ESOP Implementation Considerations

A Leverage ESOP versus a Non-Leverage ESOP

An employee stock ownership plan (ESOP) is a qualified retirement plan that allows employees to hold equity in the sponsor company that employs them. There are various strategies that may be considered when the sponsor company forms an ESOP. One important structural decision regarding the ESOP formation is whether the ESOP will be leveraged or non-leveraged. This discussion compares the leveraged ESOP structure and the non-leveraged ESOP structure.

Introduction

There is a reason for the phrase, “no two ESOPs are alike.” An employee stock ownership plan (ESOP) can be structured to meet a variety of objectives—whether to promote employee ownership, provide employee retirement benefits, reduce sponsor company income taxes, provide shareholder liquidity, or transfer the ownership of the business. The ESOP can be structured to fit any of these needs.

This discussion focuses on one decision that the selling shareholders and company board will make when determining the appropriate structure for the ESOP—that is, whether the ESOP will be “leveraged” or “non-leveraged.”

In short, a leveraged ESOP transaction involves the purchase of sponsor company stock with borrowed funds. These funds are typically borrowed from the sponsor company, which in turn borrows funds from an external lender.

In contrast, a non-leveraged ESOP transaction does not utilize debt to purchase the employer corporation securities. The non-leveraged ESOP typically acquires the employer securities through one of the following:

- Tax deductible stock contributions

- Tax deductible cash contributions from the sponsor company

The sponsor company stock is purchased gradually each year based on the sponsor company’s annual ESOP contribution amount. The ESOP ownership percentage of the sponsor company stock increases as the ESOP acquires additional shares.

If the parties to the ESOP elect to implement a non-leveraged ESOP stock purchase transaction, they may still implement a leveraged stock purchase transaction in the future. Alternatively, an ESOP can utilize leverage for the initial installation and also elect to acquire shares without leverage in the future.

An ESOP is not black and white, and it can be structured to fit the liquidity needs of the selling shareholders while simultaneously benefitting the employees and sponsor company.

Most of the ESOP professional literature and presentations at ESOP-related conferences focuses on the leveraged ESOP structure. As will be discussed later, there are a variety of reasons that leveraged ESOPs are popular among the ESOP community in general and ESOP professional advisers in particular.

Despite their popularity in the ESOP community, the National Center of Employee Ownership (NCEO) analysis of Department of Labor data reports that only 46 percent of ESOPs are leveraged.1

The following discussion provides a background of various characteristics and advantages associated with leveraged and non-leveraged ESOP structures. The following sections address the transaction structure, income tax considerations, and accounting for leveraged ESOPs and non-leveraged ESOPs.

Transaction Structure

Leveraged ESOP Structure

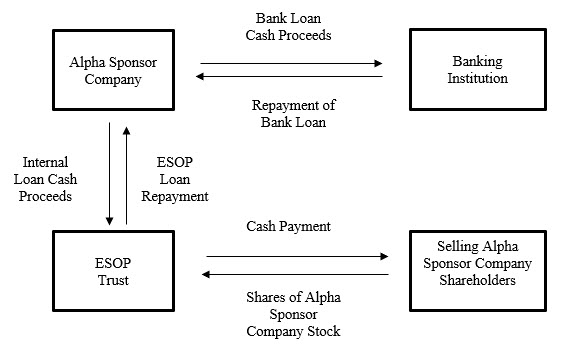

In a typical leveraged ESOP transaction, the sponsor company enters into a loan agreement with an outside lender and/or the selling shareholder(s) (the “external loan”). The sponsor company lends the proceeds from the bank loan to the ESOP trust (this is referred to as the “internal loan”). The ESOP trust uses the cash received from the sponsor company to purchase the sponsor company stock from the selling shareholder(s).

The typical leveraged ESOP transaction structure is presented in Figure 1.

