Equity Size Premium

Observations and Delaware Fair Value (Part II of II)

This is the second of a two-part article, read Part I here, that focuses on empirical evidence supporting the size premium adjustment, observations regarding the CRSP size premium 10th decile category, liquidity issues that may account for the size premium, and certain Delaware Chancery Court decisions involving a size premium discussion. In this second part, the author focuses on the latter two points. These are discussed since in the past few years there have been numerous fair value business valuation related disputes decided by the Delaware Court of Chancery that involved certain cost of equity capital postulates. Valuation analysts should be aware of potential issues related to incorporating a size premium in the cost of capital estimation in a Delaware fair value matter.

Liquidity Issues That May Account for the Size Premium

According to Aswath Damodaran, “the notion that market for publicly traded stocks is wide and deep has led to the argument that the net effect of illiquidity on aggregate equity risk premiums should be small.”[1]

It is generally accepted that less liquid securities are inherently of a greater risk profile than highly liquid securities and, therefore, investors require greater rates of return to invest in less liquid investments. In fact, a growing body of work investigating the impact of liquidity on returns has emerged.[2]

The cost of illiquidity on security pricing is influenced by macroeconomic direction. Stock illiquidity increases when economies slow down and during periods of crisis, thus exaggerating the effects of both phenomena on the equity risk premium.[3]

Security liquidity has value as discussed in the following example. Consider two assets with the same cash flows and average liquidity, but one asset has much more liquidity risk…if the assets had the same price, investors would avoid the one with the high liquidity risk, because they would fear bearing greater losses if they needed to sell it in a liquidity crisis.[4]

For many analysts, the calculation of the cost of equity includes a size premium alpha factor developed from the CRSP database. There are numerous theories addressing why small market capitalization stocks provide greater investment returns. However, there is an increasing amount of interest as to how the CRSP size premium decile conclusions may be skewed by an embedded liquidity discount.

Several studies have shown that an embedded stock liquidity discount helps to explain part of the reason that smaller capitalization companies generate higher returns—that is, the investor is compensated for investing in a low liquidity and therefore risker asset.

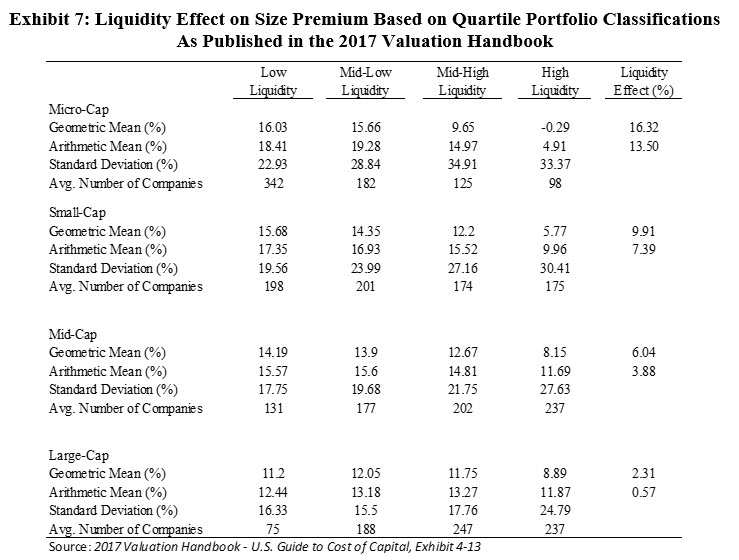

Exhibit 7 presents liquidity statistics and the impact of liquidity organized by equity market capitalization quartile classification. The analysis corresponds to publicly traded securities in the 1972 to 2016, time frame.

An interesting aspect of the embedded liquidity issue is that market capitalization and illiquidity are not always correlated since there are small, liquid companies and large, illiquid ones in the market.[5]

However, based on the data presented in Exhibit 7, it appears that the smallest capitalization securities are affected by liquidity concerns far more than larger capitalization securities. It is also noteworthy that the subcategory of micro-cap stocks populated with the most companies, on average, was classified as low liquidity securities—a total of 342 companies.

