Unlocking Client Value Leads to Firm Growth

The Opportunity for Value Growth Services

How can one differentiate oneself? Scale production or services? Whether you’re an M&A advisor, a business valuator, a CPA, a transition planner, or a turnaround consultant, you would probably be very successful if you could consistently execute this simple growth strategy. For most people, the challenges of differentiating and scaling often seem to prevent success. However, once you know the secret to differentiating, landing the highly profitable new client becomes exponentially easier. In this article, Kenneth Sanginario shares his views on how to unlock client value and unleash firm growth.

Whether you’re an M&A advisor, a business valuator, a CPA, a transition planner, or a turnaround consultant, you would probably be very successful if you could consistently execute this simple growth strategy. For most people, the challenges of differentiating and scaling often seem to prevent success. However, once you know the secret to differentiating, landing the highly profitable new client becomes exponentially easier. Then, with the help of various toolsets available in the marketplace, delivering amazing client value, in a scalable manner, is far easier than you might imagine.

Growth Strategy:

- Land Highly Profitable New Client;

- Deliver Amazing Client Value;

- Repeat … Differentiate … Scale.

We all know how competitive the marketplace is for any kind of professional services and, no matter how you try to explain to a business owner why your expertise is different, it often seems to come down to price. So, how do you differentiate?

For the first eight or nine years of my consulting career, I found it incredibly difficult to differentiate, despite constantly expanding my formal training and expertise to new areas including turnaround management, M&A advisory, and business valuations, to go along with an already strong corporate finance background. Despite the expertise I had to offer, competitive proposals still most often came down to who offered the lowest price, and I did not want to play in that commodity market. So I decided to try a different approach, and the results have been dramatic, both for my practice and for my clients. It is so simple, so logical, and so easy to execute, that I wonder why it took me so long to get it.

First, let’s look at the market need. There is no dispute that a high percentage of middle market companies will need to transfer ownership sometime during the next 10-15 years, or that the vast majority of companies seeking to do so will likely fail because they are simply not market-ready. The resulting impact will be felt not only by the company owners and employees, but also by the various professionals who rely on a robust middle market M&A environment for their professional success. The large market need, therefore, is to educate and mentor middle market business owners on improving the quality and value of their companies during the years (not months) leading up to any contemplated transition of ownership.

The secret to differentiating, and tapping into the huge opportunity to help companies become market-ready, is all in the interview approach. Take a close look at the picture below, as it depicts what life is like for most private business owners. The owner has the weight of the world on his mind, and desperately needs a most trusted advisor in whom he can confide, but the most trusted advisor chair remains empty. His CPA typically doesn’t take it, nor does his attorney, financial planner, banker, or anybody else. If only he could find somebody who could understand his whole business, and all the issues he faces…somebody who could be his go-to advisor and confidant.

The most trusted advisor chair is available. All you need to do is sit in it and assume the role. How do you do that? For starters, when you interview for a prospective engagement, stop talking and start listening. Stop selling yourself, and your skills, and start asking broad general questions about the owner and his company. Ask about his operations, his customer base and supply chain, his management team, his go-to-market strategy, his financial performance, his challenges and aspirations for growth, etc. You need not be an expert in his industry, nor offer any epiphanies during that conversation. All you need to do is demonstrate that you are interested in his whole company and not merely in the specific issue that caused him to seek help. You will quickly find the conversation takes on an entirely different tenor than your typical engagement interviews, and the owner will open up to you on a whole different level.

When it comes time to make a proposal, assuming the owner aspires to building the strongest, most sustainable, profitable, and valuable company possible, suggest a different type of engagement than he was contemplating. Suggest that you start with an enterprise-wide assessment, so you both can understand all the company’s strengths and weaknesses in their proper contexts; what initiatives should be undertaken, and in what priorities, in order to maximize his company’s future value. Explain that you utilize a proprietary process to assess his company, and that your process could help increase his company’s value by 50%–100% over a three–five year period. The process, which we’ve labeled as value growth services, can create compelling new revenue streams for your firm, while at the same time, delivering huge value to your clients.

In order to scale your new practice segment, consider utilizing the latest market tools that allow you to develop a proven, repeatable, and scalable process very easily. There are several software platforms on the market which can serve that purpose, ranging from sophisticated and robust to ultra-light. Depending on the size and aspirations of your clients, one of the platforms is sure to provide a valuable tool set for you to utilize.

Now that you have differentiated yourself from any competitors, and have a scalable process, price your services accordingly. Owners are willing to pay premium prices for premium services that add value. The assessment, itself, and the follow-on implementation work, can both be premium priced. The follow-on work is where you can truly deliver amazing client value and generate new revenue streams for your firm over the course of the client relationship.

The fact that you are now solidly in the most trusted advisor seat will open many opportunities for additional work. One key to successfully capitalizing on such opportunities is to build a network of functional experts who can work under your direction to help with areas of the business that are not within your field of expertise. Bringing other resources to the mix will only further solidify you as the go-to advisor for all the client’s needs.

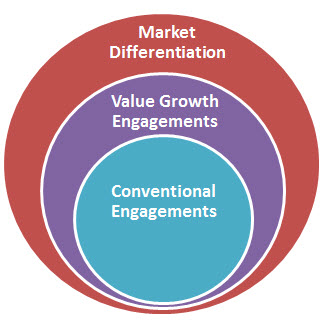

Before you know it, your practice will be transformed to a higher added value, premium priced, practice that is in demand. Think of your own firm’s growth in the following manner. Value growth services could, quite possibly, double your firm’s revenue, and the market differentiation such services provide could double it again, by attracting more clients for all of your services.

For M&A advisors and transition planners, providing value growth services to your clients who are not market-ready will increase your chances of successfully executing transactions, and at higher values, while generating steady revenue streams during the process of preparing your clients for transition.

For CPAs, you are in the best position to create new revenue streams from your existing client base of any other professional. You already have trusted client relationships, and you merely need to elevate your service to become the most trusted advisor.

For business valuators, value growth services will allow you to reposition your valuation skills to be more strategic and prospective, rather than only offering a compliance and retrospective approach.

For turnaround professionals, your skills are not only applicable to companies in distress, but also to relatively healthy companies who are trying to grow and maximize future value. Value growth services open a whole new market to you.

The market need is compelling and the opportunity is real.  Value growth services are becoming the hot new niche in the consulting industry. Your opportunity to be on the leading edge is now.

To learn more about value growth services, and the potential to transform your practice while delivering amazing client value, please visit us at: www.corporatevalue.net.

Kenneth J. Sanginario, CPA/ABV, CVA, CMAP, CM&AA, CTP, MST, MSF is the founder of Corporate Value Metrics (www.corporatevalue.net), and developer of the Value Opportunity ProfileR (“VOP” R), a cloud-based platform designed to help advisors to maximize the value of their private company clients. Mr. Sanginario has more than thirty years of experience developing value creating strategies for middle market companies, as a credentialed expert in business valuations, mergers and acquisitions, and turnaround management. He is an instructor in the Certified M&A Advisor program of the Alliance of M&A Advisors, and currently serves on the advisory board of the MidMarket Alliance as its educational leader. Mr. Sanginario can be contacted at: ksanginario@corporatevalue.net or (508) 870-5805.