How to Calculate Damages that Can Withstand a ChallengeâFraud Files

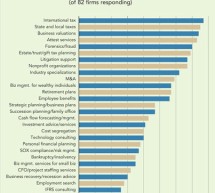

How Can You Defend "Reasonable Certainty"?  Here are Some Tips One of the common issues raised when an expert calculates damages is âreasonable certainty.â  It is not uncommon for opposing counsel to suggest that the expertâs calculated damages are speculative, explain the editors at the Fraud Files blog.  The calculation of damages necessarily requires estimates and assumptions.  Something has happened, a ...

Read more ›