Value Focus: Insurance Industry —Mercer Capital

Investors Looked Favorably Upon Insurance Underwriters in 2012: The Industry Index Did Better than the S&P. Will Momentum Continue?

Mercer Capital provides the insurance industry with corporate valuation, financial reporting, transaction advisory, and related services. Download Mercer’s Fourth Quarter 2012 summary here. More:

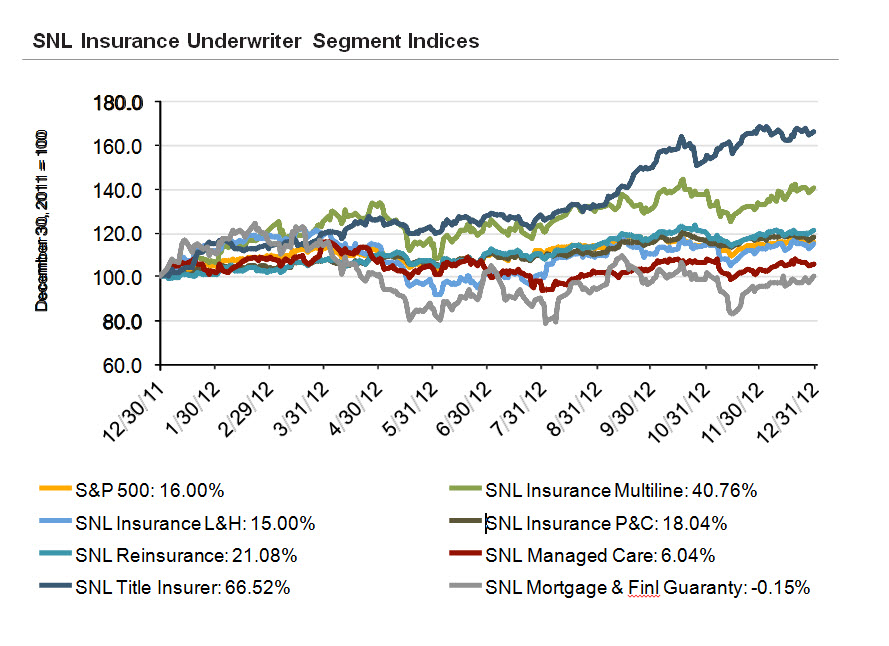

Investors looked favorably upon insurance underwriters in 2012, driving the SNL U.S. Insurance Underwriter Index to an annual return of 17.7%, which slightly edged the S&P 500 (up 16.0% for the year). The leading sectors for 2012 were Title Insurers (+67%) and Multiline Underwriters (+41%). Stocks of insurance brokers were also up for the year (+11.5%) but lagged the broader market. However, these stocks had a bit of head start, having outperformed the S&P in 2011 (+10.2% vs. +2.1% for the index).

Transaction activity in the fourth quarter slowed for underwriters but accelerated for brokers. The preliminary deal count for underwriters was the lowest quarterly total since the first quarter of 2009, although the Q4 tally may be revised upward as companies provide additional year-end disclosure. At the other end of the spectrum, the fourth quarter’s 87 broker transactions was one the strongest in the last four years. In additional to firming rates (which improved agency fundamentals), another driver of the increased transaction activity among agencies and brokerages was the threat of higher taxes for sellers in 2013. The year was also marked by several high profile private-equity backed deals in the broker space, including Goldman Sachs’ $2.3 billion sale of USI Holdings to Onex Corp and Blackstone’s sale of Alliant Insurance Services to KKR.

What does 2013 hold? For property & casualty underwriters, premium growth is expected to be modest, driven by rate increases across nearly all major lines of business and the potential for exposure unit growth as the economy continues to recover. According to Fitch Ratings, industry surplus and capital adequacy remain high relative to historical levels, although the trend of favorable reserve releases may taper off soon. The hardening market and improving economy bodes well for agencies and brokerages, as evidenced already in the organic growth rates (and share prices) of the public brokers. For life insurers, the persistent low-yield investment environment is expected to slow earnings growth in the near term, and pose particular challenges for those with large exposure to annuity and long-term care products. On the whole, the sentiment of industry analysts appears to be one of cautious optimism, with stable outlooks anticipated for most sectors.

Insurance Underwriters Did Well in 2012. Mercer Capital Recaps Results, and Looks Ahead at 2013.

Click here to download the whole summary.