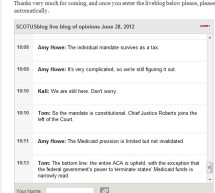

A Short History of Congress’s Power to Tax —WSJ

The Supreme Court Has Long Distinguished the Taxing Power from the Regulatory Power Paul Moreno, professor of history at Hillsdale College,  details the history on the Wall Street Journal opinion page:  The first enumerated power that the Constitution grants to Congress is the "power to lay and collect taxes, duties, imposts, and excises, to pay the debts and provide for the common defense and general welf ...

Read more ›