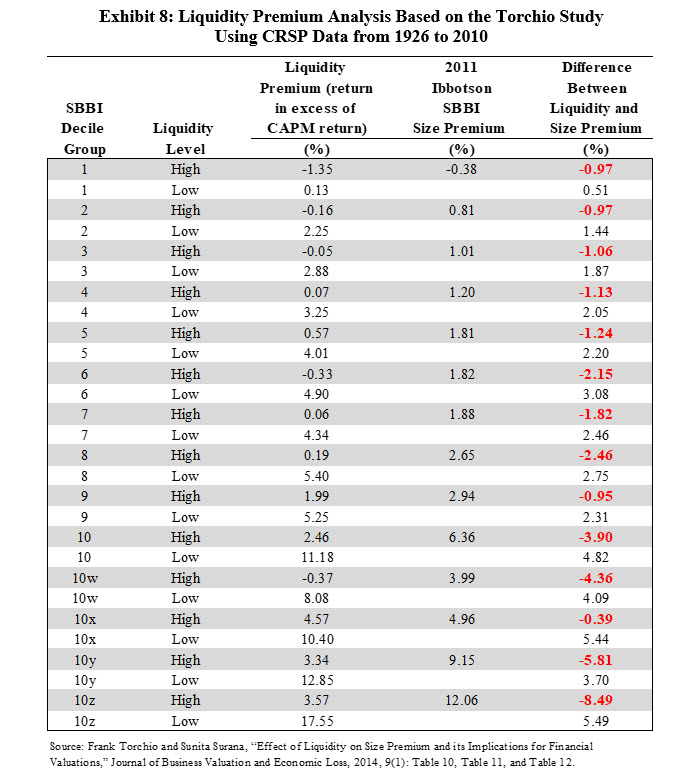

In a research article published in the Journal of Business Valuation and Economic Loss, Frank Torchio and Sunita Surana studied the effect of liquidity on size premium calculations (Torchio study).[6]

According to the Torchio study, a substantial portion of the size premium measurement reflects lack of liquidity. The Torchio study found that the lack of liquidity issue, an embedded liquidity issue, is problematic in certain fair value cases.

It is problematic because the application of the size premium—more specifically the application of the premium in small company valuations—may cause the fair value to be understated and may include an unintended valuation discount.

In order to study the effect of embedded liquidity related to the size premium, the Torchio study progressed through several procedures.[7] The three primary procedures are described as follows:

For the first procedure, the Torchio study replicated the Ibbotson SBBI 10 decile analysis using the CRSP database. The study applied the same or similar procedures used by Ibbotson, and now Duff & Phelps, to replicate the published SBBI 10 decile study results. It also replicated the 10th decile subcategories.

For the second procedure, the Torchio study subdivided the SBBI 10 deciles and 10th decile subcategories into high liquidity and low liquidity categories.

For the final procedure, the liquidity premium is calculated much the same way that the SBBI 10 decile size premiums are calculated. The liquidity premium is calculated as the excess return to the predicted CAPM return.

Exhibit 8 presents the Torchio study liquidity premium analysis results.[8]

The Torchio study provides empirical evidence of the impact that liquidity has on security rates of return. Based on Exhibit 8, the following conclusions appear to be true:

- The high liquidity level securities (stocks that exhibit trading liquidity above the decile group median) rates of return are significantly lower than the low liquidity level securities at each decile grouping.

- Compared to the size premium statistics presented in the 2011 Ibbotson SBBI Valuation Yearbook, the high liquidity group for each decile and subdecile category had much lower rates of return.

- For SBBI deciles 1 through 9, the difference between the high liquidity equity premium estimate and the SBBI size premium is not as significant as it is for decile 10 and subcategories.

