relevant skills to conduct an NFT valuation.

The NFT Valuation Engagement

The typical valuation engagement requires a discussion of methods, a detailed reasoning that supports the selection of methods, a comparison of the values among the methods, and a reasonable conclusion of value for the asset(s). The most familiar NFTs are those that closely resemble art; however, the valuation is most analogous to a business valuation or a real property valuation (there are not any Certified NFT Valuation Analysts…yet). The standards for executing a traditional valuation report apply to an NFT valuation and those that do not follow professional valuation standards should be rejected.

NFTs have sold for more than real property and more than private businesses.[10] Practitioners must include this asset in their valuation skills. NFTs have special characteristics that are publicly available. Data related to sales, transfers, attributes, rarity, and more is generally available to the public through various open-source marketplaces, where it is easier to read, or through a review of the NFT itself at the blockchain location on which it resides, where it is harder to read and may require code parsing. Several marketplaces for NFTs exist; some are centralized and some are decentralized.[11]

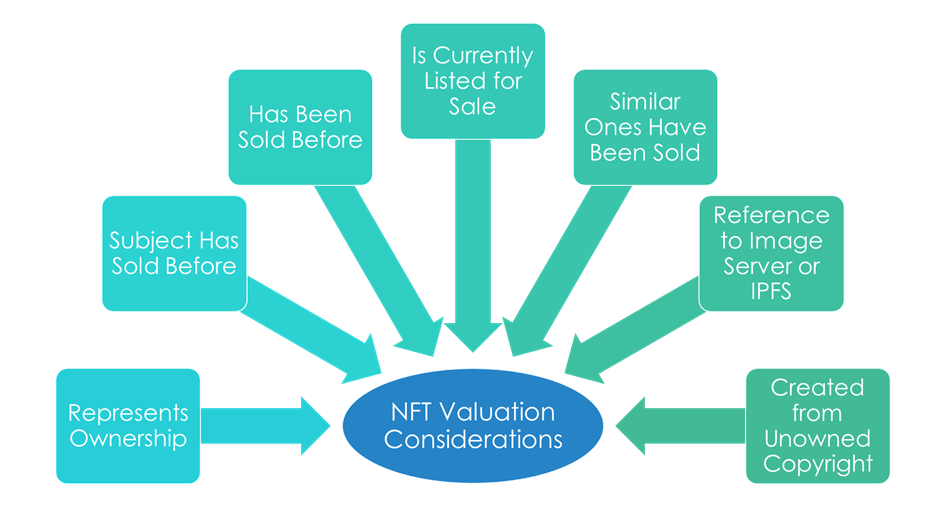

The various characteristics a practitioner must consider when valuing an NFT are summarized in the figure below, but it is not an exhaustive list. It is illustrative and represents the fact that various characteristics must be considered for each NFT. In identifying characteristics, the practitioner can determine which valuation methods are appropriate for the specific case.

Additional questions include, but are not limited to, the following:

- What percentage of the collection does a user hold?

- Is it an open edition or does it have a supply limit? Is that supply limit programmatic or edition-based?

- Where is the NFT available for sale?

- Has the creator made an important historical contribution in cryptocurrency?

- Is the creator a digital artist with physical gallery showings?

- Is the creator a digital artist with metaverse gallery showings?

- Does the NFT have rare attributes, if it is part of a collection with attributes?

- Have sales of this specific NFT occurred in the past? Were they arms-length transactions? What is the trend of past sales? What is the ratio of sales to non-sales transfers?

- Have sales of other NFTs in this collection occurred? Were they arms-length transactions? What is the trend of past sales for the collection?

- Have offers been made on other NFTs in the collection? How much do those offers differ from the collection’s floor price?

It is important to note that the same questions related to real property apply to NFTs representing metaverse property, including but not limited to:

- Has it been leased before? At what cost and for what term?

- Have the conditions of the property changed?

- Have users migrated to a different platform?

- Do users spawn nearby or farther away?

