Business Valuation with Odds

Odds as a Financial Ratio in Business Valuation Theory

Every business transaction involves a bet of sort. This is also evidenced in the price of put and call options. Can we draw some insight from sports betting to help us calculate the value of a business? Perhaps. Odds in sports betting is a common expression communicating the change and return of winning a bet. Odds as a ratio in business valuation theory is presented in this article. Using odds as a ratio in business valuation helps expressing the probability of a forecasted free cash flow. This might start further discussions and research on how to quantify the operational assumptions made and to bridge the gap between qualitative assumptions made in business valuation and quantitative concepts such as Monte Carlo valuation analysis, credit rating based on distance to default, and real options. A literature review, within other areas of science addressing odds, could help in applying odds as a financial ratio in business valuation.

[su_pullquote align=”right”]Resources:

Value Uncertainty and Risk Measurement in Business Valuation

Review of Option-based Models for Discount for Lack of Marketability

The Three Valuation Approaches‚ÄĒChallenges and Issues

[/su_pullquote]

Introduction

Let’s get back to the summer of 2016, when the Olympics dominated sports.  Some of my fellow rowing club members were qualified for participation.  Not having experience in sports betting, a working colleague was asked how I could gamble some of my money by playing on those I knew, in the hope they would do well.  Several bookmaker websites were skimmed for finding bets of my interest.  Different bookmakers were found, offering bets on athletes winning gold medals.  Not all gambling sites provided the same bets.  Some were more positive on the outcome than others.  One offering drew special attention as a good win outcome was possible in case of a positive result.  An account was opened, not really paying much attention to all the small print that was clicked away.  Money was transferred by credit card and finally the bets could be placed.  Two bets were selected and a combined bet on top was entered.  But, then the website jammed.  It seemed impossible to place the three bets as they seemed not to be processed.  The online bookmaker seemed jammed due to its risk systems in place.  The three bets could only be entered individually, and the combined bet was only allowed after a short pause in which the odds for this bet was reduced.  This reduction of odds triggered my interest and I started calculating the value of my first two bets based on the old odds versus the value of the bets based on the new odds.  This triggered the idea of business valuation with odds.

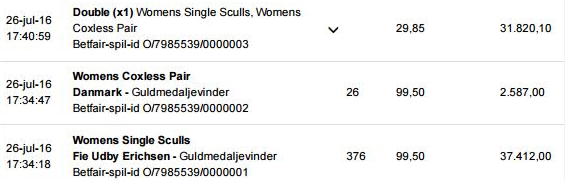

Figure: The Original Betting Slip

The placement of the double bet has reduced odds for the Women’s Single Sculls part versus the odds as in the single bet (31.820,10 DKK / 29,85 DKK = 1.066 ODDS / 26 ODDS = 41 ODDS versus 376 ODDS).

The following paragraphs introduce the concept of business valuation with odds including the element of time.  A sensitivity analyses provides insights in relevant value drivers.  A valuation textbook review presents limited use of odds as a financial ratio in the reviewed textbooks.  At the end, a discussion on further research opportunities is held.  The last paragraph contains a conclusion towards business valuation with odds.

Concept

When you place a bet‚ÄĒin sports betting‚ÄĒthen you place money.¬† This bet is made with the expectation that the athlete you bet will win the game, and as such, the bet is won.¬† The bookmaker offers odds on such bets.¬† So, if you pay 100, then you might get paid out, in a positive scenario, e.g., 156.¬† In this case the bookmaker offers the bet with odds 1,56.¬† In case of a positive scenario, you get your money back, 100, plus a win of 56.¬† Within betting, this is nothing new.¬† However, combining this with valuation theory, it gives the following formula:

FV = PV x (1 + rt)

- PV = FV / (1 + rt)

rt = FV / PV Р1

Present value (PV): 100

Future value (FV): 156

¬†¬†¬†¬†¬†¬†¬†¬†¬† Discount rate (rt): 156 / 100 ‚Äď 1 = 56% (time element is not included)

Discount factor: 1 / (1 + 56%) = 0,6410 (0,6410 x 156 = 100)

Odds: 156 / 100 = 1,56

Probability = 1 / 1,56 x 100% = 64,10%

The probability that the athlete will win and the bet is won is 64,10%.