- The liquidity premium effect is most pronounced at the 10z subcategory decile.

- The size premium is clearly influenced by the low liquidity securities.

According to the Torchio study, the large-size premiums calculated by Ibbotson are the consequence of a disproportionately greater number of low liquidity stocks comprising the small-size portfolios.[9]

For fair value in certain jurisdictions due to the presence of an embedded liquidity discount, the application of an equity size premium alpha factor based on the 10th decile or 10th decile subcategories may not be appropriate.

Certain Delaware Chancery Court Decisions Involving Size Premium Discussion

This section discusses certain appraisal rights actions filed in the Delaware Court of Chancery (the Chancery Court). The Delaware appraisal rights statute mandates fair value of a corporation as a going concern as the appropriate standard of value. The statute also allows the same fair value standard in shareholder oppression and shareholder appraisal rights actions to determine noncontrolling shareholder share value.

The Delaware Supreme Court clarified the meaning of fair value in 1950, defining it as the value that had been taken from the dissenting shareholder:

The basic concept of value under the appraisal statute is that the stockholder is entitled to be paid for that which had been taken from him, viz., his proportionate interest in a going concern. By value of the stockholder’s proportionate interest in the corporate enterprise is meant the true intrinsic value of his stock which has been taken by the merger.[10]

Several somewhat recent Chancery Court decisions involved an equity size premium related discussion, including the following:

- Gearreald v. Just Care, Inc. (Just Care)

- Merlin Partners LP, and AAMAF, LP v. AutoInfo, Inc. (Merlin Partners)

- In re Appraisal of DFC Global Corp. (DFC Global)[11]

- Merion Capital L.P. and Merion Capital II L.P. v. Lender Processing Services, Inc. (Merion Capital)

- Dunmire v. Farmers and Merchants Bancorp of Western Pennsylvania, Inc. (Dunmire)

Just Care

In the Just Care decision, the treatment and application of the equity size premium was a significant point of contention. In Just Care, both experts agreed that, by size alone, the Just Care company should be classified in the Ibbotson decile category of 10b.

As of the valuation date, the Ibbotson 10b decile included companies with a market capitalization between $1.6 million and $136 million, and an indicated equity size premium of 9.53 percent. The specific point at issue is that the company expert applied the 9.53 premium while the petitioner’s expert applied a smaller equity size premium of 4.11 percent.

The small equity size premium of 4.11 percent was based on the Ibbotson 10a decile. At trial it was argued that the 4.11 percent size premium was appropriate because of the “well-documented liquidity effect” contained within the size premium data.[12]

According to the petitioners’ analyst, because “the illiquidity premium reflected in the size premium data for small cap stocks is akin to a liquidity discount” such a discount “must be eliminated in a fair value determination—much like a discount for lack of marketability or minority interest.”[13]

In Just Care, the Chancery Court found that the petitioner’s expert was correct in that a general liquidity discount cannot be applied in an appraisal rights proceeding. Such a discount generally relates to the marketability of the company’s shares and is, therefore, prohibited.

In other words, on one hand, the Chancery Court found that entity or corporate level discounts were not appropriate and cited the Borruso v. Communications Telesystems International matter as support for its ruling.[14]

To the extent Respondent is arguing for the application of a “corporate level” discount to reflect the fact that all shares of WXL shares were worth less because there was no public market in which to sell them, I read Cavalier Oil as prohibiting such a discount. This is simply a liquidity discount applied at the “corporate level.” Even if taken “at the corporate level” (in circumstances in which the effect on the fair value of the shares is the same as a “shareholder level” discount) such a discount is, nevertheless, based on trading characteristics of the shares themselves, not any factor intrinsic to the corporation or its assets. It is therefore prohibited.

