Considerations in Valuation of SPAC Sponsor’s Equity

Probability and Scenario Analysis

In this article, the author explores considerations in valuing SPAC founders’ equity for these purposes.

Marcum LLP has been active in assisting sponsors of special purpose acquisition companies (SPAC) with registration and other aspects of initial public offering (IPO). Where appropriate and permissible under the relevant independence rules, we have also assisted our non-audit SPAC-sponsoring clients and their tax counsel with valuation issues related to founders’ equity for gifting and estate planning purposes. In this article, we will explore considerations in valuing SPAC founders’ equity for these purposes.

A Primer on SPACs

A SPAC is a publicly traded “blank check,” or “shell,” company formed for the purpose of acquiring an operating (and typically privately held) business. Essentially, SPACs’ sponsors raise capital through an IPO, and then use the raised capital to acquire an operating company.[1] SPACs are not new—they have existed since the early 1990s. The strong IPO market in the U.S. in the second half of the decade diminished SPACs’ popularity, but they re-emerged in the early 2000s and become an increasingly popular venue for IPOs in the last couple of years. In fact, the unprecedented IPO activity in the first quarter of this year—which was nearly double the volume in the fourth quarter of 2020—was driven almost exclusively by the SPAC market.

In a typical SPAC transaction, the SPAC sells units to the public, consisting of one share of common stock and a fraction of a warrant on one share of the same stock.[2] Prior to the IPO, upon formation of the SPAC’s corporate entity, the SPAC’s sponsors (who typically include the SPAC’s officers, directors and advisors, and their respective affiliates) purchase, for a nominal sum (usually $25,000 in total) such number of shares that, after the IPO, will represent 20% of the SPAC’s total outstanding shares.[3] Substantially all of the proceeds from the SPAC’s IPO are placed in a trust account for the benefit of the public stockholders while the SPAC searches for an acquisition target. The SPAC has a defined time to find a target (usually, within 18 months) and close an acquisition transaction (usually, within the next six months). If the SPAC fails to identify the acquisition target or the public shareholders disapprove[4] of an acquisition proposed by the sponsor, the SPAC is liquidated and the funds in the SPAC’s trust account are returned to the public shareholders. In this scenario, the sponsors’ equity becomes worthless.

Unlike the public shareholders, who may sell their shares in the public market, the SPAC’s sponsors are prohibited from selling their securities at least until the first anniversary of the SPAC’s target acquisition. However, the lockup usually allows for an early termination if the common shares trade above a fixed price for a specified number of days over a given period after the acquisition.

Valuation Considerations for Sponsors’ Equity

Although SPACs have surged in popularity in recent years, the jury is still out on whether or not SPACs are a good capital raising/liquidity strategy. If a SPAC is successful, its sponsors realize a significant return on their equity. That is why sponsors’ equity is an attractive asset for gift and estate tax planning. Valuation of sponsors’ equity, however, presents challenges because of the uncertain nature of important milestones that a SPAC must achieve that affect the equity’s value. Let us consider the following simplified example.

