The Level of Value

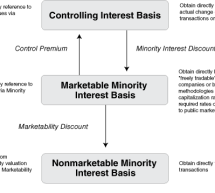

Understanding this critical element in a buy-sell agreement Traditionally, business appraisers retained for buy-sell agreements are bound to perform their services within the specific value structure of the contract. When the valuation process is involved in such agreements, itâs essential for estate planners to understand the defining valuation elements involved, particularly the level of value. ...

Read more ›