Business Valuation and the Option to Abandon

Businesses Where Real Estate is Integral to Operations

What is the best approach to use to value a business where real estate is indispensable to operations? In this article, Dr. Brous discusses the use of the option to abandon.

The standard methods business valuators apply to estimate the fair market values of private businesses are the Income, Market, and Asset-based Approaches. Typically, the quantity and quality of available data determine the applicability of each approach in a specific appraisal situation.  Untrained valuators using these approaches will occasionally use a weighted average of these models to ultimately generate their opinion regarding the business’ value.  There are business valuation assignments, however, where none of the three common approaches alone, nor a weighted average of the common approaches, or a single approach provides the optimal means to value the business.

The standard methods business valuators apply to estimate the fair market values of private businesses are the Income, Market, and Asset-based Approaches. Typically, the quantity and quality of available data determine the applicability of each approach in a specific appraisal situation.  Untrained valuators using these approaches will occasionally use a weighted average of these models to ultimately generate their opinion regarding the business’ value.  There are business valuation assignments, however, where none of the three common approaches alone, nor a weighted average of the common approaches, or a single approach provides the optimal means to value the business.

Consider a convenience store located in a residential neighborhood where the business owns the land where the store is located. In this case, none of the three common methods would provide the most appropriate estimate of the fair market value of this convenience store. The appropriate model to use to value this business should consider the value of the ongoing business with the option to abandon.[1] This alternative, option pricing model, is relatively simple to apply and provides a more appropriate (and higher) valuation when compared to the three individual approaches, or a weighted average value of the three approaches.  The reason an option pricing model is more appropriate in an instance like this convenience store is that the other approaches ignore the notion that if the value of the ongoing business decreases, but the value of the land becomes greater than the value of the ongoing business, then the value of the option to liquidate would be in the money and the owner could benefit from liquidating (abandoning) the business. If the valuator applies any of the three common approaches, the resulting valuation ignores the flexibility associated with managing a business (the abandonment option) and would undervalue the business.

Once we recognize that owners of businesses who own the land they operate on have the option to liquidate or abandon their business, and that this option has value, then in order to appropriately value the business, an analyst must consider the value of the option to abandon. The value of a business with the option to abandon equals the value of the business without the abandonment option plus the value of the option to abandon. This abandonment option is an American put option where the present value of the business’ expected future cash flows is the underlying asset and where the liquidation value is the exercise price. The valuator will also need to determine the maturity of the option, the risk-free rate of interest, and the volatility of the underlying asset. Furthermore, if the value of the underlying asset is expected to decrease over time if the option is not exercised, an estimate of the leakage of value of the underlying asset needs to be incorporated into the option valuation model.

For example, I was asked to value a convenience store located on Camano Island in Washington State. The value of this ongoing business, the average of the Income Approach and the Market Approach, was estimated to equal $1.05 million and the value of the property was appraised at $940,000. Additionally, I assumed the maturity of the option to be five years, the risk-free rate of interest (the yield on a five-year Treasury Bond) at 1.20%, the volatility of the underlying asset or the standard deviation of the underlying asset returns (based on a Monte Carlo Simulation model) at 25%, and assumed no leakage of value of the underlying asset[2]. Given these assumptions, I could value this option using either the Black-Scholes Option Pricing Model or a Binomial Lattice Option Pricing Model.[3]

If the abandonment option is valued using the Black-Scholes model, the value of this option equals $140,231 and the value of the convenience store equals $1,190,231 ($1.05M + $140,231).  If the option is valued using the Binomial Lattice Option Model, the value of this option equals $152,321 and the value of the convenience store equals $1,202,321. Based on the valuation from the Binomial Model (Black-Scholes Model), the valuation of this convenience store is 14.51% (13.36%) higher than if we ignore the option to abandon.

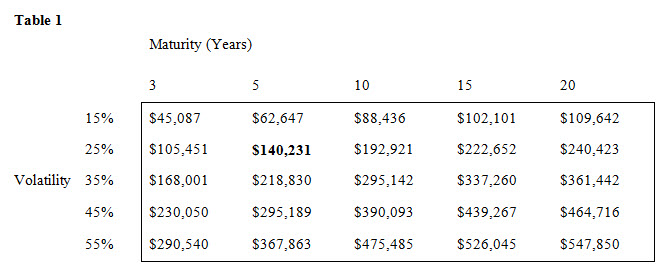

The two inputs the option value is very sensitive to are the maturity of the option and the volatility of the underlying asset. Table 1 provides the value of the option to abandon the convenience store for $940,000 given the value of the ongoing business is $1.05 million, over a range of the option’s maturity and a range of the volatility of the underlying asset. The owner of the convenience store can exercise the option to abandon any time over the expected life of the business which could be as long as 15–20 years, or longer. The volatility of the business could vary dramatically depending on the type of business and, although 40-50% is a high volatility, it is certainly possible in volatile economic environments. The results of this sensitivity analysis suggests that if the maturity is 15–20 years and if the volatility is at the high end (45-55%), then the value of this option to abandon the convenience store could be as high as $400,000 to $500,000 which represents roughly 40 to 50% of the value of the ongoing business itself.

It has long been suggested that business valuators need to value the flexibility associated with managing a business,[4] but the complexity for most business valuation assignments is a significant deterrent. In reality, there are many valuation situations where a valuable option (option to abandon or the option to expand) is not that complex and, therefore, valuators can readily incorporate simple real options resulting in more accurate valuations of the businesses they are assigned to value.

[1] Private businesses that own the land the business resides on including real estate businesses such as a bed and breakfasts or a rental unit (single family home, townhouses, apartment buildings, etc.) are ideal candidates for applying an option pricing model that includes a valuation of the option to abandon the business.

[2] Leakage would occur if there was a reason to believe the value of the ongoing business would systematically decrease each period if the option is not exercised. For example, if there is an expectation that a new competitor will enter the market in two years, then this assumption would cause the value of the ongoing business to decrease if the option is not exercised within that time frame.

[3] The Black-Scholes Option Pricing Model, although more mathematically sophisticated, has certain restrictive assumptions, while the Binomial Lattice Option Pricing Model is less mathematically sophisticated but flexible given the ability to incorporate real world situation. For example, the Black-Scholes Model assumes that the option is a European Option and can only be exercised at maturity, while the Binomial Lattice model values the option assuming it can be exercised at any time before the option matures (American Option).

[4] Dufendach, David, “Real Options: Extending Project Finance Techniques to Valuation of High Growth Enterprises”, Valuation Strategies, (1999); Mauboussin, Michael, “Get Real: Using Real Options in Security Analysis”, Frontier of Finance, (1999); and Kellogg, David and John Charnes, “Real-Options Valuation for a Biotechnology Company”, Financial Analysts Journal, (2000).

Peter Brous earned a PhD in finance from the University of Oregon in 1989 and before joining Seattle University in 1992, was an assistant professor for four years at Pennsylvania State University. He has published many articles in the top finance and accounting journals, and has published several pedagogical research papers in the Journal of Financial Education. He has served as an expert witness in over 40 cases based on his expertise in valuing employee stock options or business valuation. Additional areas of expertise include corporate performance measures, capital budgeting, corporate financing decisions, and real option analysis.

Dr. Brous can be reached at (206) 296-6495 or by e-mail to pbrous@seattleu.edu.