Adequate Consideration Status Update

Awaiting Proposed ESOP Regulations

In April of this year, the author wrote “Adequate Consideration” Defined? for QuickRead. Since then, the author has regularly checked for updates from the Department of Labor (DOL) with respect to the definition of adequate consideration as it pertains to section 408(e) of the Employee Retirement Income Security Act of 1974 and employee stock ownership plans. Although there have not been any regulatory updates from the DOL (as it pertains to the definition of adequate consideration), there is some news on the topic to share.

In April of this year, I wrote “Adequate Consideration” Defined? for QuickRead and since, I have been regularly checking for updates from the Department of Labor (DOL) with respect to the definition of adequate consideration as it pertains to section 408(e) of the Employee Retirement Income Security Act of 1974, more commonly known as ERISA, and employee stock ownership plans (ESOPs). Although there have not been any regulatory updates from the DOL (as it pertains to the definition of adequate consideration) there is some news on the topic to share.

The ESOP Association (TEA)[1] Seeks Public’s Assistance

BVWire’s July 2024[2] issue included an article citing TEA’s urge to the ESOP community to contact their state senator regarding a bipartisan letter from Senators Roger Marshall (R-KS) and Tim Kaine (D-VA). The bipartisan letter makes three requests:

- Write a fair rule that promotes ESOPs and employee ownership

- Consult the Department of Treasury about the rule, as required by law

- Ensure a robust public comment period once the draft rule is released

Concern and Change of Course in ESOP Litigation Outcomes

TEA and many others in the ESOP community are concerned that the DOL’s ~50-year failure to promulgate a regulation properly defining adequate consideration in U.S. Code 408 – Individual retirement accounts (IRC) will continue indefinitely if consistent and direct proactive action is not heeded. Without the parameters of the terminology, many retirement accounts could be in jeopardy.

“The ESOP Association’s model rule is intended to ensure ESOP fiduciaries, plan sponsors, service providers, and parties transacting with ESOPs are able to satisfy ERISA’s obligations, thereby adequately protecting ESOP participants’ interests while encouraging retirement security through new ESOP formation.”[3]

“Adequate consideration” is expected to be clarified with guidance under Section 408(e), “acceptable standards and procedures to establish good faith fair market value for shares of a business to be acquired” by an ESOP.[4] It is argued that the DOL encourages ESOP “rules” that do not properly align with commonly accepted valuation methods, procedures and standards.

In Walsh v. Bowers,[5] No. 1:18-cv-00155-SOM-WRP (D.C. Hawaii, September 17, 2021), the DOL filed suit against Bowers +Kubota and its owners alleging that the defendants violated ERISA, specifically that the stock sold to the ESOP exceed fair market value. The district court decisively ruled in favor of the trustee and the board of directors of the ESOP company Bowers + Kubota (“Company”) in an ESOP valuation case. The judge ruled that the DOL’s valuation “rests on errors” because its expert failed to follow standard valuation practices, used inaccurate and incomplete information about the company’s finances, and improperly compared the price the ESOP paid to a non-binding indication of interest unadjusted for the cash and debt on the Company’s balance sheet lower offer from another company.[6] The court in Walsh v. Bowers said that in “December 2014, Michael Wen of the Department of Labor was told by his supervisor to ‘find some ESOP cases in Hawaii’”, implying that the DOL was/is “ESOP hunting”.[7]

The American Society of Appraisers (ASA) filed a brief (“Brief”) as an amicus curiae in support of petitioners in response to the Supreme Court of the United States case Bowers + Kubota Consulting, Inc., et al., v. Julie A. Su, Acting Secretary of Labor wherein the:

“ASA has a strong interest in ensuring that generally accepted valuation standards and principles are followed, including in modern litigation where judgment in any given case frequently turns on expert testimony like that of valuation professionals. Accordingly, ASA has a strong interest in correct and uniform application of the Equal Access to Justice Act (EAJA), 28 U.S.C. Section 2412, by the federal judiciary to deter the improper use of expert valuation evidence, such as the misapplication of generally accepted valuation standards and principles, by litigants including the government. This case is therefore of paramount importance to ASA.”[8]

The EAJA was enacted in 1985 as a statutory protection to ensure that governmental suits against non-governmental entities “shall award to the prevailing party other than the United States fees and other expenses … incurred by that party in any civil action 28 U.S.C. Section 2412(d)(1)(A). EAJA is a remedial statute that provides ways to enforce rights or correct injuries;[9] in this situation, to put government and private parties on ‘equal footing’”.[10]

The ASA argues in the brief that the Ninth Circuit erred in the allowance of the DOL to bring about a lawsuit against private litigants predicated on “nothing but expert evidence that fails to meet the generally accepted standards and principles applicable to an expert witness’s area of expertise”. Furthermore, this allowance without repercussions begs the issue that additional legal matters of similar governmental inadequacies will prevail.[11]

All federal courts use the Daubert standard. There have been instances wherein ESOP defendants argued against DOL valuation overvaluation claims via a Daubert motion noting governmental valuation findings as “riddled with errors and inconsistencies”, mathematical and factual errors.[12] In Acosta v. Vinoskey, the ESOP trustee challenged the DOL’s expert qualifications under Federal Rule of Evidence 702 and claimed the expert’s calculations were unreliable under Daubert.

