Structuring the Intangible Asset Analysis Assignment

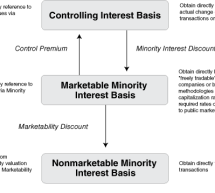

The standard 10 stages to use in an intangible asset engagement In this second installment, Robert F. Reilly completes his review of the 10 typical stages of any intangible asset analysis engagement. For purposes of this article, an intangible asset analysis may include a valuation, damages analysis, transfer price study, or other economic analysis. The business appraiser will typically consider these stage ...

Read more ›