Valuation Discounts

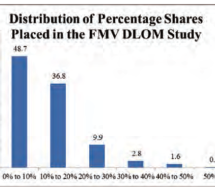

Applicable to Real Estate Holding Companies (Part II of II) In this second of a two-part series published in QuickRead August 01, 2019, the author discusses valuation discounts applicable to real estate holding companies and the incremental adjustments in the valuation of partial, non-controlling interests. After discussing the application of a minority discount or discount for lack of control (DLOC) in the ...

Read more ›