- What is the level of metafoot traffic?

Overall, the traditional skillset of the valuation analyst in identifying important characteristics that drive value, projecting the earnings from those characteristics, and discounting the cash flow relevant to those characteristics are easily applied in the NFT ecosystem.

Disclaimer: This article does not substitute for legal, tax, or financial advice and is intended for general informational purposes only. This article does not constitute an expert opinion and should not be construed as such.

[1] Gross Proceeds and Basis Reporting by Brokers and Determination of Amount Realized and Basis for Digital Asset Transactions, Internal Revenue Service, Aug. 28, 2023, https://www.regulations.gov/document/IRS-2023-0041-0001

[2] https://opensea.io/assets/ethereum/0x12f28e2106ce8fd8464885b80ea865e98b465149/100030098

[3] ERC-721 requires a new smart contract for each NFT and the ERC-1155 allows creators to use one smart contract to issue multiple NFTs and even fungible tokens. It does other things as well: https://101blockchains.com/erc-1155-vs-erc-721/?sscid=21k8_5wkjz

[4] A Kevin Hart film, Lift, portrayed values as a function of the events around the creator, much like the Mona Lisa’s value increased as a result of its theft, released Jan. 12, 2024, Netflix, https://www.imdb.com/title/tt14371878/

[5] Address Convergence is a standard cryptocurrency asset tracing method that identifies when transactions repeatedly occur between two or more addresses; Address Convergence is an indication that two or more addresses are held by or on behalf of the same individual.

[6] ChickenFT4 Collection, https://opensea.io/collection/chickenft4

[7] Metaverse Landlords are Creating a New Class System, Wired Magazine, Jan. 18, 2023, https://www.wired.com/story/landlords-rentals-decentraland-metaverse/; On a separate note, the term metaverse in no way relates to the company that owns Facebook and other platforms, and should not be capitalized (that company claimed to have renamed itself to focus on the metaverse). It refers to several platforms that offer a collective virtual shared space; among them, Decentraland, Sandbox, Cryptovoxesl, and Somnium are the largest.

[8] Mastercard to Celebrate LGBTQIA Pride Month in the Metaverse, June 14, 2022, https://www.mastercard.com/news/latin-america/en/newsroom/digital-press-kits/dpk-en/2022/mastercard-to-celebrate-lgbtqia-pride-month-in-the-metaverse/

[9] The native token on the bitcoin blockchain is a bitcoin and the smallest unit of it is a satoshi, named for Satoshi Nakamoto, the pseudonym author of the bitcoin white paper in 2008. The native token on the Ethereum blockchain is ether and the smallest unit of it is a wei, named for Wei Dai, the author of Crypto++, an extensive cryptographic library for use in the C++ language. The native token on the Cardano blockchain is the ADA token and the smallest unit of it is the Lovelace, named for Ada Lovelace, the author of the first computer algorithm.

[10] The 20 Most Expensive NFT Sales of All Time, https://nftnow.com/features/most-expensive-nft-sales/

[11] https://decrypt.co/80595/best-nft-marketplaces, https://rarible.com/, and NFT Marketplaces are Centralized and It’s a Real Problem, https://nftnow.com/features/nft-marketplaces-are-centralized-and-its-a-real-problem/

Dorothy Haraminac, MBA, MAFF, CFE, PI, provides financial forensics, digital forensics, and blockchain forensics under YBR Consulting Services, LLC, and teaches software engineering and digital forensics at Houston Christian University. Ms. Haraminac is one of the first court-qualified testifying experts on cryptocurrency tracing in the United States and provides pro bono assistance to victims of cryptocurrency investment scams to gather and summarize evidence needed to report to law enforcement, regulators, and other parties. If you or someone you know has been victimized in an investment scam, report it to local, state, and federal law enforcement as well as federal agencies such as the FTC, the FCC, and the IRS.

Ms. Haraminac can be contacted at (346) 400-6554 or by e-mail to admin@ybr.solutions.