The bet has a present value of 100, as that is the amount you must pay for it with the bookmaker.  In the scenario of a positive result, the money paid out is 156.  The amount of 156 is therefore the future value of the bet.  The difference between the two, present value and future value, is explained by the discount rate.  The discount rate is rewritten to a discount factor.

Compared with textbook business valuation theory (Hitchner, 2017), the element of time, as in, 1 Euro today is not equal to 1 Euro yesterday or tomorrow (Fisher, 1930), is not part of the logic followed.  When opening an account at a bookmaker it is accepted by the customer that there is no interest on the amounts placed on the account.  Furthermore, it seemed as time passed, that the odds offered by the bookmaker did not change due to the element of time.  It could be expected that odds would change the closer you come to the sports event you are gambling on, simply due to time.  Nevertheless, this seems not to be reality.

Having introduced the basics of sports betting, the logic can be applied to business valuation.  A prospective investor is considering paying 1.000.000 for obtaining a business.  Based on the future expectations of the investor, as formalized in a discounted cash flow (DCF) valuation, the investment can be aligned with the logic of sports betting.  What amount will the investor have in its hands when realizing the expectations?  If the valuation is based on annual cash flows, then the future value of each annual cash flow is discounted to a present value.  This gives input for finding the odds of realizing the investment expectation.

Correction for Time Element

The following table shows the concept of business valuation with odds, corrected for element of time.  The free cash flow is used to find out the odds.  The free cash flow is presented per year.  For each year the odds are calculated, see formula 2.  Using the sum of the discounted free cash flow (Williams, 1938) allows calculating the odds of the whole project.  The odds of the whole project correspond to the sum of the weighted odds per year, see formula 3.

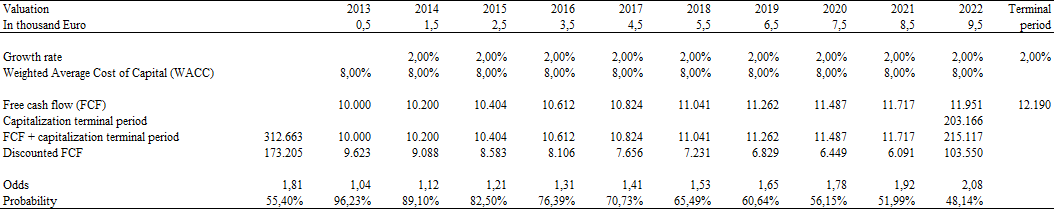

Table: Business Valuation with Odds

Formula:          9.623 / 10.000 = 1,04                          (2)

Formula:          173.205 / 312.663 = 1,81                                (3)

The odds represent the amount of money you get returned as a multiple of the amount you placed at the start.  The net present value of the project is 173.205.  If this amount is paid and the expectations are realized, then the realized free cash flow will be 312.663.  So, the investor of this project invests 173.205 at the start with odds 1,81 in the expectation to get free cash flow of 312.663 over the years to come.

Odds can be rewritten into probability.  By rewriting odds into probability, it is expressed what the expectations are towards the future free cash flow.  This is demonstrated in formulas 4 and 5.

Formula:          1 / 1,04 x 100% = 96,23%                               (4)

Formula:          1 / 1,81 x 100% = 55,40%                               (5)

The probability that the whole project is realized following the forecasted free cash flow is 55,40%.  The probability that the first year of the forecasted free cash flow is realized is 96,23%.  The probability that the first year is realized is much higher than that of the whole project.  The longer it takes, the lower the probability of realizing the forecasted free cash flow.

Sensitivity Analyses

As demonstrated in the above table, business valuation with odds, are the odds different for each year.  Based on a sensitivity analyses, it becomes clear which value drivers in a discounted cash flow valuation affect the odds and how big the impact is.