Figure 1: Typical Leveraged ESOP Structure for the Initial Purchase of the Sponsor Company Stock

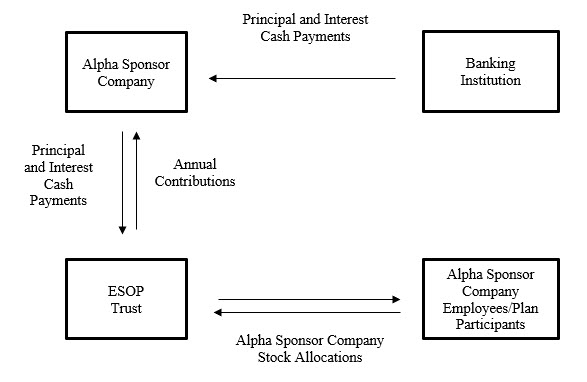

To calculate the number of shares released from treasury (that is, the shares allocated to the ESOP participant accounts) using the principal and interest method, the principal and interest paid is divided by the current and future principal and interest, multiplied by the total unreleased ESOP shares.

The number of released shares calculation is similar when using a principal only method, except the numerator and denominator do not include annual interest payment and current and future interest, respectively.

The principal only method is only allowed if the internal loan provides for annual payments of principal and interest at a cumulative rate, with payments at least equal to level annual payments for a period of 10 years.2

After the shares are released and allocated to participant accounts, they produce a repurchase obligation liability. A repurchase obligation is the obligation to repurchase shares from an ESOP participant in accordance with the plan documents. The repurchase obligation is typically triggered by a retirement, separation of service, or participant diversification election.

Although the stock repurchase liability is typically funded by the sponsor company, it is not recorded as a liability on the sponsor company’s balance sheet. However, the sponsor company is required to bring attention to the liability in the notes to its audited financial statements.

Non-leveraged ESOP Structure

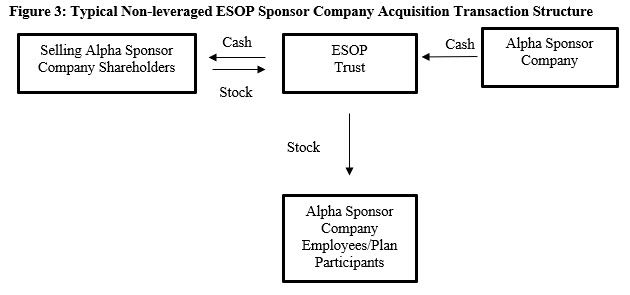

A non-leveraged ESOP transaction is often less complicated and involves fewer parties than a leveraged ESOP transaction. A non-leveraged ESOP transaction involves the contribution of cash or stock to the ESOP trust by the sponsor company.

If stock is contributed directly to the ESOP, then the stock can be allocated to participant accounts. If cash is contributed to the ESOP, then the ESOP will typically buy stock from the selling shareholders. Then, the stock will be allocated to the ESOP participant accounts.

The typical non-leveraged ESOP contribution structure is presented in Figure 3.

Figure 3: Typical Non-leveraged ESOP Sponsor Company Acquisition Transaction Structure

Alternatively, the sponsor company could redeem shares from the selling shareholders. The sponsor company would then contribute shares to the ESOP.

A non-leveraged ESOP typically results in a slower ownership transition than a leveraged ESOP. The ESOP acquisition of stock will be based on annual cash or stock contributions from the sponsor company, as opposed to debt financing. The annual cash or stock contributions are made on a pretax basis.

When purchasing stock from a shareholder using the non-leveraged ESOP transaction structure, the acquisition of the ESOP stock typically is based on the following:

- The sponsor company’s available cash flow in any given year, which may be limited by the annual tax-deductible contribution limits equal to 25 percent of the payroll for eligible ESOP participants, as set forth in the Code

- The value of the sponsor company stock

Mature sponsor companies that have ample cash flow will typically be able to acquire company stock at a faster rate than sponsor companies that require operating cash flow for growth.

