Are Valuation Experts Tax-Affecting the Wrong Earnings?

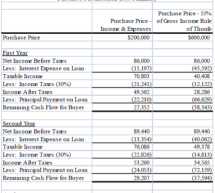

Important factors to consider in making tax adjustments to pass-through income Damodaran recently wrote about the potential devaluation of dividend-paying stocks if the preferred dividend tax rate were to climb back up to the ordinary rate. This could inspire valuation experts to make a tax adjustment reducing untaxed Pass-Through Entity (PTE) income to equate it with corporately taxed income that qualifie ...

Read more ›