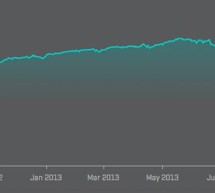

Business Acquisition Market Improves

Wave of boomers fuel business acquisition market This article examines the upswing in the business acquisition market as holdouts from 2009 and 2010 are freed up, as well as the increasing number of baby boomers looking to move into the next phase of life. ...

Read more ›