If ownership transition is not an immediate objective, then the sponsor company may choose to issue the ESOP shares from treasury. This transaction would provide retirement benefits and employee ownership, while increasing current cash flow.

Income Tax Considerations

The income tax benefits associated with ESOP transactions may be one of the primary incentives for undergoing an ESOP transaction. There are various tax benefits available to ESOP sponsor companies and selling shareholders.

Many of the available income tax benefits depend on the following:

- The structure of the ESOP sponsor company stock purchase transaction

- The organization of the sponsor company

Leveraged ESOP

There are various economic and income tax advantages associated with a leveraged ESOP. These advantages are available to the sponsor company and the selling shareholders. A leveraged ESOP enjoys all of the income tax benefits of a non-leveraged ESOP—and several additional benefits.

Sponsor Company

If the ESOP sponsor company is structured as a C corporation, the sponsor company can deduct principal and interest payments on the internal loan for federal income tax purposes. The sponsor company may deduct additional contributions that are equal to or less than 25 percent of total eligible payroll of the ESOP participants.

S corporations pass income, losses, deductions, and credits through to the company shareholders for federal income tax purposes. Shareholders report the income, losses, deductions, and credits on their personal tax returns at their individual income tax rates. This procedure allows S corporations to avoid double taxation on corporate income.

The ownership interest held by the ESOP does not incur federal income taxes. Therefore, an S corporation that is wholly owned by an ESOP does not owe federal income taxes.

If the sponsor company has multiple investors, cash distributions that are made to cover the tax liability of non-ESOP shareholders are made on a pro rata basis. The cash is allocated to ESOP participants, and the cash may be used to fund future stock purchases or make other investments.

A leveraged ESOP transaction generally maximizes the tax benefits for C corporation and S corporation sponsor companies.

Selling Shareholders

The main benefit available to selling shareholders is the Code Section 1042 election. Section 1042 allows a selling shareholder to defer capital gains tax on the sale of the private company to the ESOP. All else equal, the seller would, therefore, realize greater net after-tax proceeds when selling the sponsor company stock to the ESOP.

The Section 1042 election eligibility requirements include the following:

- The sponsor company should be a C corporation

- The selling shareholder(s) should hold the company stock for at least three years prior to the sale

- As a result of the transaction, the ESOP should own:

- at least 30 percent of the stock after the sale or

- at least 30 percent of the total value of the sponsor company

- The seller should reinvest the sale proceeds into a qualified replacement property within 12 months of the transaction

Non-leveraged ESOP

Compared to the income tax benefits available to a leveraged ESOP, the income tax benefits of a non-leveraged ESOP are limited. The sponsor company receives an income tax deduction equal to the amount contributed to the ESOP (as long as the contributions are consistent with the deduction limits set forth in the Code).

S corporation non-leveraged ESOPs have the same benefits as leveraged ESOPs. However, the slower ownership transition means that the tax benefits will be realized over a longer period.

Financial Considerations

The board of directors may consider the impact that the ESOP structure could have on a company’s financial statements. The ESOP assets are not included on a company’s balance sheet, but they are included as assets within the ESOP trust.

Leveraged ESOP

If considering an ESOP transaction, especially a leveraged ESOP transaction, it is important to understand ESOP accounting policies and the impact the internal and external loans may have on the company’s financial statements.

The receivable associated with the internal loan, made to the ESOP, is not to be recorded as an asset of the sponsor company. Instead, the loan is recorded against equity as unearned ESOP shares. Federal Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 718-40 provides accounting guidance for recording the earned and unearned ESOP shares.

A sponsor company will record compensation expense, as the sponsor company makes contributions to the ESOP. Contributions made to the ESOP trust are tax deductible up to 25 percent of the covered payroll.

The external loan receives the same financial statement treatment as normal external financing. The external loan is recorded as a liability on the sponsor company balance sheet and the interest payments made on the external loan are recorded as an expense.

