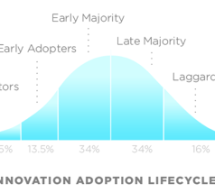

Survey: Business Development Now Tops Forensic and Valuation Services Practitioners’ List of Concerns

Business development concerns outpacing technical issues A new survey by the AICPA reveals that priorities for forensic and valuation services (FVS) professionals have changed significantly in just the last three years. The report details what’s most important to them today and why it may not have as much to do with the economy as you think. ...

Read more ›