On the other hand, the Chancery Court found that although a liquidity discount related to the marketability of a company’s shares is prohibited, that does not mean that the use of any input that is correlated with a company’s illiquidity is, per se, invalid.[15]

A company’s liquidity is highly correlated with its size, that is, smaller companies tend to be less liquid.[16] As a result, their equity is riskier and investors will demand higher returns from such investments, increasing the cost of capital. It is this kind of liquidity effect that is captured in the Ibbotson size premium.

In support of its decision, the Chancery Court cited the JRC Acquisition Corp. matter, as follows:[17]

The Ibbotson size premium number reflects the empirical evidence that smaller firms have higher returns than larger firms. Petitioner’s position that JR Cigar is a low-cap company (rather than a micro-cap company) decreases the expected rate of return on JR Cigar’s stock by lowering the “size premium” applied. The problem with using liquidity as a basis for justifying a lower expected return, however, is that low liquidity is associated with higher expected returns. Investors seek compensation for the high transaction costs of illiquid securities, e.g., the bid/ask spread. In other words, even if JR Cigar had a higher market capitalization than the market price of its stock suggested because of its illiquidity, investors would still expect higher returns because of its illiquidity.

According to the Chancery Court, the liquidity effect, in this case, arises in relation to transactions between Just Care and its providers of capital.[18]

As such, the Chancery Court reasoned that, the liquidity effect is part of the company’s value as a going concern. Where a company’s illiquidity affects its ability to obtain financing for its operations, the company’s overall risk and return profile will be affected, that is, the company will be worth less as a going concern because its financing costs are higher.[19]

In Just Care, the Chancery Court ruled against the petitioner theory that the embedded liquidity premium in the Ibbotson’s size-related data should be adjusted in order to develop a cost of capital estimate.

The Chancery Court found that the liquidity effect at issue relates to the company’s ability to obtain capital at a certain cost and not a shareholder level liquidity discount issue. This finding suggests that the liquidity effect is related to a company’s intrinsic value as a going concern, and it should be included when calculating its cost of capital.

The Chancery Court, in rejecting the petitioner argument, stated that the adjustment by the petitioners’ analyst, as a matter of law, is unreliable. The Chancery Court concluded that small company-size premiums are regularly applied in appraisal proceedings in the Chancery Court without the type of adjustment performed by petitioners’ analyst.

In other words, the Chancery Court found that the petitioner analyst’s adjustment was unprecedented and, furthermore, had not been peer reviewed.

Although, the Chancery Court ruled against the petitioner argument in Just Care, it did not completely dismiss the idea of a challenge. The Chancery Court concluded that it may adjust a company’s size premium where sufficient evidence is presented to show that the company’s individual characteristics make it less risky than would otherwise be implied under its corresponding decile classification based on size alone.

In the instant case, however, the petitioners’ analyst did not argue that Just Care was less risky than other companies in decile 10b. The petitioners devoted only one sentence in the opening brief to attempt to justify the treatment of Just Care as a decile 10a company.[20]

Because petitioners did not provide compelling evidence for treating Just Care as a decile 10a company, the Chancery Court concluded that the decile 10b was appropriate based on the company size.

Merlin Partners

The Merlin Partners dispute is related to a cash-out merger of AutoInfo, Inc. (AutoInfo), shareholders. The petitioners in this matter demanded the appraisal of their shares in connection with the merger. Similar to the Just Care decision, the analyst for the petitioner and the analyst for the defendant did not agree on the appropriate equity size premium.

The petitioner analyst selected the size premium for Ibbotson’s micro-cap category. The micro-cap category includes the 9th and 10th deciles. For the year of the instant case, companies in the 9th and 10th decile had market capitalizations ranging from $1.139 million to $514.209 million.[21]

The defendant analyst selected the 10z subdecile. The Ibbotson’s 10z subdecile, at the time of the AutoInfo valuation analysis, consisted of companies with market capitalizations between $1.139 million and $96.164 million.[22]

At the time of the merger, AutoInfo had an approximate publicly traded market capitalization of $30 million.[23] Therefore, the AutoInfo market capitalization was fully within subdecile 10z. In Merlin Partners, because the AutoInfo market capitalization was within subdecile 10z, the Chancery Court concluded that AutoInfo should be classified in the 10z size premium and not the micro-cap size premium.

