Adding Growth to Exit Planning

Observations of Needs of Boomer Owners as the Exit Tsunami Begins

Readers serving as advisors to privately held business owners stand in the position of being the authority when it comes to topics such as growth and exit planning. This QuickRead article is written to share the research on the privately held business owner market and mindset, which points to important considerations for business owners who are considering and/or executing upon a plan to grow and/or exit their privately held business. The article covers five important issues that will enable advisors to understand the opportunity in this market, an opportunity that has just started.

[su_pullquote align=”right”]Resources:

Certified Business Exit Consultant® (CBEC®) Credentialing Program

[/su_pullquote]

As an advisor to privately held business owners, you stand in the position of being the authority when it comes to topics such as growth and exit planning. This newsletter is written to share with you research on the privately held business owner market and mindset, which points to important considerations for business owners who are considering and/or executing upon a plan to grow and/or exit their privately held business. This article covers:

- An overview of the baby boomer tsunami that has ‘hit the shoreline’

- Six years of data from the Business Exit Readiness Index™ (BERI™) survey that shows a low financial and a low mental readiness to exit from a majority of owners surveyed

- Four years of data from the Owner Dependence Index™ (ODI™) survey that shows a national average of owner dependency at a 53% level

- A word on timing and market readiness

- An initial conclusion that exit planning is a growing business and including a growth plan for the company to both increase the value of the business to meet an owner’s personal goals as well as to set a course to make the business less dependent upon the owner and, therefore, more transferable, expands and extends the overall engagement with an owner

An Overview of the Baby Boomer Tsunami That has ‘Hit the Shoreline’

For more than a decade, many authors and prognosticators (including yours truly) have been writing about the wave of baby boomers (those born between 1946 and 1964) who own privately held businesses and who are aging, presumably heading towards retirement. This tsunami has been building over that past decade and, with the Great Recession hitting hard and lasting long, the pent-up demand for these boomers to exit their businesses has only grown. Today, the leading boomers are 74 years old, and the trailing boomers are turning 56 years old. And with a strong U.S. economy, business valuations are back at a level where most of these owners last saw them in 2006 and 2007—13 to 14 years ago. And for the past dozen or so years, organizations such as Pinnacle Equity Solutions, Inc., have been building the exit planning industry with professional advisors—in our case, through our Certified Business Exit Consultant® designation and membership programs. As a result of the industry-building activities, more and more owners today are aware that there is a service available to assist them with the exit from their privately held business.

Combining the aging of the boomers, the strong economy, high valuations, and a marketplace better equipped to serve these owners, there exists a situation where the boomers are seeking exit planning at record levels to effectively and successfully handle the largest financial and emotional transaction of their lives. All of this market activity suggests that the baby boomer tsunami has hit the shoreline and should be around for a long time.

More data and resources are available today to help understand, analyze, study, find, communicate with, assess, and deliver solution to the needs of these owners. Two interesting tools that assess business owners are the Business Exit Readiness Index™ (BERI™) and the Owner Dependence Index™ (ODI™). Together the national averages of thousands of owners surveyed illustrates an interesting picture of today’s landscape of boomer owners as well as a growing opportunity to be of greater service to these owners.

The Business Exit Readiness Index™ (BERI™) Survey Results

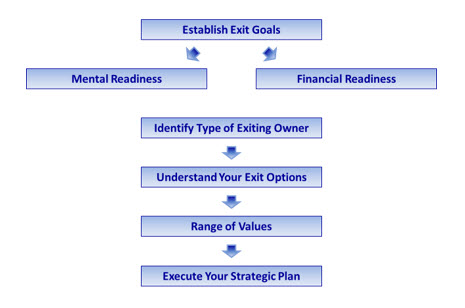

Pinnacle Equity Solutions’ exit planning process follows six steps, as seen below:

After setting goals (step #1) the process moves to assessing an owners’ readiness for an exit. The two areas of readiness that are used are financial readiness—how financially dependent the owner is on the business—and mental readiness, which is an indication of how much longer the owner wants to continue working. The chart below shows the quadrant system that is used in the second step of the six-step exit planning process with financial readiness on the vertical axis and mental readiness on the horizontal axis.

