Dual-Purpose 409A Valuations: Here’s Why and How They Overvalue Stock Options

Why Built-up Volatility Rates Produce Better Value Indications

In part one of a three-part series, Lorenzo Carver explains how the interaction between auditors and valuation professionals during dual-purpose 409A valuations of common stock and employee stock options destroys value for hundreds of thousands of employees receiving stock options every year by granting options at strike prices that are above the fair market value of the underlying common stock.

This article describes how the interaction between auditors and valuation professionals during dual-purpose 409A valuations of common stock and employee stock options destroys value for hundreds of thousands of employees receiving stock options every year, by granting options at strike prices that are above the fair market value of the underlying common stock.

It is the first of three articles on the topic. In this first piece, I’ll introduce the problem, suggest three general solutions that might solve it, and delve a bit into the specifics of the problem, which is how to measure volatility.

In the second article, I’ll provide an example of how a 409A valuation destroys shareholder value as shown in the ConnectU v. Facebook lawsuit. In my final article, I’ll explain how the valuation problem in these sorts of cases is actually exacerbated by current audit methods, and put specific suggestions on how our industry can better address these sorts of situations in the future.

Three Steps to Avoiding Overvaluation at Venture-Backed Companies

I believe there are three ways to drastically reduce the frequency with which employee stock options are overvalued at venture-backed companies. The first two are conceptual, and relate to the state of mind of those involved in these valuations (both appraisers and auditors). The third and final step is mechanical and can be used to properly adjust inputs to common allocation and discount calculation methods used in these valuations. The three steps, which I will discuss in depth, are as follows:

- Think of enterprise value for a venture-funded company as takeover value. This would include the marketable control value of preferred stock, the marketable control value of common stock, the market value of debt, and also the derivatives (including employee stock options) on each of the aforementioned types of securities. Then consider the returns which VCs holding control interests in the preferred stock of these companies would require before approving a sale.

A 10X multiple is often cited as a target cash-on-cash payback sought by early-stage investors. The reality that such results are achieved by only a handful of investors does not change the fact that this perception impacts asset volatility, the same way market volatility in public markets would be impacted if all investors expected and invested in only opportunities that had the potential to generate 10X their money in a 10-year period.

- Either (a) stop relying on 409A valuations as “dual purpose” valuations, satisfying both the intended purpose of tax compliance and the auditor-driven purpose of financial reporting; or (b) recognize that for most companies the true risk of understating option expense for financial statement reporting purposes by using a lower option price (a fair price) is substantially less than the risk of inflating the grant price for options, thereby issuing options to employees at values that are in fact above fair market value. Perform the valuation with an eye open to the area of highest risk to the company.

- Use an appropriate volatility estimate, and “build it up” similar to the way you would build up a discount rate. The most likely positive event for a venture-backed company in any given year is not an exit event, but rather a financing event, which generally means issuing a new series of preferred stock or convertible debt. Inputs into the size and potential terms of future financing events, prior to a liquidity event, remain a missing element in most valuations for 409A purposes, as well as those for fund financial statements issued to limited partners. So, for instance, if the company’s growth plans call for raising a subsequent preferred round of $30 million from VCs in 15 to 24 months, the required exit value for existing common stock holders to get the first penny of proceeds will be a lot higher than if the same company plans to raise just $5 million in preferred stock over the coming 15 to 24 months.

Based solely on the expected size of the required fundraising to get to the next stage, an appropriate volatility input can be assessed. When valuation professionals, auditors, and other parties look at the same inputs that will shape decision making by key stakeholders of the company in the coming year (expectations with respect to the size of the next round of preferred stock financing, for instance), more reliable value indications emerge.

Instead of focusing on next-round pricing scenarios as a more reliable input to value indications, typical 409A valuation efforts, filtered through auditor scrutiny and direction, rely heavily on future financial results projected out three to five years. These inputs, along with financial data from public “comps,” or the market approach, are often given more weight than future financings that will occur far sooner than when a venture-backed company will be truly “comparable” to a publicly traded company. In addition to the weaknesses related to quantifying speculative estimates of future earnings to justify a present value of a future potential exit, prevailing methods take the attention away from the events (financing rounds) and parties (venture capital investors) most likely to influence value within any 12-month period. This produces distortions in the volatility estimate.

