Winning the Report Writing Derby

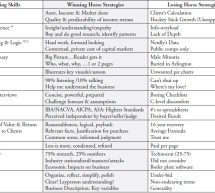

Winning Skills and Strategies in Writing Exceptional Reports Tom Helling shows how to enhance your own reputation, build future business, and help clients solve problems in your written report. Key ingredients are careful logic, strong research, and good writing. Learn how to do it all. ...

Read more ›