Hospital Valuations–Market Approach

Beware of the Limitations of Hospital Transaction Databases

The market approach is one of three established valuation approaches. In this approach the valuation analyst will look for comparable companies. In this article the authors caution against the outright use of databases as a means of developing a Conclusion of Value for a hospital. Independent verification is time-consuming and essential. The authors discuss five common mistakes seen using the market approach.

Hospital market valuation multiples can vary significantly from published source material. While published databases are helpful to identify market level activity, astute valuation professionals must not blindly rely on database conclusions of revenue and earnings before interest, taxes, depreciation, and amortization (“EBITDA”) multiples without proper independent verification. Common mistakes identified by VMG in hospital comparable transaction databases include the following:

Hospital market valuation multiples can vary significantly from published source material. While published databases are helpful to identify market level activity, astute valuation professionals must not blindly rely on database conclusions of revenue and earnings before interest, taxes, depreciation, and amortization (“EBITDA”) multiples without proper independent verification. Common mistakes identified by VMG in hospital comparable transaction databases include the following:

- Inclusion of cancelled transactions

- Inconsistently or inappropriately identifying transaction structure (e.g. affiliations, acquisitions or mergers)

- Incomplete information on specific transactions, which is easily obtained via the American Hospital Directory, publically available financial filings via the U.S. Securities and Exchange Commission (“SEC”) website or Electronic Municipal Market Access (“EMMA”) website, Attorney General review opinions or other state/federal agency websites

- Misunderstanding or misstatements of deal terms (e.g. working capital, assumed debt, percent ownership interests, earn-out provisions) when calculating deal multiples

- Incorrect historical revenue and EBITDA representation

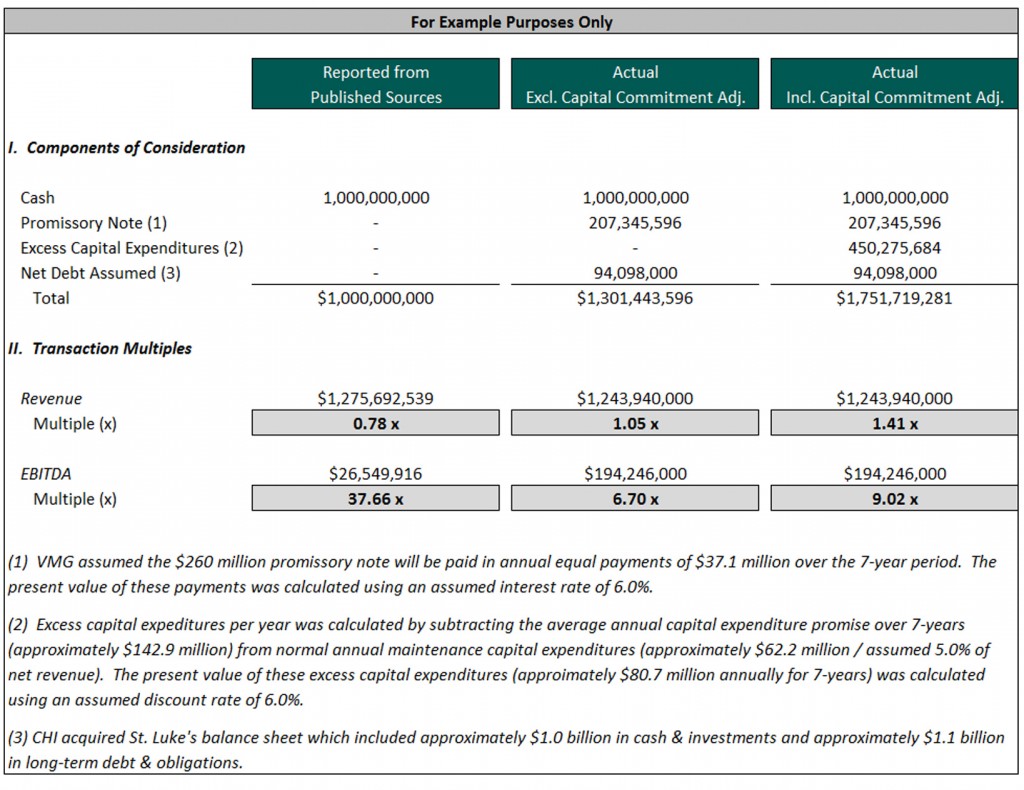

For illustrative purposes, we have reviewed the published data for the Catholic Health Initiatives (“CHI”) acquisition of St. Luke’s Episcopal Health System (“St. Luke’s”) effective June 2013. As part of the consideration, CHI agreed to contribute $1.0 billion in cash and issue a $260 million promissory note payable over seven years to the Episcopal Health Foundation. In addition, CHI made a commitment to spend $1.0 billion in future investments for the benefit of St. Luke’s properties over a seven-year period. Finally, based on our review of the CHI 2013 annual report, it appears that CHI acquired the cash and assumed the debt of St. Luke’s for a net debt position at closing of approximately $94 million.

As reported in published databases, CHI acquired St. Luke’s based on revenue and EBITDA multiples of 0.78x and 37.66x, respectively. The databases failed to capture CHI’s promissory note of $260 million and assumed net debt of $94 million in their calculated purchase price of $1.0 billion. Additionally, the databases used an EBITDA of $26.5 million which significantly differs from St. Luke’s actual EBITDA of $194.5 million as reported in audited 2012 financials. When adjusting for the aforementioned items, revenue and EBITDA multiples are calculated at 1.05x and 6.7x, respectively.

Additionally, including capital promises in excess of normal maintenance expenditures as purchase price consideration provides analysts an alternative way to view hospital transaction multiples. Based on our experience, capital commitments by acquires are an important deal term and can be viewed as “consideration” by the seller. Therefore, if CHI’s excess capital commitments are factored into total purchase price consideration (as detailed in the footnote 2), revenue and EBITDA multiples are calculated at 1.41x and 9.02x respectively.

Valuation professionals use similar transactions in the marketplace to support the worth of comparable entities. Due to the wealth of information available regarding acute-care hospital transactions, the use of valuation multiples from published sources regarding specific transactions and/or groups of transactions is widespread. Based on our experience, important transaction details from these published sources may be incomplete, misleading, or otherwise incorrect.

When applying market level multiples of revenue or EBITDA for a specific valuation, it is essential to have an understanding of the transactions in the comparable set so the market approach will yield a more accurate and useful result.

Colin McDermott, CFA, CPA/ABV is a Senior Manager with VMG Health and is based in the Dallas office. He specializes in providing financial, valuation, and transaction advisory services to clients in the healthcare industry. His clients have included hospitals, hospital systems, ambulatory surgery centers, imaging centers, laboratories, physician groups, and other healthcare entities. Mr. McDermott leads VMG Health’s accounting related valuation services team. Mr. McDermott can be reached at (972) 616-7808 or by e-mail at ColinM@vvmghealth.com.

Corey Palasota, CFA is a Manager with VMG Health’s Dallas office. He can be reached at (214) 369-4888 or by email at CoreyP@vmghealth.com.