Moving Toward the Virtual Firm (Part 1 of 5)

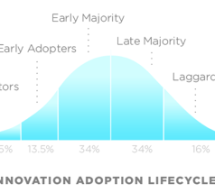

Digital technology removes barriers and excuses Most professional services organizations are already adopting some form of digital identity. It takes just a bit more to embrace the cloud and reap the benefits of becoming a virtual firm. ...

Read more ›