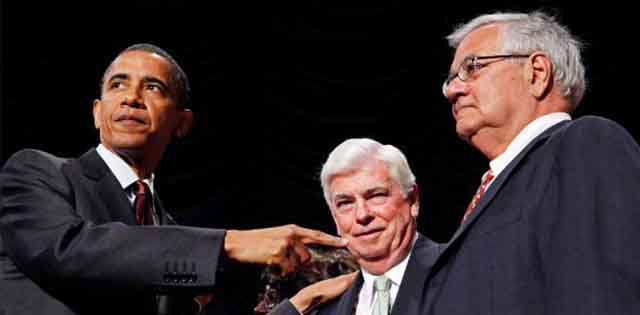

Dodd-Frank Survives Court Challenge by States

The states, in an amended complaint, challenged only the portion of Dodd-Frank that empowers the Treasury secretary to order a liquidation of a financial company whose collapse may threaten the stability of the banking system.

Dodd-Frank Survives Court Challenge by States

U.S. District Judge, Ellen Segal Huvelle recently dismissed a lawsuit brought by 11 states and a Texas-based bank, challenging Dodd-Frank’s financial regulations, specifically those that create the Consumer Financial Protection Bureau. According to Bloomberg, the plaintiffs claimed that establishing such an agency violated the U.S. Constitution because Congress does not appropriate its budget, the president has limited powers to remove its director and the courts are restricted from reviewing many of its records. Huvelle threw the case out, citing that it lacked legal standing.Â

“State National Bank of Big Spring is a community bank that has served its community for generations, and it is disturbing that the opinion — and the government — ignored the very real harm Dodd-Frank has inflicted on it and the customers who rely on the bank to provide loans for everything from their home to their small business”Â