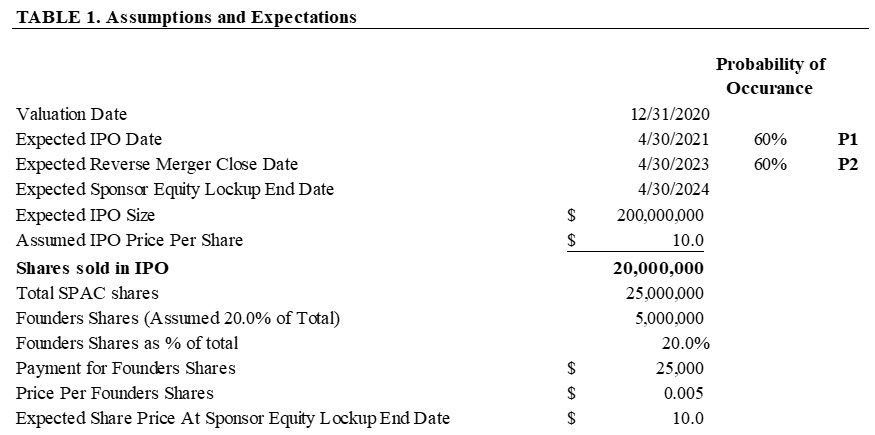

Sponsors form a SPAC corporate entity on December 31, 2020, in anticipation of an IPO in four months, i.e., April 30, 2021. They expect to raise $200 million by selling 20 million shares to investors at a price of $10/share.[5] Although the SPAC IPO market generally has been hot, the sponsors see uncertainty with raising the targeted amount of capital and estimate a probability of success of 60%. As part of its formation, the SPAC issues five million founders’ shares[6] to the sponsors in exchange for $25,000. The SPAC will have 18 months from the IPO date to identify an acquisition target, and then six months from then to negotiate a transaction, perform due diligence, and close on the acquisition. The sponsors of the SPAC have an industry investment focus, but do not yet have a specific acquisition target identified; therefore, they estimate a 60% probability of success in identifying a target and closing the transaction by the specified date.[7] The founders’ shares will be subject to a lockup until the first anniversary of the closing of the acquisition transaction. With the above expectations, the sponsors have decided to seek a valuation of their shares for gift and estate planning purposes. The expectations are summarized in the table below.

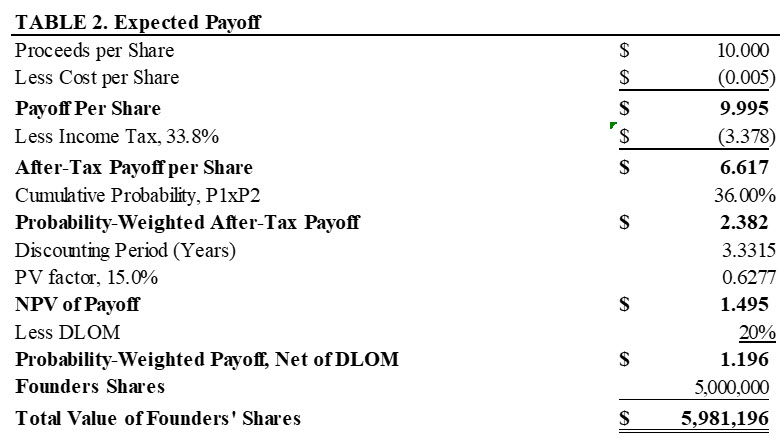

The following table summarizes a potential payoff of the founders’ shares assuming a sale of the shares in the open market at $10/share on April 30, 2024,[8] the expected date of expiration of the sponsor equity lockup period. The net present value (NPV) of the expected payoff is calculated assuming a discount rate of 15% and a discount for lack of marketability (DLOM) of 15%:

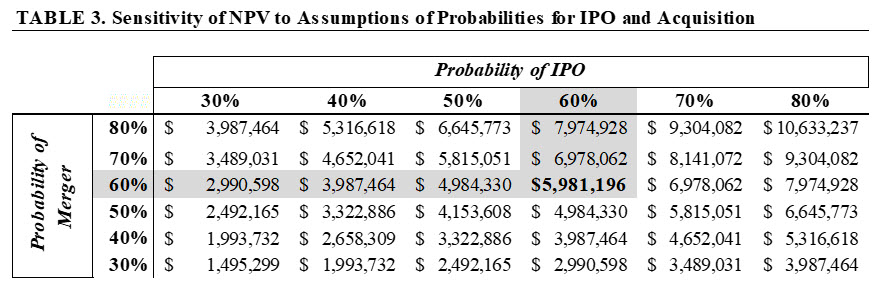

Although the calculation of the payoff’s NPV appears fairly straightforward, the calculation drastically oversimplifies the reality and significantly underestimates the uncertainty. As the next table illustrates, the NPV is very sensitive to the IPO and merger probability assumptions:

As Table 3 illustrates, if the probabilities of the IPO and the merger are 50% each, instead of 60% each, the resulting NPV of $4,153,608 would be approximately 30.6% lower than the calculation presented in Table 2. On the other hand, if the probabilities are 70% each, the resulting NPV of $8,141,072 is approximately 36.1% higher than the outcome in Table 2.

