What is Your Name Worth?

The Art of Licensing Your Trademark

What is the value of a name? A trademark? In this article, the authors discuss the traditional valuation approaches and their limitations deriving the fair market value of the trade name.

A trademark is defined by the Trademark Act of 1946 as “any word, name, symbol or device or any combination thereof [used by someone to] identify and distinguish his goods, including a unique product, from those manufactured or sold by other to indicate the source of the goods.” The value that inures to a trademark in terms of public recognition and acceptance is known as goodwill.  Intellectual property, such as a trademark, is a unique asset since it may be exploited by several parties simultaneously.

A trademark is defined by the Trademark Act of 1946 as “any word, name, symbol or device or any combination thereof [used by someone to] identify and distinguish his goods, including a unique product, from those manufactured or sold by other to indicate the source of the goods.” The value that inures to a trademark in terms of public recognition and acceptance is known as goodwill.  Intellectual property, such as a trademark, is a unique asset since it may be exploited by several parties simultaneously.

Royalties are usage-based payments made by one party (the licensee) to another (the licensor) for the ongoing use of an asset. Royalty payments are oftentimes associated with intellectual property rights, such as copyrights, trademarks, patents, trade names, and industrial design rights. Typically, the owner, or licensor, of a trademark retains the primary rights, and the licensee receives narrowly defined rights for its use. The agreement by which this is accomplished is a license.

The implications of defining fair market value (FMV) correctly are crucial to most licensing agreements in the healthcare industry, as regulatory constraints require FMV as a standard of value for transactions between referring entities.

Valuation Methodologies

There are three generally accepted valuation approaches to determine an appropriate royalty payment for intellectual property, such as a trademark. These are the Cost, Market and Income Approaches, as detailed below:

The Cost Approach is a valuation technique that estimates the value of a trademark based on the cost to develop the asset. The expenditures required to develop and implement a trademark may include the following: concept development, consulting expenses, trademark searches, consumer testing, designs, advertising campaign development, and other expenses. The Cost Approach is simply the sum of these costs.

However, trademarks do not attain an established existence as the result of a single investment. Instead, they mature into their value through many years of investment and in combination with other assets. Furthermore, cost is not necessarily an indication of the value of the trademark. For example, unless economic benefits can be earned from ownership of the trademark, the value of the trademark would be relatively low regardless of amount of historical expenditures required to develop and implement the trademark.

The Market Approach is a valuation technique that considers the value of the use of the trademark based on comparable royalty rates in the marketplace. RoyaltyStat, RoyaltySource, ktMINE and MARKABLES are a source for royalty rates for all types of intellectual property, including trademarks.

To be determined a useful proxy, many aspects of the license agreement must be analyzed, such as:

| Relationship of the parties | Date of agreement |

| Financial condition of the parties | Nature of the intellectual property |

| Industry in which the parties operate | Territory or country |

| Term of the agreement | Nature of consideration |

| Aspects of exclusivity | Form of royalty payment |

Most published royalty fees do not include detailed information regarding the terms of the agreement; therefore, assessing the value of a trademark relative to “comparable” assets is frequently difficult. However, the Market Approach can serve as a useful guide for reasonable royalty rates related to trademarks.

The Income Approach is a valuation technique that considers the future economic benefits expected to accrue to the owner of that interest. The Income Approach is based on the premise that the economics controlling a licensing transaction are those of the licensee’s business. Stated another way, the amount that a licensee would be willing to pay is dependent upon the value of the anticipated future economic benefits the licensee could expect to achieve through use of the trademark. One technique to quantify the anticipated future benefits is through the “With and Without” Method, as detailed below:

It is not reasonable to assume that a licensee will be willing to pay 100 percent of the incremental benefit produced by use of the trademark to the licensor. Assuming the latter, then the licensee would be no better off than if it decided not to pursue the affiliation. Therefore, valuators must consider a number of factors when determining an appropriate allocation of the incremental benefit to be derived through use of the trademark between the parties such as strength of the trademark, nature of the license (exclusive or non-exclusive, restricted or non-restricted), relationship between the parties (competitors in the same line of business or territory), duration of the agreement, and the entity that is bearing the majority of the business risk associated with achieving the anticipated future incremental benefits.

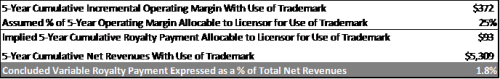

Once an appropriate allocation of the anticipated future economic benefits between the parties is determined, the valuator can calculate a reasonable royalty payment for use of the trademark. In the following example, the concluded royalty payment is expressed as a percent of net revenues:

Valuing a license agreement for a trademark is an art. With the measured frequency of health systems licensing their trademarks to potential ventures, it is crucial to obtain an accurate and credible valuation that meets the criteria of FMV.

Elliott Jeter, CFA, CPA/ABV, is a partner of VMG Health. He specializes in providing valuation, transaction advisory, strategic, and operational consulting services to the firm’s clients. Mr. Jeter has extensive experience working closely with ambulatory surgery centers, hospital systems, physician groups, and other healthcare providers. He can be reached at (214) 369-4888.

Amy Hilliard, CVA, is a senior manager with VMG Health and is based in the Dallas office. She specializes in providing financial, valuation, and transaction advisory services to clients in the healthcare industry. Mrs. Hilliard received a bachelor of business administration and a master of business administration from the University of Texas at Austin. Mrs. Hilliard can be reached at (214) 369-4888.