The petitioner valuation analyst testified that he “would have used [a size premium] close to the 10z category, if not 10z itself,” had he not believed it necessary to strip out a marketability factor.[24]

The Chancery Court reasoned that, just like in Just Care, the petitioner’s valuation adjustment ran counter to Delaware case law.

In the Merlin Partners decision, the Chancery Court rejected the adjustment of using a lower equity size-related premium (lower meaning smaller premium, due to the use of a higher capitalization decile classification) by reference to Just Care in the following passage: “because the liquidity effect at issue relate[d] to the Company’s ability to obtain capital at a certain cost,…[and was therefore] related to the Company’s intrinsic value as a going concern and should be included when calculating its cost of capital.”[25]

The Chancery Court ruled that the publicly traded market capitalization of AutoInfo should be used to select the implied size-related equity risk premium.

DFC Global

The details related to the equity size premium issue in the DFC Global matter are different than the Just Care and Merlin Partners matters. However, the valuation analyst selection of the equity size premium was an issue in DFC Global.

Both analysts applied size premiums in calculating the DFC Global Corporation (DGC) weighted average cost of capital.[26]

The analysts, however, disagreed on the magnitude of the equity size premium. The Chancery Court, in DFC Global, sided with the petitioner analyst’s use of the publicly traded market capitalization of DGC in selecting an equity size premium.

Because DGC was publicly traded, the Court relied on the DGC equity market capitalization as of the date of the analysis. It then discounted the calculated equity market capitalization to account for the potential decrease in market capitalization due to discouraging financial results announced on the day of the DGC transaction.

In DFC Global, the Chancery Court considered that the defendant analyst arrived at a conclusion using a combination of the (1) the micro-cap premium and (2) the Duff & Phelps Risk Premium Report.

Because DGC was a financial-services-related business, the Chancery Court excluded the application of the Duff & Phelps Risk Premium Report for the subject business.[27]

The opposing analyst applied the 9th decile size premium. As of the valuation date, DGC had an approximate market capitalization of $346 million, which was in the 9th decile of $340 million to $633 million.[28]

Because the DGC market capitalization was near the lower end of the 9th decile and it had just announced poor financial performance that may not have been priced into the $346 million equity market capitalization, the Court selected the decile 10w size premium.[29]

One reason for selecting the 10w decile and not the micro-cap decile is that the decile 10w equity size premium is not as unduly influenced by very small companies and thinly traded stocks that are prevalent in the lower 10th decile equities.

On August 1, 2017, the DFC Global decision was reversed and remanded back to the Chancery Court by the Supreme Court of Delaware (SPCD).[30]

The SPCD did not specifically address the size premium. The primary focus of the SPCD decision related to the weighting of the subject transaction price and certain other Income Approach valuation variables related to the Chancery Court decision. According to the SPCD, the Chancery Court did not explain its weighting of the subject transaction price in a way that is supported by the record before it.

Merion Capital

Merion Capital is a shareholder dispute related to a merger of Lender Processing Services, Inc. (LPS), and Fidelity National Financial, Inc. The petitioners demanded the appraisal of their shares in connection with the merger. Similar to the Just Care decision, the valuation analyst for the petitioner and valuation analyst defendant did not agree on the appropriate equity size premium. However in Merion Capital, one analyst applied a size premium and one did not.

In Merion Capital, the petitioner’s analyst applied a 0.92 percent size premium.[31]

The respondent analyst did not add an equity size premium. The reason for not including an equity size premium was that there “is no consensus in the academic literature as to whether such a premium still exists.”[32]

Because the respondent analyst did not add an equity size premium, and the exclusion of the size premium favored the petitioner, the Chancery Court accepted the respondent analyst decision not to add an equity size premium.

