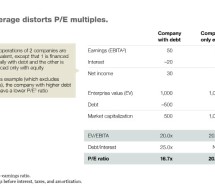

Enterprise Value vs. Market Value of Invested Capital

In Small Business Valuations In a recent joint business valuation review engagement, the author and a fellow appraiser discussed whether one should use market value of invested capital (MVIC) or enterprise value (EV) when applying an income approach in business valuation. In this article, the author discusses these two concepts and sheds some light on why one might use one over the other. A recent joint bus ...

Read more ›