Pre-IPO Studies Are Not a Valid Basis for Calculating DLOMs

The two most widely approaches used by valuators to determine a discount for lack of marketability (DLOM) are restricted stock studies and IPO studies. The restricted stock studies compare transaction prices in restricted shares with contemporaneous trading prices for unrestricted shares. The pre-IPO studies, on the other hand, according to the author, lead to conclusions that are unsound in theory and in practice. In this article, the author discusses six major flaws in the data that, in the author’s opinion, make the pre-IPO studies’ conclusions totally unreliable for determining discounts for lack of marketability.

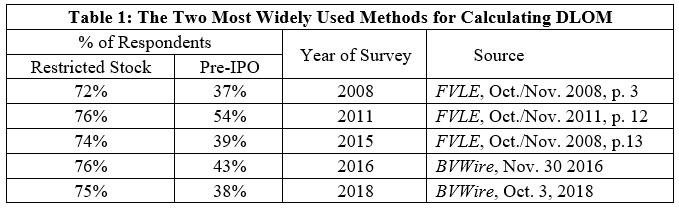

The two most widely approaches used by valuators to determine a discount for lack of marketability (DLOM) are restricted stock studies and IPO studies (based on the difference been the prices of initial public offerings and prior purchases, and sales of common stock and stock equivalents of the issuers). According to surveys published in BVWire and Financial Valuation and Litigation Expert, restricted stock studies are used by about 75% of practitioners and pre-IPO studies by about 40% (see Table 1).

The restricted stock studies compare transaction prices in restricted shares with contemporaneous trading prices for unrestricted shares. These studies have minor imperfections; e.g., they assume that the prices of restricted shares were set on the announced date rather than an earlier date, and they assume that the restricted stock has no restraints on sale other than the assumed Rule 144 restriction. Nonetheless, the restricted stock studies are, on balance, a reasonable factor to weigh in estimating a DLOM.

The pre-IPO studies, on the other hand, lead to conclusions that are unsound in theory and in practice. This article will discuss six major flaws in the data that make the studies’ conclusions totally unreliable for estimating DLOM:

- Pre-IPO restricted securities and the subsequent IPO are not priced contemporaneously.

- The IPO price is not knowable at the time of a pre-IPO transaction.

- Most IPOs are intentionally underpriced.

- The database necessarily includes only companies which subsequently become publicly traded.

- Convertible preferred stock sold re-IPO transactions is worth more than common stock equivalent.

- Discounts for securities issued in pre-IPO transactions include two components: the risk that the IPO will not occur and the fact that securities are subject to restrictions at the time of the IPO.

The IPO Studies

There have been three broad-based studies of discounts in pre-IPO transactions.[1] John D. Emory published a series of studies in Business Valuation Review. His first two studies covered two 18-month periods in the 1980s and seven more studies collectively covered the periods from August 1987 through December 2000 (with one five-month gap). The first nine studies were based on common stock sales (22%) and options at fair market value (78%). The 10th and final study, covering May 1997 through December 2000, included preferred stock (at conversion price) and common stock, but not options. He examined transactions within five months of the date of each IPO he reviewed. Most of his studies arrived at DLOMs in the 40%–50% range.

Willamette Management Associates published 23 studies showing median discounts (but no additional information) for pre-IPO transactions for the 28 years from 1975 through 2002. (Two of the early studies covered multiple years.) They include transactions up to three years before an IPO, with adjustments for changes in company and industry P/E ratios. The midpoint of the medians for this period was about 50%, but with wide variation. The medians in two of the years were over 70%, three years had medians close to 30%, and the median for 2001, following the dot.com collapse, was minus 196%.

The only study covering more recent periods is by Brian Pearson of Valuation Advisors, LLC. The study covers transactions since 1985 and is updated monthly. The database includes information as to each individual transaction. It includes pre-IPO common stock, options, and convertible preferred stock, and can be sorted by the user. The database includes transactions for up to 10 years prior to the IPO. Below-market transactions are adjusted to fair value based on SEC guidelines.

Although the quality and detail of the Valuation Advisors study is materially better than the earlier ones, it nonetheless suffers from several material conceptual problems. The principal flaws are discussed below.

The Datapoints are not Contemporaneous

In the restricted stock studies, the discount is calculated based on the difference between the price of the restricted stock and the public market price of the stock on the same date or a proximate date. In contrast, the pre-IPO data is based on widely separated dates—the IPO does not occur until months (or years) after the private transaction. This mismatch of dates makes the calculated pre-IPO discount an unreliable and unsound data point.

If the pre-IPO transaction brings material funding to the company, the benefits from the new money should serve to increase the value of the company. Also, market conditions change. In bull markets, the IPO price will normally benefit from the rising tide. When markets turn sharply lower, the few companies that go public are likely to be priced at lower levels than had been anticipated in brighter days; witness the substantial negative discount in the 2001 Willamette study after the collapse in the dot.com sector.

