Understand the Value of an Insurance Brokerage —Mercer Capital White Paper

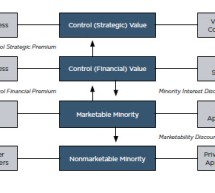

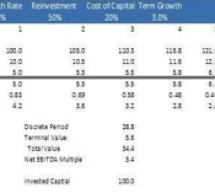

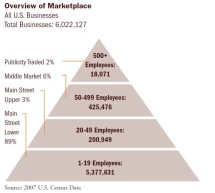

Most Business Owners Understand Interim Cash Flows.  But Terminal Cash Flow May Be Most Important: More Detail on Standards of Value. Lucas M. Parris at Mercer Capital has authored a white paper at Mercer Capital that posted last month titled Understand the Value of an Insurance Brokerage that guides consultants through the process of selling out, selling in [transferring ownership to heirs], putting toget ...

Read more ›