CBO: New Obamacare Taxes Raise $6.9 billion in 2016; Average Tax is $1,600 —CBO, Washington Examiner

CBO Details Penalties For Being Uninsured Under The Patient Protection And Affordable Care Act

The non-partisan Congressional Budget Office recently reported an estimated six million people would be subject to the Obamacare tax, approximating $7 billion in taxes in 2016 with each of the 6 million people paying at least $695.

“80 percent of those who’ll face the penalty would be making up to or less than five times the federal poverty level. Currently that would work out to $55,850 or less for an individual and $115,250 or less for a family of four.”

The CBO describes the Obamacare tax as:

“The greater of: a flat dollar amount per person that rises to $695 in 2016 and is indexed by inflation thereafter (the penalty for children will be half that amount and an overall cap will apply to family payments); or a percentage of the household’s income that rises to 2.5 percent for 2016 and subsequent years (also subject to a cap).”

In 2008, Obama pledged “no family making less than $250,000 a year will see any form of tax increase — not your income tax, not your payroll tax, not your capital gains taxes, not any of your taxes.”

The Washington Examiner notes most of the affected 6 million are in the middle class, with 4.7 million having incomes “500 percent of the federal poverty level,” which the CBO projects will be “$60,000 for individuals and $123,000 for families of four by 2016.”

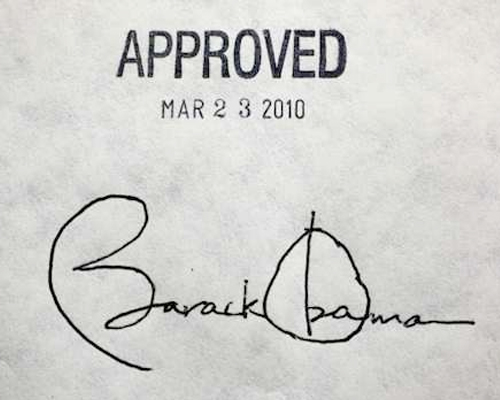

The Supreme Court, by a 5-4 vote, ruled Obamacare was constitutional because it was a tax and, in so doing, ensured one of Obama’s  central promises from 2008 was broken. Obama previously, and almost immediately in his first term, raised taxes on the middle class via various tax hikes on things like cigarettes, but had previously not raised any income taxes on the middle class.

central promises from 2008 was broken. Obama previously, and almost immediately in his first term, raised taxes on the middle class via various tax hikes on things like cigarettes, but had previously not raised any income taxes on the middle class.