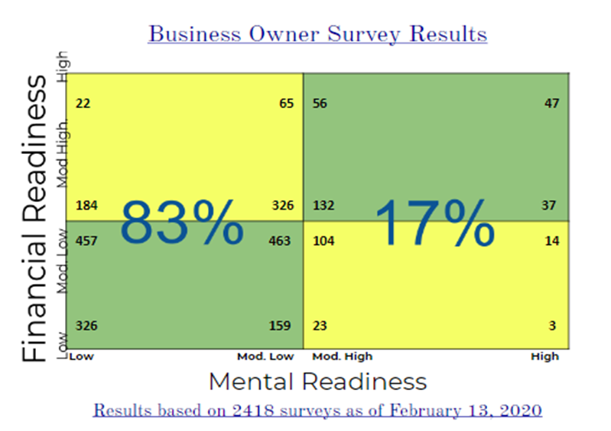

In order to more easily assess an owner’s financial and mental readiness, Pinnacle created a software-driven survey tool (available to CBEC® applicants and members) that asks business owners 20 questions—10 about their financial readiness for an exit and 10 about their mental readiness for an exit. The Exit Quadrant Chart below provides updated statistics on more than 2,400 of these BERI™ survey results over the past six+ years.

According to Pinnacle’s research, 83% of business owners have a LOW mental readiness for an exit, while only 17% have a HIGH mental readiness. Owners with a LOW mental readiness exit generally:

- Have no written plans for an exit

- Have not thought about a future without them working in their business

- Take less than three weeks of vacation per year

- Are performing at the ‘top of their game’

- Lack the management team to replace their responsibilities at the company

- Continue to have a high level of enthusiasm to work at their companies

In short, this statistic tells us that the majority of business owners—8.3 out of 10—are not ready for a business exit. The statistics indicate that the opportunity to assist business owners over a period of years prior to their exit is greater than the opportunity to help owners sell their companies in the short term.

Another interesting data point from the Exit Quadrant Chart is the fact that 58% of survey respondents were in the lower left-hand quadrant. This means that these owners’ financial readiness for an exit it low, in addition to their mental readiness also being low. So, a majority of owners are not only not ready to leave their businesses, but most also (generally speaking) cannot afford to exit today.

Again we see that the largest opportunity both assist owners with developing an exit plan but also incorporating a plan to grow the value of the business. The next set of data from the Owner Dependence Index™ further supports this conclusion.

The Owner Dependence Index™ Survey Results

In addition to the BERI™ survey tool, a few years later Pinnacle also created the Owner Dependence Index™ survey tool. This software-based survey tool is similar to the BERI™ tool in function but is quite different in form. The ODI™ survey seeks to answer the question, How dependent is a company on the individual efforts of the business owner?

The ODI™ survey is 40 questions long and covers eight functional areas of the business, assessing each area in terms of the dependency on the owner. For example, there are five survey questions relating to sales to assess how dependent a company is on that owner’s revenue-generating activities. The lower a score on the ODI™ survey, the less dependent the company is on that individual owner and, hence, the more transferable the business.

The data from 648 owners who have completed the ODI™ assessment shows an overall, national average score of 53%. This means that the average small business is more than one-half dependent upon the active involvement of the owner(s).