C corporations may be eligible for additional income tax deductions associated with the internal loan. These C corporation income tax deductions include the following:

- Additional tax deduction of up to 25 percent of covered payroll expense for the repayment of the principal on the internal loan3

- Contributions applied for interest payments on the internal loan4

It is important to consider that the terms of the internal loan and the external loan will often be different. Often, the sponsor company will structure the internal loan with a longer term than the external loan. This structure allows the sponsor company to allocate shares to participate accounts over a longer period while the sponsor company services the external debt at an accelerated rate.

The share allocation creates a repurchase obligation liability for the sponsor company. However, the repurchase obligation liability is not a recorded liability, but it is mentioned within the notes of the company’s financial statements.

The impact of the external loan on the sponsor company’s financial statements may be a primary consideration when determining how to structure the ESOP. Typically, the external loan will decrease the value of the sponsor company equity. The leverage from the transaction may prevent the sponsor company from having the necessary capital for future growth initiatives.

Non-leveraged ESOP

The non-leveraged ESOP structure typically does not impact the sponsor company’s financial statements as significantly as a leveraged ESOP transaction. The initial contribution to a non-leveraged ESOP is very similar to making an employer contribution to a 401(k) plan.

The sponsor company will record the contribution of cash or stock to the ESOP as a compensation expense on the income statement. This compensation expense figure will be equal to the total cash, or the fair market value of the shares, contributed to the ESOP.

The accounting impact of this contribution on the sponsor company’s financial statements is summarized below:

Financial Statement Accounts Debit Credit

Cash or Common Stock $100,000

ESOP Contributions $100,000

In accordance with the plan document of the ESOP, shares are then allocated to the participant accounts. This allocation creates a repurchase obligation for the company, which is mentioned in the notes to the financial statements. The magnitude of the repurchase obligation liability will increase as the ESOP acquires more shares.

Since a non-leveraged ESOP transaction does not require external funding and the establishment of new debt obligations, the sponsor company is more likely to have available capital for growth initiatives.

A financial feasibility analysis can be performed to estimate the financial impact of the leveraged and non-leveraged ESOP structures. The considerations of the financial feasibility analysis with respect to the decision to use leverage are discussed below.

Fiduciary Considerations

Fiduciary liability concerns may be an additional consideration when determining which ESOP structure is the most appropriate. There are few litigation cases involving non-leveraged ESOP transactions.

However, there have been dozens of litigation cases associated with leveraged ESOP transactions. The allegations in these cases typically involve a trustee breach of fiduciary duties. The plaintiffs in the cases often argue that the ESOP trustee caused the ESOP to enter into a prohibited transaction by paying more than fair market value for the subject shares.

Leveraged ESOP transactions are often more expensive to implement than non-leveraged ESOP transactions. This is due to the size and complexity of a leveraged ESOP transaction.

Leveraged ESOP transactions often require several professionals with specific qualifications to be involved in the deal process. The professionals involved may include administrators, attorneys, trustees, valuation advisers, investment bankers, and other specialists. The higher audit risk and related fiduciary liability risk also could increase the total cost of installing a leveraged ESOP.

Non-leveraged ESOP transactions are typically smaller in size and complexity than leveraged ESOP transactions. The smaller size and complexity typically decreases the initial installation expense (in terms of professional fees).

In either transaction structure, it may be advisable for the sponsor company to obtain fiduciary liability insurance. The expense and necessary coverage, however, is likely to be significantly greater following a leveraged ESOP transaction.

Determining the Most Appropriate Structure

An ESOP can be an effective vehicle for structuring the sale of a private company business. Several specific factors may influence the decisions to undergo a leveraged or non-leveraged ESOP transaction.

