Navigating Capital Structure Assumptions

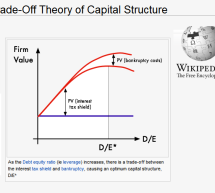

Ensuring Accurate Valuations with Real-World Testing One of the key assumptions valuation professionals must make is about a company's capital structure. This article explores factors valuation professionals should consider as they arrive at the debt and equity used to value the entity. Business valuation and financial modeling involve navigating a wide range of assumptions, and for the resulting values pro ...

Read more ›