Dunmire

In Dunmire, the Chancery Court provided some commentary on the equity size premium issue in a footnote to its decision, as follows:[33]

The use of a size premium is a subject of some controversy. See, e.g., Guide to Cost of Capital 4:8 (“In fact, some commentators contend that the historical data are so flawed that valuation analysts can dismiss all research results that support the size effect. For example, is the size effect merely the result of not measuring beta correctly? Are there market anomalies that simply cause the size effect to appear? Is size just a proxy for one or more factors correlated with size, suggesting that valuation analysts should use those factors directly rather than size to measure risk? Is the size effect hidden because of unexpected events?”); see also Hopkins Report Sections 138-45. I express no opinion on this debate. My use of a size premium simply follows from the fact that it is integral to the methodologies both experts utilized, from which my own determination of the discount rate is derived.

In Dunmire, both analysts used an equity size premium, so the Chancery Court did not take a formal position with respect to the equity size premium debate.

However, the Chancery Court’s opinion suggested that it is open to considering arguments as to why the equity size premium may be excluded. It appears that the argument for and against the equity size premium is not likely to disappear anytime soon.

Summary and Conclusion

Analysts often use the Income Approach in valuation-related forensic analysis matters. The Income Approach may be used to estimate value in matters prepared according to the following standards of value:

- Fair value

- Fair market value

- Intrinsic value

- Investment value

There are at least two primary inputs to the Income Approach. The income stream or cash flow and the investment rate of return—present value discount rate—are primary components.

The focus of this discussion was to provide some background and information on the bits and pieces that form the foundation of the investment rate of return used to discount or capitalize the selected income stream.

Dating back to the Banz study, and more recently by way of the Duff & Phelps CRSP size premium analysis, empirical evidence has been gathered and analyzed in support of the size-related phenomena theory. Small closely held company investment returns cannot be entirely explained by the standard application of the basic CAPM model for estimating the cost of equity capital.

Because the basic CAPM does not entirely explain small closely held company investment returns, analysts typically apply the MCAPM to estimate the cost of equity capital in such instances.

There are many observations regarding the size-related phenomena theory and the CRSP size premium data used by most analysts. These observations include the following:

- The small capitalization premium has disappeared in recent years. The empirical evidence supports varying size-related premium at different points in time. Therefore, in certain time periods, it would not be surprising for small capitalization stocks to provide lower investment returns than larger capitalization stocks.

- Premium, at the smallest level, is unduly influenced by stocks of less than five million dollars in market capitalization and stocks that trade at prices less than two dollars per share. The most statistical noise in the CRSP size premium data is in the 10th decile classification and its smaller subcategory classifications. This factor may not be as relevant if the subject matter company is a very small business that is similar to the companies that populate the 10th subcategories of 10y and 10z.

- The idea that other factors, specifically liquidity or lack thereof, provide important detail that analysts should consider in the decision to use, or not to use, the CRSP size premium data.

If the valuation assignment is a fair value matter, the analyst should consider research that is intended to illustrate the explanatory factors behind the size premium phenomena. Based on the Torchio study results and liquidity analysis presented in the Valuation Handbook, the CRSP size premium data may incorporate an embedded liquidity discount factor.

By using the CRSP size premium data—specifically the for the 10th decile category—an analyst may be incorporating an unintended discount into the valuation assignment. If the embedded liquidity theory holds, the incorporation of an embedded liquidity discount may, at some point, run counter to Delaware Court of Chancery case law regarding fair value.

But for now, the application of the implied CRSP size premium to develop a cost of equity is a generally accepted business and security valuation practice.

This article was previously published in Willamette Insights, Autumn 2017, and is reprinted here with permission.

