Common Pitfalls to Avoid in a 409A Valuation

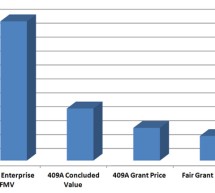

How to Avoid Them! A 409A valuation refers to a method of determining the value of a company's common stock. In other words, the 409A valuation is a method of calculating fair market value (FMV) according to the regulations under the Internal Revenue Code (IRC). This valuation can be carried out using various types of valuation methodologies, however, it is important to avoid pitfalls in 409A valuation when ...

Read more ›