Daubert v. Merrell Dow Pharmaceuticals case law requires judges to scrutinize not only the expert’s methodology but also the underlying scientific principles; a shift objective to mitigate unreliable expert testimony.[13] “Scientific methodology” includes a set of illustrative factors to ensure that hypotheses were formulated justly.[14] Considering the seemingly apparent lack of application of generally accepted standards and principles, it is questionable as to why a Daubert motion was not addressed in Walsh v. Bowers.[15]

Conclusion

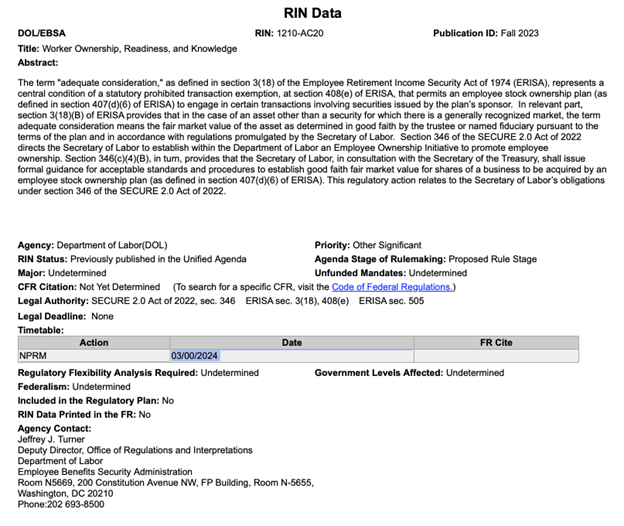

The DOL website has yet to update the timing for the finalization of the proposed ESOP regulations (see the DOL screenshot below obtained from their website wherein the highlighted “due date” text stands as “03/00/2024”). Many valuation associations and professionals, governmental bodies, professional service providers, private business owners and employees, among others, anxiously await the draft regulations for not only the reasons cited herein, but other rationale not detailed (i.e., confidence in sufficient retirement income). We will continue to monitor and report information on this hotly followed topic as it comes in. In the meantime, please reach out with other pertinent topical content on this matter so that we can ensure inclusion in future QuickRead postings.

[1] The ESOP Association (TEA) https://www.esopassociation.org

[2] https://www.bvresources.com/articles/bvwire/action-needed-email-your-senator-re-dols-esop-valuation-rule

[3] https://www.esopassociation.org/articles/esop-association-provides-model-regulation-language-us-department-labor-rulemaking (emphasis added)

[4] https://www.bvresources.com/articles/bvwire/still-waiting-for-the-dol-esop-regs

[5] Martin J. Walsh, Secretary of Labor, United States Department of Labor, Plaintiff, v. Brian Bowers, an individual; Dexter C. Kubota, an individual; Bowers + Kubota Consulting, Inc., a corporation; Bowers + Kubota Consulting, Inc. Employee Stock Ownership Plan, Defendants. https://casetext.com/case/walsh-v-bowers

[6] Additionally, the Company never agreed to the proposed purchase price.

[7] https://www.bvresources.com/blogs/business-valuation-law-news/2021/11/18/recent-esop-ruling-changes-the-game

[8] Special thanks to C. Zachary Meyers for sharing this brief https://www.appraisers.org/docs/default-source/advocacy/asa—bowers-amicus-brief-filed.pdf?sfvrsn=69857865_1 (emphasis added)

[9] https://www.lsd.law/define/remedial-law#:~:text=Remedial%20law%20refers%20to%20laws,right%20when%20something%20goes%20wrong.

[10] https://www.appraisers.org/docs/default-source/advocacy/asa—bowers-amicus-brief-filed.pdf?sfvrsn=69857865_1

[11] Ibid.

[12] https://www.bvresources.com/articles/bvwire/starkly-different-valuation-narratives-in-vinoskey-esop-trial

[13] https://www.law.cornell.edu/wex/daubert_standard#:~:text=The%20Daubert%20case%20introduced%20a,pseudoscientific%20or%20unreliable%20expert%20testimony.

[14] https://en.wikipedia.org/wiki/Daubert_standard

[15] Author was not able to find information to the contrary.

Trisch Garthoeffner, ABV, CVA, MAFF, EA, MAcc, has 20+ years of experience in providing business valuation and financial consulting services. She is an Accredited Business Valuator (ABV) through the AICPA, a Certified Valuation Analyst (CVA) and Master Analyst in Financial Forensics (MAFF) through the NACVA, an IRS representative (Enrolled Agent or EA), and a court certified expert witness. Additionally, she has her master’s in accounting with a concentration in business valuations (MAcc). In 2020, she was nominated as a NACVA Standards Board (SDB) member; in 2021, nominated vice-chair; in 2022, served as chair; and is a current Executive Advisory Board appointed advisor to the SDB. She is a past Florida State Chapter President for NACVA, a current member of the NACVA exam task force (providing teaching for the preparation of the CVA exam for valuation expert candidates nationwide), a board member and quarterly author for the QuickRead periodical, a past treasurer of the Florida Academy of Collaborative Professionals, and a past vice-president of the Southwest Florida Chapter of Collaborative Professionals and current member. In her spare time, she enjoys spending time with her daughter, antiquing, and fostering animals for the local Humane Society.

Ms. Garthoeffner can be contacted at (239) 919-3092 or by e-mail to trisch@anchorbvfs.com.