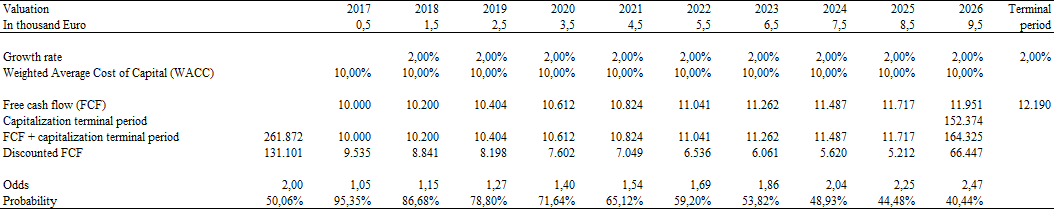

Table: Business Valuation with Odds, WACC Changed From 8% into 10%

The change triggered a difference in every single year and for the project.

The annual odds are a relative ratio expressing the difference between the free cash flow and the discounted free cash flow.  The risk assumption, as done by the applied discount rate, affects the annual odds and therefore, the odds of the whole project.

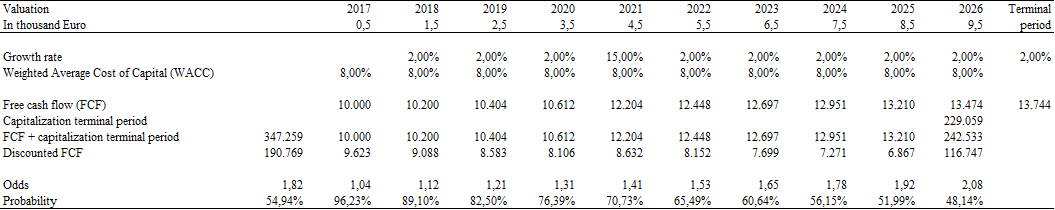

Table: Business Valuation with Odds, 2021 Annual Growth % Changed From 2% into 15%

The change triggered a difference of 0,01 in odds for the whole project and 0,46% difference in probability for the whole project.

The annual odds, as in formula 2, are not impacted by operational assumptions affecting the forecasted profit and loss statements and balance sheets.  Only discount rate affected the annual odds.  The size of the cash flow is not relevant for the odds.  Size of the free cash flow did not influence the annual odds, as the relative difference is only driven by the discount rate.

Operational value drivers did influence the total odds of the whole project, as in formula 3, as operational value drivers impact when and how much cash flows are realized.  A higher growth rate, other working capital assumptions and investment decisions influence the projected cash flows over time.  The timing of cash flows realized affects the total odds of the whole project.

Valuation Textbook Review

The outcome of a textbook review is presented.¬† The search function of Google Books was used on three valuation textbooks: Koller (2015), Damodaran (2016), and Hitchner (2017).¬† A search in these textbooks on the key word ‚Äúodds‚ÄĚ resulted in the below observations.

None of the three valuation textbooks makes references to odds as a financial ratio in business valuation theory.¬† The term ‚Äúodds‚ÄĚ is used as an expression in the text.¬† The expressions are often used to introduce uncertainty toward a situation.

Koller (2015) uses the word odds two times.  Both the sentences refer to the operational success expressed in odds.

Page 330: ‚ÄúIn contrast, increasing the odds of a successful launch has a much greater impact on shareholder value.¬† Increasing the success probability from two-thirds to three-fourths would boost shareholder value by more than ten percent.‚ÄĚ

Page 768 ‚ÄúUnfortunately, the odds of a successful development are small.¬† The cumulative probability of success over the research and testing phase is only six percent (0,15 for research x 0,40 for testing).‚ÄĚ

Damodaran (2016) used the word twice.  In both situations the word odds is used in relation to the success of a merger and potential synergies realized.

Page 562: ‚ÄúWe follow up by laying out a framework for assessing how best to fairly share the benefits of synergy and where the odds are greatest for succeeding with a synergy-based acquisition strategy.‚ÄĚ

Page 574: ‚Äú‚Ķbest to improve the odds on delivering synergy and some common errors in the valuation synergy.‚ÄĚ

Hitchner (2017) only used the word once on page 555, in an expression: ‚Äú‚Ķa result that appear to be at odds with‚Ķ‚ÄĚ.