Moreover, as Chris Mercer and Travis Harms point out:

[T]he IPO itself changes the nature of the pre-IPO company. As a result, the observed discounts include both the impact of illiquidity and the changing characteristics of the company. Since valuation analysts are generally not able to separate the two components, the observed pre-IPO discounts do not provide relevant evidence for the marketability discounts applicable to illiquid minority interests in private companies.[2]

The IPO Price is Not Knowable in Advance

Not only is the date of the IPO unknown when the pre-IPO transaction occurs—the IPO price itself is necessarily unknown since it is finally determined only on the eve of the IPO. The price may not only be outside the price range anticipated when the pre-IPO shares transaction occurred— it sometimes is outside the range expected when the preliminary prospectus was filed. Any “calculation” of a “discount” based on an unknown and unknowable future offering price is meaningless.

The only situations in which a meaningful discount might be determined are offerings where the investor buys a convertible preferred stock that is convertible at a contractual discount to the IPO price[3] or there is another form of adjustment pursuant to a formula based on the IPO price. Otherwise, the IPO price is an unknowable denominator for calculating the marketability discount at the time of the pre-IPO transaction.

IPOs are Underpriced

A common criticism of IPO studies is that IPOs tend to be underpriced because IPOs commonly trade at premiums to the offering price in the immediate aftermarket. To the extent that IPO prices are less than post-IPO trading prices, the DLOMs calculated in the pre-IPO studies are overstated.

Pearson, in a BVR webinar last year, responded to this criticism with an unsupported assertion:

We believe it is somewhat illogical for a company selling shares to underprice its offering, thereby forgoing millions of dollars it could receive from investors, all for the sake of having a successful offering (a first day “pop” in the stock price) which doesn’t benefit the company.[4]

It would be difficult to find an experienced investment banker or a CEO who would agree with that statement. I have observed, in my 60 years in investment banking, that almost every company wants its shares to trade up after an IPO rather than to trade flat or pennies below the offering price. Contrary to Pearson’s view, a successful offering does benefit a company. A company whose shares fail to improve after an IPO, either immediately or in the succeeding weeks, can expect that the reception of its next equity offering will likely be adversely affected.

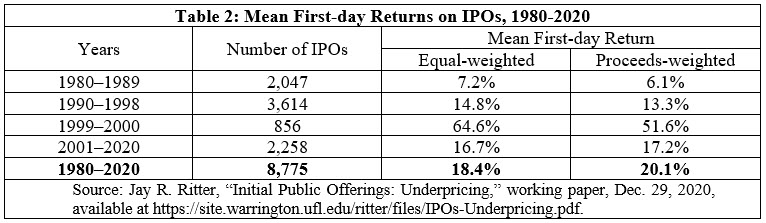

A review of the extensive literature on IPO pricing by academics and by investment banking professionals is close to unanimity as to the pact that underpricing of IPOs is the general practice. Professor Jay Ritter has written extensively on the subject. As shown in Table 2, he has calculated that the average first-day gain for all IPOs in the past 40 year is more than 15%, even if the 1999–2000 data is excluded.

IPOs are intentionally underpriced in relation the anticipated aftermarket—that fact is understood by all investment bankers and professional investors. It is illogical to expect that investors would purchase shares in an IPO without an expectation (not always realized) that the shares would not sell at a lower price the next day. The discount for pre-IPO shares would be greater if a higher price were used in the calculation. However, that post-IPO price is not only unknowable at the time that pre-IPO securities are priced—it is unknowable even when the offering price is set on the eve of the IPO.

The Data Only Includes Companies That Go Public

Statistically, the IPO studies suffer from survivorship bias. The sample selection problem arises because the data only includes companies that have completed an IPO. It excludes companies that are acquired and, more importantly, it excludes companies that have sold shares in private placements with the intent to go public but are unable to do so due to market conditions, failing to grow sufficiently, or ceasing operations.

Companies whose value increases after a private placement of equity or the issuance of stock options are obviously more likely to have a successful public offering than companies that do not perform as well. Therefore, the necessary exclusion from the database of companies that do not go public results in an unmeasurable upward bias to the calculated DLOMs.

Convertible Preferred Stock is Worth More than Common Stock Equivalent

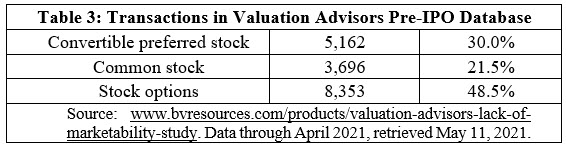

The Emory and Willamette IPO studies include not only sales of common stock, but also convertible preferred stock; Emory also included stock options. Far more pre-IPO transactions were reviewed in the Valuation Advisors study, whose data includes stock repurchases. The breakdown among convertible preferred stock, common, and options is shown in Table 3.

Shannon Pratt pointed out in 2004:

[C]onvertible preferred stock … is more valuable than the common stock with which its price is compared. Also, many of the institutional investors demand “put” rights. These factors would result in a downward bias in the calculated discounts.[5]

Convertible preferred stock always has at least one contractual provision that common stock does not have and that adds value to the preferred stock in comparison to the common. Preferred stock almost always has a liquidation preference. Other provisions that it may have include: inter alia, a dividend (in stock or in cash), a redemption right if an IPO does not occur in a specified time frame, a right (as a class) to elect one or more directors, antidilution protection, a veto right (as a class) on certain transactions, and a drag-along right.[6]

The IPO studies value the pre-IPO convertible preferred stock as a common stock equivalent. The failure to quantify and adjust for the incremental value of preferences causes the calculated DLOM of convertible preferred to be overstated.