Leveraged ESOP transaction structures are often selected by selling shareholders with the following attributes:

- Motivation to quickly liquidate their ownership

- Motivation to diversify their asset holdings

- Satisfaction with the current fair market value of the company

Leveraged ESOP transaction structures are often selected by sponsor companies with the following attributes:

- Financial ability to acquire a significant liability

- Financial ability to incur additional implementation expenses

- Financial ability to incur additional fiduciary liability insurance expenses

Non-leveraged ESOP transactions are often more appropriate for selling shareholders with the following attributes:

- No immediate liquidation needs

- Incentive to continue participating in the growth of the company

Non-leveraged ESOP transactions are often more appropriate for sponsor companies with the following attributes:

- Inability or lack of desire to acquire a significant liability

- Plans to incur major capital expenditures for growth initiatives

- Concern regarding the potential fiduciary liability risk associated with leverage ESOP transactions

- Multiple shareholders with the need for future liquidity

When determining which transaction structure is most appropriate, it is important to balance the needs of the various constituents of the transaction. It is also important to consider that selecting a specific transaction structure (leveraged or non-leveraged) does not prevent a company from undergoing the alternative transaction structure in the future.

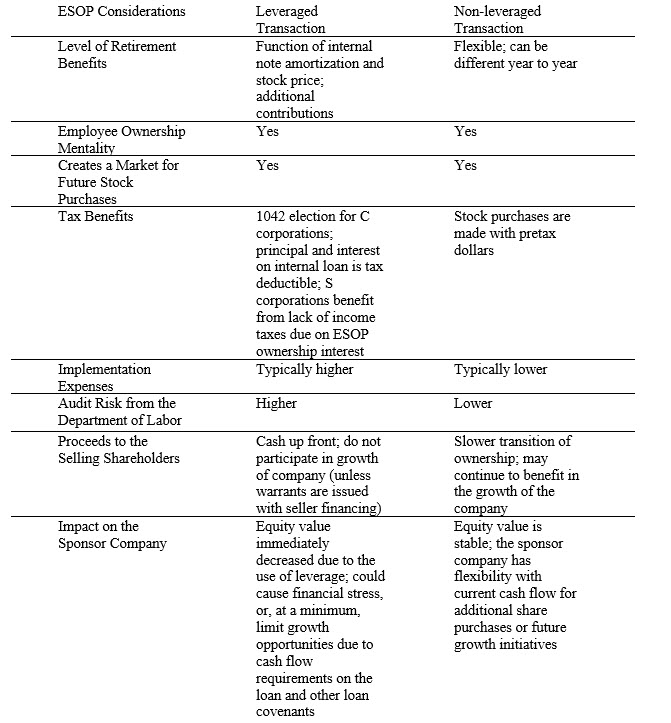

Exhibit 1 summarizes many of the considerations related to a leveraged and a non-leveraged ESOP transaction.

Exhibit 1: Considerations of a Leveraged ESOP Stock Purchase Transaction versus a Non-leveraged ESOP Stock Purchase Transaction

Summary and Conclusion

There is no “one size fits all” approach to structuring the installation of an ESOP at a sponsor company. By researching and understanding the impact of individual ESOP structures, an ESOP structure can be implemented that meets the needs of (1) the sponsor company, (2) the selling shareholders, and (3) the to-be-formed ESOP participants.

Notes:

- NCEO analysis of the Department of Labor data, https://www.nceo.org/articles/employee-ownership-by-the-numbers. Some existing ESOPs may have utilized leverage previously.

- Internal Revenue Service Technical Advice Memorandum 201425019.

- See Code Section 404(a)(9)(A). This is in addition to the general tax deduction up to 25 percent of covered payroll. Therefore, a C corporation may be eligible for a tax deduction up to 50 percent of covered payroll.

- See Code Section 404(a)(9)(B).

This article was previously published in Willamette Insights Spring 2020, Issue 124, and is republished here with permission.

Ben Duffy is a manager in our Atlanta practice office.

Mr. Duffy can be contacted at (404) 475-2326 or by e-mail to brduffy@willamette.com.