Four Specific Steps for Succession Success —JofA

Keys to Exit Excellence: Act Now, Begin the Grooming Process, Proactively Identify Potential Acquirers, and Create Value in Your Practice

Donald J. Korn writes in The Journal of Accountancy that it’s critical to be proactive in building an exit plan. Here he talks to a number of experts on the topic—including NACVA member Marty Abo, who recently was featured in Smart CEO Magazine—and collects tips on best practices:

Talk to any small CPA practitioner with an eye toward retirement and they will tell you one of their biggest challenges and concerns is finding a successor for their business. As baby boomer CPAs head toward retirement, a wave of buying and selling is likely to hit small firms; that is, at least, those small firms that have properly positioned themselves. This article looks at some of the strategies sole practitioners and partners in small firms are using to realize the full value of the practices they’ve spent decades building, for themselves and their heirs.

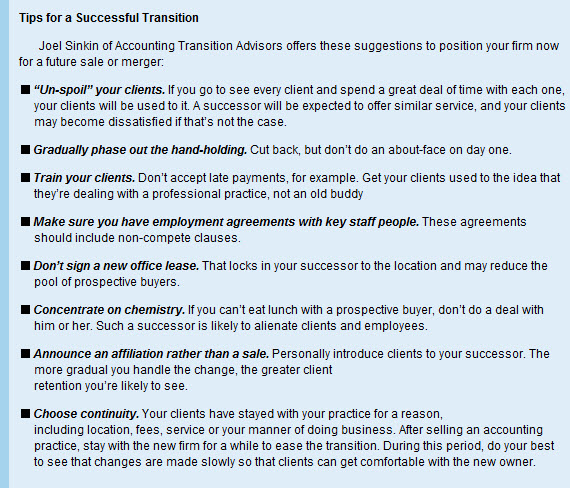

Finding a successor may not be easy in the near future, with relatively few 30- and 40-something CPAs ready to step into the shoes of the vast pool of soon-to-be retirees. The first key to success in this increasingly competitive environment is to act now. “Plan several years in advance,” says Joel Sinkin, senior partner, Accounting Transition Advisors, a mergers-and-acquisitions consulting firm.

Waiting until you’re almost ready to retire may be a mistake, warns Gary Bong, who is managing partner of Blanding Boyer & Rockwell, a firm with several locations in California. “Don’t depend on one interview at the last minute. If you speak to several firms over the years, you’re more likely to find the right fit when the time comes.”

Learn about setting up a process by reading the full article.

Some Tips on Planning Successful Succession Strategies