Entertainment Tax Credits and Loan-Out Withholding

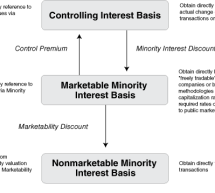

A rough ride This article examines recent state legislation in Georgia that requires entertainment production companies and their payroll providers to withhold state income tax on payments made to loan-out companies as a prerequisite to claiming tax credits. Peter Stathopoulos examines the difficult transition involved with this legislation that may spawn similar proposals in other states that host a large ...

Read more ›