S-Corporations and Taxes: A Summary of Relevant Case Law

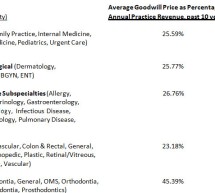

Taxes on S-Corporations are Hotly Discussed by Legislators and May Change. Here’s the History, Standing Precedents, and Current Law. S Corporations have been much in the news lately, as we’ve noted on the QuickRead blog. In this piece, Peter Agrapides provides a comprehensive chronological account of valuation cases where the issue of tax affecting S-Corporations has taken center stage. ...

Read more ›