Five Variations on a Theme: Analyzing Transaction Premium Data (Part 2)

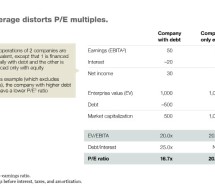

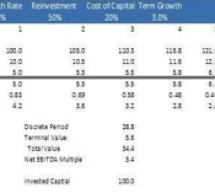

Part 1 of this series offered an overview of observed transaction premium data (from the 2016 Mergerstat Review) for acquisitions of public companies. That post also deliberated on one of five common avenues to incremental economic benefits that motivate market participants to transact. Part 2 walks through the four remaining variations on the incremental economic benefits theme, and offers some concludin ...

Read more ›