If we combine the BERI™ statistics and the ODI™ statistics, we see that the largest opportunity to assist business owners is to develop a multi-year plan that:

- Sets the exit path and goals,

- Evaluates financial and mental readiness to understand the value gap,

- Measures the increase in business value needed to meet the owners’ personal goals,

- Looks at the obstacles that would prevent a future transition, leading with owner dependence, and then…

A Word on Timing and Market Readiness

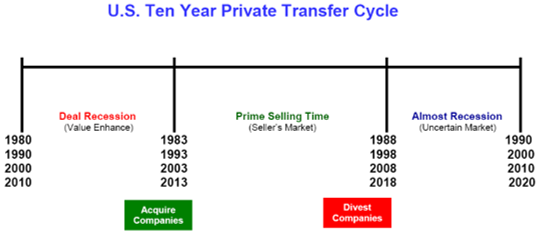

As far as business growth and exit planning goes, timing may end up being one of the most important elements of an overall plan. The chart below illustrates the cycle of business exits and shows that today’s market may be the ideal time for a business exit at a high valuation. According to this ten-year transfer cycle chart, in 2020 we are at the outer edges of the Prime Selling Time and nearing the verge of Almost Recession.

While past performance of markets is not necessarily a perfect predictor of the future, the chart above indicates that the last four decades have followed a similar pattern of economic growth, expansion, and then retraction/recession. Therefore, it is reasonable to anticipate that over the next year or two (likely somewhere in 2020 or 2021), the U.S. will experience another recession. Today’s question to boomer owners is, Whether or not they want to enter the next recession with the majority of their wealth continuing to be concentrated in their illiquid business?

If owners determine that now is the time to exit, then what they are saying is that they are willing to hand over a growth plan to another owner to capture the opportunities in today’s vibrant market. If owners agree with the transfer cycles and do not want to exit their businesses in the next 12 to 24 months, then they should likely plan to hold onto their companies through the next recession, another three to seven years, in which case a growth plan is very helpful, particularly through a recession.

- An initial conclusion that a solid exit plan includes a growth plan for the company to both increase the value of the business to meet an owner’s personal goals as well as to set a course to make the business less dependent upon the owner.

We believe that the data shown above indicates a very large opportunity to assist owners with a growth plan as a part of their exit planning. If a growth plan is incorporated into an exit plan, then your engagement with the owner does not just rely upon the owner’s exit from the business but extends to the growth in the value of the business. So, whether the owners want to exit in the short-term or in the longer-term, you can have a value-proposition of assisting owners with reaching their overall goals, on their timeframe.

Let’s summarize what has been discussed:

- The tsunami of boomer owners exiting has begun, and their mindset and needs are complex but better understood today than ever before,

- The BERI™ statistics show a marketplace of owners who have both low financial and mental readiness to exit, with a large need to grow the value of their business prior to exit, to meet their goals,

- The ODI™ survey shows that most privately held companies will struggle with a transition of the business because the owner(s) are very involved in the running of the company, and

- The market timing shows that either owners should seek an exit today or be prepared to hold onto their businesses for another three to seven years, through the next recession.

This all supports that idea that a growth plan should be an essential part of any exit plan. Now that we have made the argument for incorporating growth planning into an exit plan, let’s briefly introduce what a growth plan includes.

A growth plan is a comprehensive document that touches on all areas of the business so that the next owner’s concerns are addressed and allows opportunity to be seen and reinforced. A growth plan is an architectural design for the next level that the business can reach that not only paints a picture of a future for the business but also designs a blueprint for the build out to that next level.

Our next QuickRead article will focus on areas of a growth plan that should be in an exit plan and outline the architecture and blueprint concepts introduced in this newsletter.

John M. Leonetti is the founder and owner of Pinnacle Equity Solutions, Inc., the Certified Business Exit Consultant (CBEC) professional designation course and the International Growth and Exit Planning Association. He is also the author of Exiting Your Business, Protecting Your Wealth – A Strategic Guide for Owners and Their Advisors, which includes a six-step exit planning process that has been used by thousands of professional advisors (and business owners) over the past decade. Mr. Leonetti is active in the daily running of Pinnacle, the CBEC course and the IGEPA. He also serves as an advisor to select business owners, using the tools and delivering the solutions that he provides in the training and membership programs.

Mr. Leonetti can be contacted at (781) 821-2608 or by e-mail to john@pinnacleequitysolutions.com.