The above indicates that odds as a financial ratio in business valuation theory is not an established concept that is included in the three valuation textbooks reviewed.

Discussion

Odds help to quantify the operational assumptions made into quantitative outcome.  As such, odds are another financial ratio that can be used in business valuation, besides other financial ratio’s such as pay-back period, multiples, and discount rate.

Overview of Different Financial Ratio’s in Business Valuation

Pay-back period gives insight in duration of required commitment and debt finance options.

Multiples gives price information based on market data.  Share listings provide ongoing information versus transactions provide point in time information.

Discount rates are based on risk assumption of the cash flow.  It is an expression of risk not included in the cash flow projections.

Odds provide information on the probability of the expected cash flow to be realized.

Odds help in answering basic questions when buying a business, such as:

- What is the chance of getting your investment back?

- What is the chance of outperforming a risk-free investment?

Odds are used in other areas of science.  As such, literature is available on odds.  A literature review with odds as a subject, and the applicability of such literature in relation to business valuation could help in applying odds as a financial ratio in business valuation.

Analysis of historical business valuation cases could help in developing datasets with odds for business valuation purposes.  Empirical study could help understand the odds that are implied in real deals.

Further, related topic discussions on odds as a financial ratio in business valuation can help in addressing subjective assumptions that build on quantitative theories (Weaver and Michelson, 2008) but today rely on qualitative inputs, as for example:

- Monte Carlo valuation analysis, which calculates with different cash flow scenarios including a probability assumption for the variables simulated in the analysis.

- Real option theory, which allows for decision making if certain future conditions are fulfilled.

- Default risk is an element in business valuation (Jennergren, 2013). Credit rating based on distance to default (Kliestik, 2015) helps assessing the risk, but requires company specific quantified input related to the financial situation of the company (Meitner, 2014).

Conclusion

Odds as a financial ratio in business valuation theory is presented in this article.  Odds is an expression of the chance of getting an investment back and the possible return on top of that.  Using odds as a financial ratio in business valuation helps expressing the probability of a forecasted free cash flow to be realized.  Further research might help in applying and understanding odds as a financial ratio related to business valuation.

Copenhagen, 12-06-2018

This article was previously published in SSRN on July 03, 2018 and is republished here with the author’s permission.

—

Literature

Damodaran, A., (2016), Damodaran on Valuation: Security Analysis for Investment and Corporate Finance, Wiley and Sons.

Fisher, I., 1930, The Theory of Interest, The Macmillan Company.

Hitchner, J.R., 2017, Financial Valuation: Applications and Models, Wiley and Sons.

Jennergren, L.P., 2013, Firm Valuation with Bankruptcy Risk, Journal of Business Valuation and Economic Loss Analysis, Volume 8, Issue 1. Pages 91‚Äď131.

Koller, T., Goedhart, M., Wessels, D., (2015) Valuation: Measuring and Managing the Value of Companies, McKinsey and Company Inc., Wiley and Sons.

Kliestik, T., Misankova, M., Kocisova, K., 2015, Calculation of Distance to Default, Procedia Economics and Finance, Volume 23, Pages 238‚Äď243.

Meitner, M. and Streitferdt, F.G., 2014, DCF-Valuations of Companies in Crisis: Distress-Related Leverage, Identification of Risk Positions, Discounting Techniques, and ‚ÄúBeta Flips‚ÄĚ, Journal of Business Valuation and Economic Loss Analysis, Volume 9, Issue 1. Pages 145‚Äď174.

Weaver, C.W. and Michelson, S., 2008, Quantifying Risk When Using the Income Approach, Journal of Business Valuation and Economic Loss Analysis, Volume 3, Issue 1.

Williams, J.B., 1938, The theory of investment value, Cambridge, Mass., Harvard University Press.

Mark F.J. van Herk RV, MBV, MSc, bc, is a Register Valuator in The Netherlands (NIRV) working in Denmark and has had formal valuation education from TIAS Business School.

Mr. vanHerk can be contacted at markvherk@hotmail.com.