Multi-National Companies Face Tax Risk with Transfer Pricing

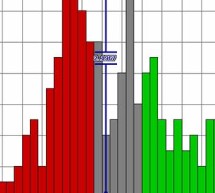

Because of increased IRS audit procedures, multi-national corporations face great risk when it comes to transfer pricing from both a compliance and tax planning perspective. The familiar multi-nationals like Amazon or Microsoft have made headlines regarding transfer pricing disputes and adjustments that run into the billions. In an excellent article by the Journal of Accountancy, small, closely-held compa ...

Read more ›