Two Discounts are Applicable to Pre-IPO Securities

In addition, there is a major flaw in the pre-IPO studies that has rarely been discussed in prior critiques of this approach. The IPO studies compare the transaction prices to the IPO price. The calculated discount for securities issued for cash includes two components—there is not only a discount relative to the IPO price but also a discount for the risk that the IPO may not occur.

Pratt noted, “Most underwriters will not register selling shareholder stocks on the IPO. Those that do register it generally have an extended ‘lockup’ period before the existing shareholders can sell.”[7] Under SEC Rule 144, shares of a company that has registered its shares are now subject to a minimum holding period of six months (changed from one year in February 2008) and may be subject to further restrictions if the holder is an affiliate of the issuer.

In addition, it is common practice for purchase agreements for pre-IPO shares to restrict sales for six months or more after an IPO. Even if this limitation is not in the purchase agreement, the lead underwriter of an IPO will ordinarily restrict sale of shares by pre-IPO investors.

The shares acquired by employees on exercise of stock options may be subject to further restrictions. Stock option issuances are usually priced based on third party valuations rather than actual transactions.[8] They represent almost half the datapoints in the Valuation Advisors study and 78% in the first nine Emory studies.

IPO studies compare the prices at which the pre-IPO shares were sold with the IPO price. The “marketability” discount calculations include not just a discount for lack of marketability but also a further discount reflecting the risk of non-consummation of the IPO. This results in massive overstatement of the DLOM for registered shares. Moreover, pre-IPO shares are commonly still restricted after an IPO.

Conclusion

The first four points above—non-contemporaneous pricing, the unknowable IPO price, underpricing of IPOs, and selectivity—have frequently been addressed by commentators and help to explain why 60% of the respondents in the polls do not rely on pre-IPO studies. The last two points— the valuable protections given to convertible preferred stock purchasers and the overstatement of calculated DLOMs on pre-IPO shares because of both the risk that the IPO may not occur and the fact that they continue to be restricted—have seldom been discussed in valuation literature. They give additional support to the conclusion that pre-IPO studies are unsound.

All approaches to estimating DLOMs are subject to challenge. The restricted stock studies are somewhat outdated and include assumptions as to the date of relevant restricted stock transactions but, nonetheless, are widely accepted. Other methods, such as option models and those proposed by Longstaff, Finnerty, Frazier, and Mercer, are not without flaws but can be helpful. In contrast, the IPO studies are fatally flawed and should not be used as a basis for estimating discounts for lack of marketability.

Gilbert E. Matthews, CFA, is Chairman and Senior Managing Director of Sutter Securities Financial Services, Inc. in San Francisco. Mr. Matthews has been with Sutter Securities since December 1995. From 1960 through 1995, Mr. Matthews was with Bear Stearns in New York. From 1970 through 1995, he was Chairman of Bear Stearns’ Valuation Committee, which was responsible for all opinions and valuations issued by the firm. He has spoken on fairness opinions, valuations, and related matters before numerous professional groups. He has testified as an expert witness with respect to investment banking practice, corporate valuation, fairness, and other issues in numerous Federal and state courts and before regulatory agencies. Mr. Matthews has written several book chapters and articles on fairness opinions, corporate valuations, and litigation relating to valuations and appraisals, and is on the Editorial Review Board of Business Valuation Review. He received an AB from Harvard and an MBA from Columbia.

Mr. Matthews can be contacted at 415-613-4559, or by e-mail to gil@suttersf.com.

[1] For a detailed discussion of these studies, see James R. Hitchner, Financial Valuation, 4th ed. (John Wiley & Sons, 2017), pp. 422–37.

[2] Z. Christopher Mercer and Travis W. Harms, Business Valuation: An Integrated Theory, 3rd ed. (John Wiley & Sons, 2021), p. 328.

[3] For example, the writer recently purchased a preferred stock convertible into common at 70% of the future IPO price.

[4] Brian K. Pearson, “Pre-IPO Revival: Up your DLOM Game in 2020 Using the Valuation Advisors DLOM database,” Business Valuation Resources webinar, Jan. 29, 2020: Slide 9; available at www.bvresources.com/articles/training-event-transcripts/pre-ipo-revival-up-your-dlom-game-in-2020.

[5] Shannon P. Pratt, “Rebuttal to Bajaj: answers to criticisms of pre-IPO studies,” Business Valuation Update, June 2004: 1, 3.

[6] See Neil J. Beaton, “Valuing Early Stage and Venture-Backed Companies” (John Wiley & Sons, 2010), Chapter 2.

[7] Pratt, “Rebuttal to Bajaj” at *2.

[8] The analyses as to the fair market value assumed in pre-IPO option exercise prices are not publicly available. Thus, it is unclear whether they reflect to risk of an IPO not happening.