Why Built-up Volatility Rates Produce Better Value Indications

When a valuator builds up a discount rate for a private company, care is taken to verify that both the diversifiable risk and the idiosyncratic risk of realizing the expected benefit streams are reflected in an appropriate required rate of return. The resulting discount rate can have a profound impact on value indications and conclusions. But value conclusions for common stock of venture-backed companies tend to be far more sensitive to volatility inputs than to discount rate inputs, due to two prevailing practices in these valuations.

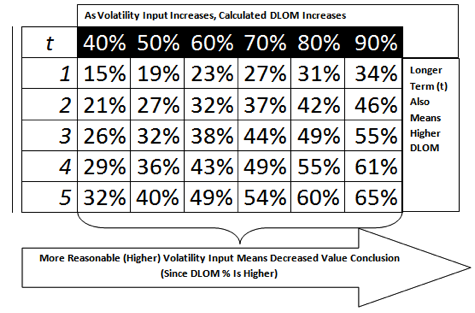

Since most 409A valuations use the Black-Scholes option pricing model as the primary calculation method in determining the discount for lack of marketability (DLOM), volatility is a critical input. As the volatility input goes up, the increased put option value (as a percentage) results in a lower (fairer) conclusion of value for a minority interest in the common stock. As illustrated in Exhibit 1, as volatility increases with a term (t) of five years, from 40 percent (far left column) to 90 percent (far right column), the indicated DLOM also increases from 32 to 65 percent. If common stock for a venture-backed company had an indicated value of $1.00 per share before the discount, for example, the resulting non-marketable minority conclusion of value could be more than 94 percent higher based solely on which volatility input was used. In this example, the risk-free rate is assumed to be 2 percent. If a higher risk-free rate were used, the calculated DLOMs would decrease from those shown in Exhibit 1.

Exhibit 1: Indicated DLOM Changes as Volatility Changes

The other prevailing practice in 409A valuations for venture-capital-funded companies is the use of the option pricing method (OPM) to either allocate an enterprise value arrived at using other approaches and methods or to solve for an enterprise value using the price paid by venture capitalists for a recent sale of preferred shares. In the case of solving for an enterprise value using the issue price for a recent round of preferred stock sold, a lower volatility input will generally result in a lower indicated enterprise value.

Despite the high sensitivity of 409A valuations to volatility inputs, venture-backed company valuations implicitly assume that the same risks and required returns associated with a peer group of publicly traded companies sufficiently match those of the venture-capital-backed company being valued. The argument for using public comps for volatility estimates is reasonable, often emphasizing a lack of quantitative data from a large enough sample size. But in reality, there have been a fair number of studies done of venture financing round-to-round volatilities and, perhaps more applicably, venture financing return variability. Each of these studies concludes volatilities in the area of 100 percent or a little more on average for VC returns.

For those reasons, as discussed previously, expectations about future financing rounds and details regarding prior financing rounds can be preferable for either building up a volatility rate or solving for an indicated volatility rate using readily observable inputs. Some of the observable inputs that could be considered when building up a volatility input include the following:

Readily Observable Inputs for Building Up A Volatility Rate

- Who (existing VCs, new investors, IRRs/stages, GPs)

- What (security/rights they purchased, impact of mix on their target future returns, and present returns/residual value)

- When (timing of prior financing transactions versus expected timing of future transactions, expected burn rate or runway)

- Why (pro-rata with outside lead? secondary sale?)

- How much (size of rounds, magnitude of required returns, implications on future volatility)

By either solving for or building up volatility, value conclusions will compare more reasonably to the true dispersion of prices and returns typically experienced by investors in these types of companies. As we focus more on the expected dispersion of prices for venture financing rounds, as opposed to focusing almost exclusively on anticipated sale scenarios, a better context for assessing the right volatility input for a specific subject company emerges. The example that follows illustrates how using this approach can add credibility and reliability to value conclusions for 409A reports for venture backed companies, while insuring that employees are granted options with strike prices that properly preserve their value.

Next week: How differences in value estimates drove the ConnectU v. Facebook lawsuit.

Lorenzo Carver, MS, MBA, CPA, CVA, is founder and CEO of Liquid Scenarios (www.LiquidScenarios.com) in Boulder, CO. He invented the Carver Import Algorithm and Search2Model, and holds a patent on VC valuation technology. Carver is the author of Venture Capital Valuation (John Wiley & Sons, Hoboken, 2011), and programmed the award-winning small business valuation software, BallPark Business Valuation (1999).