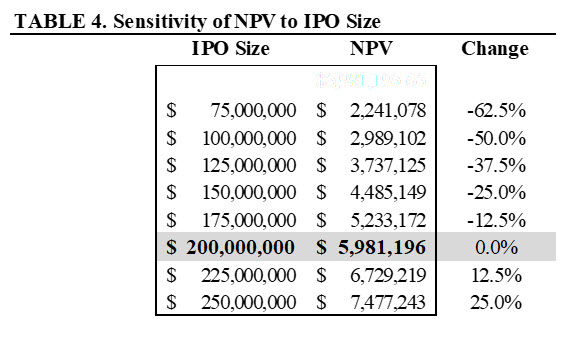

In addition, the NPV is sensitive to the assumed IPO size, as Table 4 shows:

Table 4 illustrates that, all other things being equal, if the SPAC ultimately raises $175 million, instead of the targeted $200 million, the NPV would be 12.5% lower than the outcome in Table 2. Alternatively, an oversubscribed IPO that raises $225 million would result in a NPV that is 12.5% higher.[9]

Tables 3 and 4 illustrate variability of the NPV due to changes in only three inputs, such as the assumed probabilities for the IPO and the merger, and the IPO size. However, there are other variables to consider, even in our simplified example:

- What if, upon the expiration of the lockup period, the price per share is different than $10/share (which it will likely be)?

- What if the sponsors are unable to sell all their shares on the date of the lockup expiration because of insufficient daily trading volume, and a disposition of shares (and a payoff) happens over a longer period that depends on a daily trading volume?

- What effect do the previous conditions (or an early termination of a lockup, if the daily share price meets the predetermined threshold) have on a DLOM?[10]

Scenario-based and simulation techniques can significantly assist in the analysis, as they allow appraisers to model the specific risks and variables. While the goal of the valuation analysis is not to capture every contingency and outcome, the above examples highlight the need for a thorough understanding and appreciation of the complexities involved, and knowledge of the appropriate tools in performing SPAC valuations.

This article was previously published in Marcum, May 19, 2021, and is republished here by permission.

[1] This assumes that the SPAC’s shares will be trading at the IPO price when the sponsors are able to sell them.

[1] In some respects, a SPAC is similar to a private equity fund in that it is typically sponsored and managed by investment managers and industry advisors who have experience in completing acquisitions and private equity investing in a specific industry targeted by the SPAC.

[2] The warrant typically becomes exercisable upon the later of (i) completion of an acquisition of an operating company, or (ii) the first anniversary of the SPAC’s IPO.

[3] For example, if the SPAC plans to issue 1,000,000 shares in the IPO, the sponsors will purchase 250,000 shares, representing 20% of 1,250,000 shares that will be outstanding following the IPO. The founders’ shares are also referred to as the “promote”.

[4] A typical threshold is between 20% and 40%, which means that a rejection of the proposed transaction does not require a majority of votes.

[5] For simplicity of illustration, the example assumes that the SPAC will not be issuing warrants.

[6] The number of founders’ shares represents 20% of the expected total number of shares outstanding following the IPO of 25 million, i.e. five million of founders’ shares and 20 million investors’ shares.

[7] The probability also reflects the likelihood of the investors approving the proposed acquisition transaction.

[8] This assumes that the SPAC’s shares will be trading at the IPO price when the sponsors are able to sell them.

[9] The IPO size affects the NPV through a number of shares that the sponsors would be required to purchase to maintain a 20% post-IPO ownership.

[10] In addition to the specific variables, it is also important to consider a magnified effect if more than one of the variables differs significantly from the assumption.

Vladimir V. Korobov, CPA, ABV, ASA, is a partner at Marcum LLP in the Valuation, Forensics, and Litigation Services group. He has more than 20 years of experience providing business valuation, litigation support, and advisory services with a focus on alternative and traditional asset management, and financial institutions.

Mr. Korobov can be contacted at (203) 781-9785 or by e-mail to Vladimir.Korobov@marcumllp.com.