Kevin M. Zanni, ASA, CVA, CBA, CFE, is a Managing Director at Willamette Management Associates in the firm’s Chicago office. He provides taxation valuation opinions, litigation valuation and damages opinions, fair value valuation opinions, transactional fairness opinions, and solvency opinions. He is the past president of the Chicago Chapter of the American Society of Appraiser and the current president of the Business Valuation Association of Chicago.

Mr. Zanni can be contacted at (773) 399-4333 or by e-mail to kmzanni@willamette.com.

[1] Damodaran, “Equity Risk Premiums (ERP): Determinants, Estimation, and Implications—The 2015 Edition”: 12.

[2] Duff & Phelps, 2017 Valuation Handbook: U.S. Guide to Cost of Capital, 4–21.

[3] Damodaran, “Equity Risk Premiums (ERP): Determinants, Estimation, and Implications—The 2015 Edition”: 12.

[4] Yakov Amihud, Haim Mendelson, and Lasse Heje Pedersen, Market Liquidity, Asset Pricing, Risk, and Crises (Cambridge: Cambridge University Press, 2013), 103.

[5] Damodaran, “The Small Cap Premium: Where is the Beef?”

[6] Frank Torchio and Sunita Surana, “Effect of Liquidity on Size Premium and Its Implications for Financial Valuations,” Journal of Business Valuation and Economic Loss 9, no. 1 (2014): 55–85.

[7] The Tochio study was based on monthly stock data provided by the CRSP database for the period of 1926 to 2010.

[8] Torchio and Surana, “Effect of Liquidity on Size Premium and its Implications for Financial Valuations”: 77–79.

[9] Ibid., 77.

[10] Tri-Continental v. Battye, 74 A.2d 71, 72 (Del. 1950).

[11] In re Appraisal of DFC Global Corp., C.A. No. 10107-CB, 2016 WL 3753123 (Del. Ch. July 8, 2016), rev’d and rem’d sub nom. DFC Global Corporation v. Muirfield Value Partners, L.P., No. 518, 2016, 2017 WL 3261190 (Del. Aug. 1, 2017).

[12] Gearreald v. Just Care, Inc., C.A. No. 5233-VCP, 2012 WL 1569818 at *10 (Del. Ch. Apr. 30, 2012).

[13] Ibid.

[14] Ibid. at *11, citing Borruso v. Communications Telesystems International, 753 A.2d 451, 460 (Del. Ch. 1999).

[15] Ibid. at *10.

[16] Ibid. at *11.

[17] Ibid., citing Cede and Co. v. JRC Acquisition Corp., No. Civ.A. 18648-NC, 2004 WL 286963 at *9 (Del Ch. Feb. 10, 2004).

[18] Ibid.

[19] Ibid.

[20] Ibid. at *12.

[21] Merlin Partners LP and AAMAF, LP, v. AutoInfo, Inc., C.A. No. 8509-VCN, 2015 WL 2069417 at *15 (Del. Ch. Apr. 30, 2015).

[22] Ibid.

[23] Ibid.

[24] Ibid.

[25] Ibid.

[26] In re Appraisal of DFC Global Corp., 2016 WL 3753123 at *12.

[27] The Duff & Phelps Risk Premium Report size-related statistics exclude financial services businesses.

[28] In re Appraisal of DFC Global Corp., 2016 WL 3753123 at *12.

[29] Ibid. at *14.

[30] DFC Global Corporation v. Muirfield Value Partners, L.P., No. 518, 2016, 2017 WL 3261190 (Del. Aug. 1, 2017).

[31] Merion Capital L.P. and Merion Capital II L.P., v. Lender Processing Services, Inc., C.A. No. 9320-VCL, 2016 WL 7324170 at *29 (Del. Ch. Dec. 16, 2016).

[32] Ibid.

[33] Dunmire v. Farmers and Merchants Bancorp of Western Pennsylvania, Inc., C.A. No. 10589-CB, 2016 WL 6651411, n.139 (Del. Ch. Nov. 10, 2016).